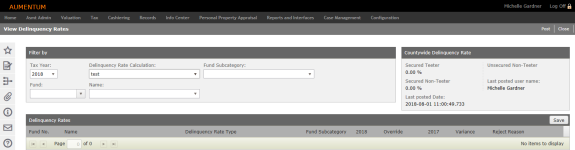

Delinquency Rates

Navigate:  Tax > Levy Management > Tax Rate Maintenance > Delinquency Rates

Tax > Levy Management > Tax Rate Maintenance > Delinquency Rates

Description

Use this task to view and post delinquency rates for Debt Rate Calculation after the instance of tax roll processing calculation is complete.

Steps

-

On the View Delinquency Rates screen, make a selection from the Tax Year drop-down list.

-

Make a selection from the Delinquency Rate Calculation drop-down list.

- The Countywide Delinquency Rate panel is automatically updated with percentages and the last user and posted date.

- Optionally, make a selection from the Fund Subcategory drop-down list.

-

Optionally, make a selection from the Fund and Name drop-down lists, which is where the delinquency rate calculation is posted.

-

The Delinquency Rates panel displays all records matching your parameters.

-

To override rates, click in the Override column and enter a new value, or click the up and down arrows to increase or decrease the value as a percentage.

-

Click in the Reject Reason column to open a pop-up to enter comments for the override and the reason for rejecting the original rate value.

-

Click Finish to save the message and close the pop-up. The column displays a truncated view of the message to indicate an override message was created. When selecting it, the pop-up displays again with the message for editing and copying.

-

After reviewing the delinquency rates for each fund, if the rates are correct, click Post to submit the posting process for the delinquency rates to batch process.

- Click Info Center > Batch Processes to access the results on the Monitor Batch Processes screen.

Prerequisites, Dependencies, and Setup

-

An annual tax roll process must be completed for Debt Rate Calculations for an instance of Delinquent Rate.

-

Data from distribution needs to exist.