Tax Bill Transfer Maintenance

Navigate:  Tax > Levy

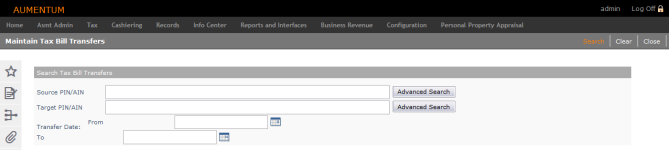

Management > Tax Bill Transfer > Tax Bill Transfer Maintenance

Tax > Levy

Management > Tax Bill Transfer > Tax Bill Transfer Maintenance

Description

NOTE: This functionality may not be available in your jurisdiction.

Sometimes, a tax bill is transferred to the incorrect revenue object account (PIN), and the transfer needs to be reversed.

Use this screen to search for existing tax bill transfers and then reverse them.

NOTE: When using this task and when searching/selecting revenue objects that have bills in tax sale, Levy prohibits adding the revenue object and a message prompts you to use the Tax Sale Certificate Split Workflow.

Steps

-

On the Maintain Tax Bill Transfers screen, enter search criteria matching the transfers you want.

-

Source and target revenue objects - Enter the PIN or AIN of a revenue object, or click Advanced Search to use Revenue Object Search.

-

-

Enter the From and To dates for the transfer.

-

Click Search to find active transfers matching the criteria. Transfers in which multiple source bills were combined into one target will display all of the source information separately.

-

Set the schedule options if you want to run the process at a future time.

-

Select one or more transfers to reverse and click Reverse to submit the process to the batch processing queue.

The target tax bills are adjusted to zero and the original split/transfer amount is transferred back to the source tax bills. Any payments on the target bills are transferred to surplus.

-

Click Remove to remove an item from the list.

-

Click Clear to clear the search criteria for a new search.

-

Click Close to end the task.

Tips

You cannot reverse a transfer if the target tax bill has had a tax charge correction.

CVB only: You can perform a tax bill transfer for an inactive GPIN.