TIF-TAF Negotiated Agreements

Navigate:  Tax > Levy Management > TIF District Maintenance > TIF-TAF Negotiated Agreements

Tax > Levy Management > TIF District Maintenance > TIF-TAF Negotiated Agreements

Description

A TIF is a public financing method used as a subsidy for redevelopment, infrastructure, and other community-improvement projects in many countries.

Use this task to maintain existing and create new Tax Increment Financing (TIF)-Tax Authority Fund (TAF) negotiated agreements. Maintain all the negotiated legal agreement details, such as percentage rate, etc., between the public financier(s) of the TAF project and all the TAFs to which the TIF applies.

Steps

-

On the Search for TIF-TAF Negotiated Agreements screen, enter your search criteria and click Search.

-

In the TIF - TAF Negotiated Agreements panel, select the checkbox for one or more agreements and click Next. Or, click New to create an agreement.

-

In the Maintain TIF-TAF Negotiated Agreement screen, the year selected on the previous screen carries forward to this screen.

-

Edit or enter a TIF Description.

-

Select the Rate Rules from the Rate Rules panel header, and enter the rate rule(s).

-

Enter the From and Through values to which the rate applies.

-

Enter the Rate in percentage.

-

Click Add to add additional rules

-

Click Apply to apply the rules.

-

Click Cancel to cancel the action.

-

-

-

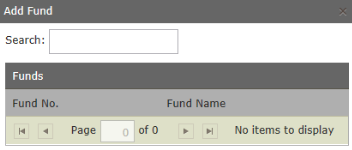

Select the Tax Authority Funds to which the TIF applies. Click Add in the Applies to Tax Authority Fund List panel to open a pop-up of available fund listings.

-

Select from the list to close the pop-up and populate the panel with the selections.

-

-

The Evaluation panel displays only if you selected Amount from the Rate Rules header panel drop-down list.

-

Select the Evaluation Value Type.

-

Select the Value Scope.

-

Select the Contributor Level.

-

Select the Recipient Level.

-

-

Define the following from the Calculation panel:

-

Select the Calculate Value Type.

-

Select the Low/Mod Housing Income to Exclude or Include.

-

Select whether to Exclude or Include the LMH1 (concurrent) Timing.

-

Select whether to Exclude or Include Administrative Costs and define the Administrative Costs Timing.

-

-

Define any capping amounts in the Caps panel.

-

Click Add to add a new row for defining any capping amounts.

-

Define the Cap Reached Rate.

-

Click Apply.

-

Click Cancel to cancel the action.

-

-

-

Click Save to save the negotiated agreement.

-

Click Close to end the task.

-

Dependencies, Prerequisites, and Setup

-

Tax Authority Funds must be created via Levy Management > Setup > Tax Authority Funds

-

TIF Districts must be defined via Levy Management > TIF District Maintenance