Tax Entity Validation Rules

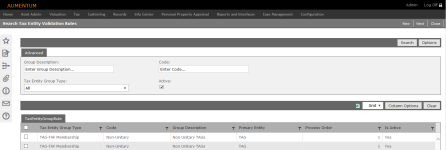

Navigate:  Tax > Levy Management > Setup > Tax Entity Validation Rules

Tax > Levy Management > Setup > Tax Entity Validation Rules

Description

Configure rules for tax entity calculations. Typically, Levy Setup tasks are performed by the Aumentum Engineering team working with your jurisdiction. Contact your Aumentum Support representative if you need assistance with tax entity configuration rules.

Steps

- On the Search Tax Entity Validation Rules screen, enter your search criteria and click Search, or click New.

- In the Tax Entity Group Rule panel, select the checkbox for one or more items and click Next.

- On the Maintain Tax Entity Validation Rules screen, click Add in the Primary Entity Criteria panel.

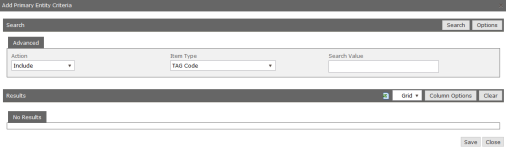

- On the Add Primary Entity Criteria screen, enter your search criteria and click Search.

- In the Item Type Value panel, select the checkbox for one or more items and click Save at the bottom of the screen.

- Your selections are added to the Primary Entity Criteria panel.

- In the Rule Criteria panel, click Add.

- In the Define Rule pop-up, enter a rule name and specify the order in which to apply the rule when tax entity maintenance and calculations are performed.

-

In the Condition panel, click Add new record.

- Click in the Object field and make a selection from the drop-down list.

-

Make a selection from the Action drop-down list. If you select Min/Max, additional fields are displayed.

-

In the Criteria panel, click Add new record and click in each column to define criteria for the rule.

-

Click Save to save the rule.

- Click Delete in on any condition or condition to delete it.

-

Click Close to close the pop-up.

-

On the Maintain Tax Entity Validation Rules screen, click Save.

-

Click Close to end the task.

-