Bank Earned Interest Factor Calculation

Navigate:  Tax >

Levy Management > Factor Calculations

> Bank Earned Interest Factor Calculations

Tax >

Levy Management > Factor Calculations

> Bank Earned Interest Factor Calculations

Description

Use this task to perform interest calculations for TIF and TAF based on the selected tax year.

Steps

-

On the Calculate Bank Earned Interest screen, make a selection from the Tax Year drop-down list.

-

Make a selection from the Bank Earned Interest Instance drop-down list, or click New to create a new instance.

-

Enter a description for the instance and click OK.

-

-

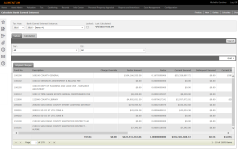

In the Values tab, make a selection from the TAF and TIF drop-down lists.

-

Click Search.

-

In the Original Charges tab, click Edit at the end of the row for an item in the grid.

- In the Opening Charge pop-up, enter an amount in the Override field.

- Optionally, enter a note for the charge.

- Click Save to close the pop-up.

- Click Cancel to close the pop-up without saving changes.

-

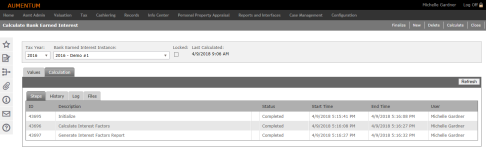

Click Calculate in the Command Item bar. The Calculation tab opens automatically.

-

When calculation processing is complete, click the History tab to view a detailed history of the calculations.

-

Optionally, make a selection from the Iteration drop-down list.

-

Click the Log tab to view a log of calculation events.

-

In the Filter field, enter all or part of a word to filter the log results.

-

Click Errors Only to view a log of errors.

-

Click Download Log to download a text file log.

- Optionally, make a selection from the Iteration drop-down list.

-

Click the Files tab to view files from the calculations.

-

Click on a file to open or save it.

-

Click Finalize in the Command Item bar.

-

Click Close to end the task.

-

NOTE: If the Locked checkbox is selected, then the instance has been finalized and locked from further editing. Your selections in the drop-down lists are used to filter the results in the Original Charges tab.