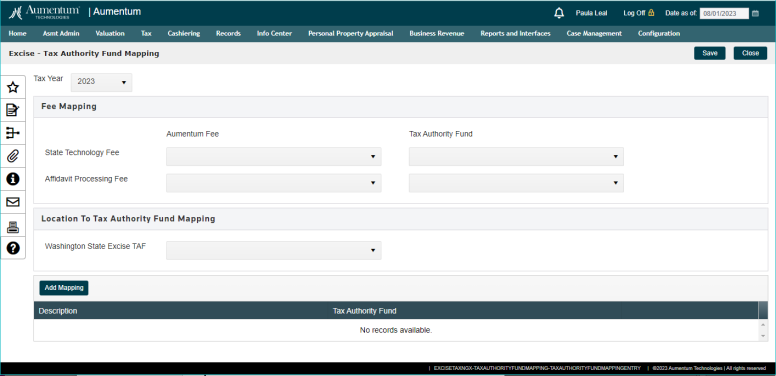

Tax Authority Fund Mapping

Navigate:  Tax >

Excise Tax > Tax Authority Fund Mapping

Tax >

Excise Tax > Tax Authority Fund Mapping

Description

This page allows the user to map Tax Authority Funds (TAFs) to the appropriate Excise entities. These need to be mapped for financial reasons so charges can be generated properly and flow through to Distribution and Tax Accounting.

Preliminary Configuration

Levy Configuration:

Prior to performing this configuration Tax Authorities will need to be created for each entity who will be receiving money from Excise. This includes each Local districts, and the State; and if the jurisdiction wants the Fees broken out, then separate TAF's can be created for those as well.

User defined Field:

A Tax Authority Fund (TAF) level User Defined Field (UDF) for "Is Excise" should be created in Configuration > User Defined Fields which will allow the Excise Cross-Reference page to show only the TAF records with the UDF set to Yes - this will narrow down the information displayed for selection.

Maintain Tax Authority:

Funds will also need to be created and linked to the appropriate Tax Authority (TA) using TAX > Levy Management > Setup > Tax Authorities. Doing this should Create a TAF record which will have a TAFID that will be needed by Accounts Receivable. This TAF record will also contain the TAID, which will need to be sent to Accounts Receivable as well.

On the Tax Authority Fund Row, there will be a Button for UDF - click this and check the "Is Excise" option for all records that should appear in the Cross Reference Setup in the Excise Module.

Fees Setup:

Before starting the jurisdiction will need to create two new fees, one for the Affidavit Processing Fee and the other for the State Technology Fee. This can be accomplished using the Configuration > Fee Maintenance page. Use a Fee Process of "Excise Fee" and the Fee Type will be Flat Fee. Fill in the other information as appropriate and save.

Steps

NOTE: TAFs are generated per tax year, so this Excise TAF mapping is also tax year based. It will only need to be changed if changes are made to the Tax Authority and TAF setup.

- After the above configuration is complete, then enter the Tax Authority Fund Mapping Page and click int he drop-down under Aumentum Fee.

- Select the appropriate Fee For the State Technology Fee and the Affidavit Processing Fee.

- Then select the Tax Authority Fund to map to each of these fees.

- Next scroll down to the Washington State Excise TAF. Selec tthe appropriate TAF for these funds.

- Finally scroll down to the Local Mapping grid

- Click the Add Mapping button, then on the row theat appears select the Location to be mapped, and then in the next column select the TAF to be associated witht he Location. Once all is correct, select Add, or if the row needs to be exited, click cancel.

- Repeat step 6 until all locations for the jurisdiction have been mapped.

- Click the Save button to save all changes in the page.

- If there is a need to remove a row, that can be done by clicking the Remove Button and then clicking Save.