Special Assessment Distribution Status Report

Navigate:  Tax >

Distribution > Reports

> Special Assessment Distribution Status > Special Assessment Distribution

Status Report

Tax >

Distribution > Reports

> Special Assessment Distribution Status > Special Assessment Distribution

Status Report

Description

Generate a report that shows each district special assessment, charges by the date range specified, taxes, penalty, and interest, and total due.

Steps

-

Select the Report Format

-

Define the Schedule date to generate the report or click the Date Picker to select the date.

-

Select the items from the Available Items panel to include in the Selected Items panel and click Add Selected Item(s).

-

Select the item and click Remove in the Selected Items panel to return it to the Available Items panel

-

-

Select the Charges/Payments to Include in the Report.

-

Define the Payment Business Date From and Payment Business Date To ranges. These are required.

-

Select the Bill Event Year or accept the All default.

-

Check the Include Bill Detail checkbox to include bill details

-

-

Click Add to select the Distributions to Include in the Report. This opens a Distribution Search pop-up.

-

Optionally, define any Distribution Search Filters and click Apply Filter to search for the particular distribution based on your search parameters.

-

Click on the particular distribution to select it.

-

Click the window X to close it. The distribution selected is displayed in the Distributions to Include in Report panel.

-

-

Click Queue Process, which submits the report to the batch queue. To view the report, go to Information Center > Batch Processes > Monitor Batch Processes, click on the process in the grid to open the View Batch Process Details screen. Click on the report to view report details. Then close the batch process screens to return to this screen.

-

Click Close to end the task.

-

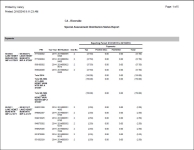

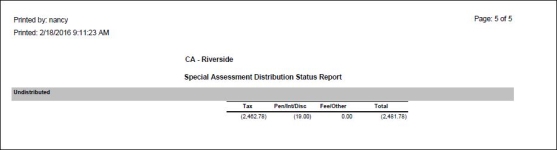

Report Samples

Page 1

Page 2