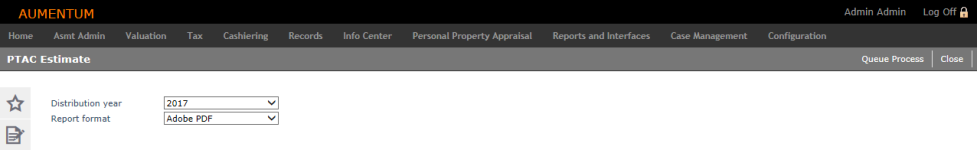

PTAC Estimate

Navigate:  Tax

> Distribution > Reports

> PTAC Estimate > PTAC Estimate

Tax

> Distribution > Reports

> PTAC Estimate > PTAC Estimate

Description

Generate a report showing estimated PTAC distributions based on Standard - with PTAC settings set via Tax > Distribution > Setup > Advanced Commission Setup.

Jurisdiction

Specific Information

Jurisdiction

Specific Information

California

-

You can exclude PTAC from TIF adjustments by setting the RDA Successor [rdaSuc] fund type to exclude PTAC from TIF Adjustment Amounts. For each agency, you will need to:

-

Set up a Tax Authority and Tax Authority Fund via Tax > Levy Management > Tax Entity Maintenance.

-

Set the TIF UDF of TAF Map for Label to Successor Agency and associate the agency with the Successor Agency via Tax > Levy > TIF District Maintenance.

Steps

-

Select the Distribution year.

-

Select the Report format if other than the Adobe PDF default.

-

Click Queue Process to submit the report to batch process which opens the Monitor Batch Processes screen. Select the report when finished processing to advance to the View Batch Process Details from which you can select the report for viewing/printing.

-

Click Close to end the task.

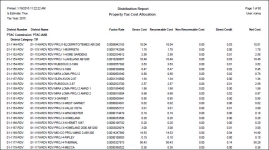

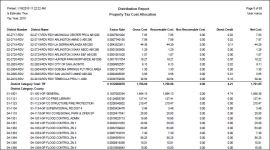

Report Samples

Property Tax Cost Allocation

Sample 1

Sample 2