J29 Report

Navigate:  Tax > Distribution > Reports > J29 Report

Tax > Distribution > Reports > J29 Report

Description

The J29 Report is required by the state of California. There are two estimated reports and one actual report prepared each year. The report pulls data from posted distributions that allocate funds to school districts. The reports also can be exported to the state’s CPATS reporting system, which allows the J29 report data to be accumulated for each school district in the county and then uploaded to the state.

NOTE: Certain jurisdictions use CPATS software that integrates with Aumentum Tax to import data and compare it to the existing J29 data in the application.

Jurisdiction Specific Information

Jurisdiction Specific Information

California

-

To accommodate separate area wide school factors for the city and county allocate area wide school revenues on the J29 report, perform the following setup:

-

Go to Tax > Distribution > Setup > J29 Distribution Rules > Manage Distribution Rules and Add a new rule and description for City, County, and Other.

-

Click Edit on each rule to advance to the Edit Distribution Rules screen and select the Rule Process of J29 Report. Click Edit in the Collections Criteria panel header and Include the Item Types of Contributing TIF Fund Category and Tax Authority. Click Add in the Calculation Rule List panel to select and define the rules as applicable for each.

-

Next, go to Tax > Levy Management > TIF District Maintenance > TIF Districts > Maintain TIF District Details and select the User-Defined Fields Tab. Select the RDA Fund Category field to correspond to the Contributing TIF Fund Category on the J29 Distribution Reporting for each of the City, County, and Other rules.

-

Run the report via Tax > Distribution > Reports > J29 Report > Print J29 Report, and select the Report Period of Estimate and define the other details as applicable.

Riverside, California

- Report Distribution Rules need setup if running the Estimate Period 1 (P1 - November 15th) or Estimate Period 2 (P2 - April 15th) J29 Report.

SETUP: Navigate to Tax > Distribution > Setup > J29 Distribution Reporting Rules.

NOTE: J29 Distribution Rules are locked to only include Percent of Totals rules.

A California standard report that is generated three times per year and submitted to the State. The report provides tax estimates used to calculate state aid for school district revenue limits for the apportionments made by the State to schools.

Steps

-

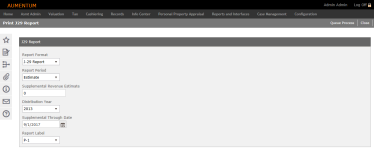

Select the Report Format. Current options are:

-

PDF

-

Extract

-

-

Select the Report Period. Optoins are:

-

Annual

-

Estimate. If you select the Estimate, the Supplemental Revenue Estimate and Supplemental Through Date fields become available on the screen.

-

Select the Distribution Year.

-

Enter a Report Label.

-

Click Print.

-

Click Close to end the task.

-

NOTE: The Distribution Reporting Rules are used for the Estimate report period and require setup prior to running the Estimate report.