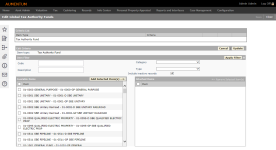

Global Tax Authority Funds

Navigate:  Tax >

Distribution > Apportionment

Factors > Global Tax Authority Funds > Edit Global Tax Authority

Funds

Tax >

Distribution > Apportionment

Factors > Global Tax Authority Funds > Edit Global Tax Authority

Funds

Description

Define criteria and associated TAFs as part of your global Tax Authority Funds for distribution apportionment factors.

Jurisdiction Specific Information

Jurisdiction Specific Information

California

-

The Inactive TAF rule redirects all revenue in inactive TAFs to a Redirect to TAF destination regardless of tax year.

Steps

-

Click Edit in the Criteria List panel to make the criteria selections available.

-

To filter available TAFs, enter the Code.

-

Enter a Description.

-

Select a Category.

-

Select a Type.

-

Check the Include inactive records checkbox to include inactive TAFs.

-

Click Apply Filter to filter the TAF results in the Available Items panel.

-

Select all items or select specific items from the Available Items panel and click Add Selected Item(s) to move them to the Attached Items panel to be used for apportionment.

-

Click Update.

-

Click Save to save the screen.

-

Click Close to end the task.

-