Apportionment Factor Groups

Navigate:  Tax

> Distribution > Apportionment

Factors > Apportionment Factor Groups

Tax

> Distribution > Apportionment

Factors > Apportionment Factor Groups

Description

Apportionment factors are a by-product of the Annual Process (tax charge generation) and are used to determine the distribution of the 1% general tax. Apportionment factors are based on:

-

Factor Types

- Annual

- Estimated

- Supplemental

-

Factor Category

-

Unitary (for county-wide state assessed properties)

-

Secured (local real property - unsecured uses Prior Year Secured)

-

Debt

These factors are not used for tax calculation but are used by Distribution and are maintainable.

SETUP: See Distribution and Apportionment Factors for any applicable prerequisites, dependencies and setup information for this task.

Jurisdiction Specific Information

Jurisdiction Specific Information

California

-

You can calculate 1% Qualified Electric Factors. To do so:

-

Import the QP TAG-level values via AA > Reports and Extracts > Data Interfaces > Import to import values.

-

Then, go to Tax > Levy > Factor Calculations > Qualified Property Values to manage the QP TAG-level values.

-

Next, calculate QP Apportionment factors via Tax > Processing > Tax Roll Processing. Select a tax year and the Apportionment Factors process. Run Calculate QP Apportionment Factors.

-

Finally, view the calculated rates in Tax > Distribution > Apportionment Factor Groups > Apportionment Factor Group Rates.

Steps

-

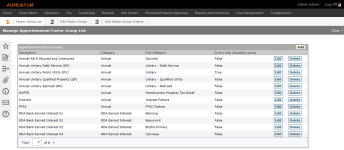

On the Manage Apportionment Factor Group List screen, click Add in the Apportionment Factor Groups panel header, or Edit on an existing group.

- On the Edit Apportionment Factor Group screen, edit the apportionment factors and add factor group criteria.

- Click Delete and OK on the delete confirmation to delete an existing group.

-

Click Close to end the task.