Tax Write Off

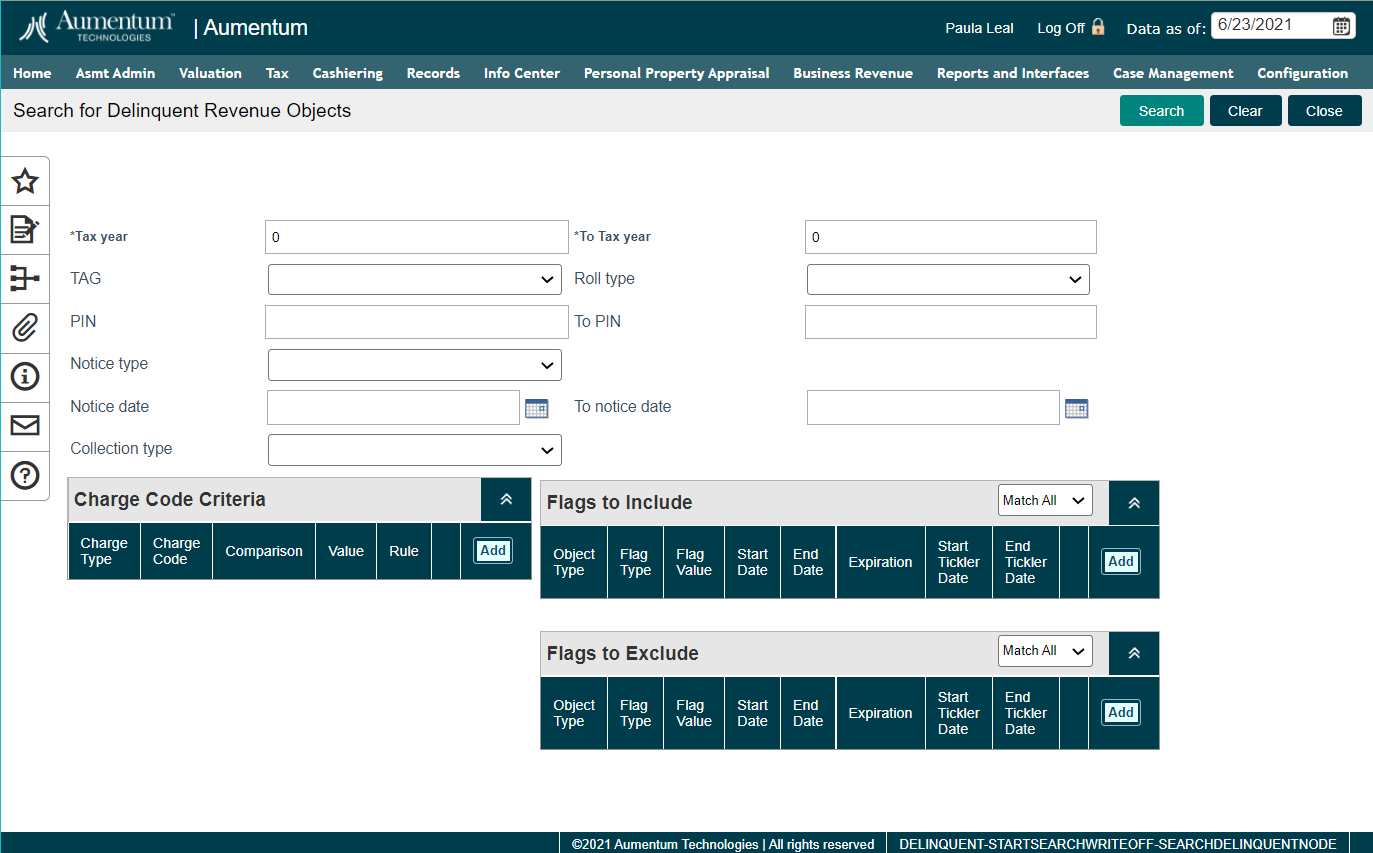

Navigate:  Tax

> Delinquent > Tax Write Off

Tax

> Delinquent > Tax Write Off

Description

When the delinquent taxes and other charges of a delinquent revenue object are deemed uncollectible or below the minimum collectible amount, write off the charges by delinquent group or individually. The delinquent write off process also removes any penalties or interest (with the correct selection of charges or the selection of the adjust-to-zero option).

The search can be lengthy and is performed as a batch process.

Process Write-Offs by Detail

-

To search efficiently, enter as much information as you can into the search fields.

-

From tax year - To tax year – Enter the tax year range for the search; default is the all tax years.

-

TAG – Select the TAG from the drop-down list.

-

Roll type – Select the type of tax roll, such as real or personal property.

-

From PIN - To PIN – Enter a range of PINs to include, from lowest to highest.

-

Notice type – Select by the type of notification that was mailed to the delinquent owner.

-

From notice date - To notice date – Enter a date range of notices to select by this item.

- Collection Type

-

-

Set the charge code criteria, if needed. You can define one or more Rules to select Charge Type/Charge Code combinations and use a Comparison against a Value. For example, you could search for revenue objects that have all charges paid (equal zero) except for penalty (greater than zero).

IMPORTANT: If no charge code is specified to be written off, then the amount due is written off. If the amount due is specified in the Charge Code grid, any other criteria within the Charge Code grid are ignored, and the amount due is written off.

NOTE: To write off penalty and/or interest as well as the delinquent charge, you must include those charge types.

- Select flags in the Flags to Include grid to determine which cases will be included in the search results.

PIN

Flags Applied to PIN

Flags to Include Grid Settings

Will PIN be returned in the search?

101

Bankruptcy - Chapter 7

NSFMatch All:

Bankruptcy - Chapter 7, NSFYes, matches the criteria for inclusion

102

Bankruptcy - Chapter 7

Match All:

Bankruptcy - Chapter 7, NSFNo, does not meet criteria for inclusion

103

Bankruptcy - Chapter 7

Match Any:

Bankruptcy - Chapter 7, NSFYes, matches the criteria for inclusion

104

none

Match Any:

Bankruptcy - Chapter 7, NSFNo, does not meet criteria for inclusion

-

Select flags in the Flags to Exclude grid to determine which revenue objects will be excluded from the search results.

PIN

Flags Applied to PIN

Flags to Exclude Grid Settings

Will PIN be returned in the search?

101

Bankruptcy - Chapter 7

NSFMatch All:

Bankruptcy - Chapter 7, NSFNo, it meets the criteria for exclusion

102

Bankruptcy - Chapter 7

Match All:

Bankruptcy - Chapter 7, NSFYes, does not meet criteria for exclusion

103

Bankruptcy - Chapter 7

Match Any:

Bankruptcy - Chapter 7, NSFNo, it meets the criteria for exclusion

104

none

Match Any:

Bankruptcy - Chapter 7, NSFYes, does not meet criteria for exclusion

-

Click Search to begin the search, using the criteria you defined. The search is performed as a batch process and goes into the queue shown on the Monitor Batch Processes screen.

When the batch process is complete, click the Common Action View Searches on Search for Delinquent Revenue Objects to go to the Select Batch of Delinquent Bills screen, where you select a batch from the search results.

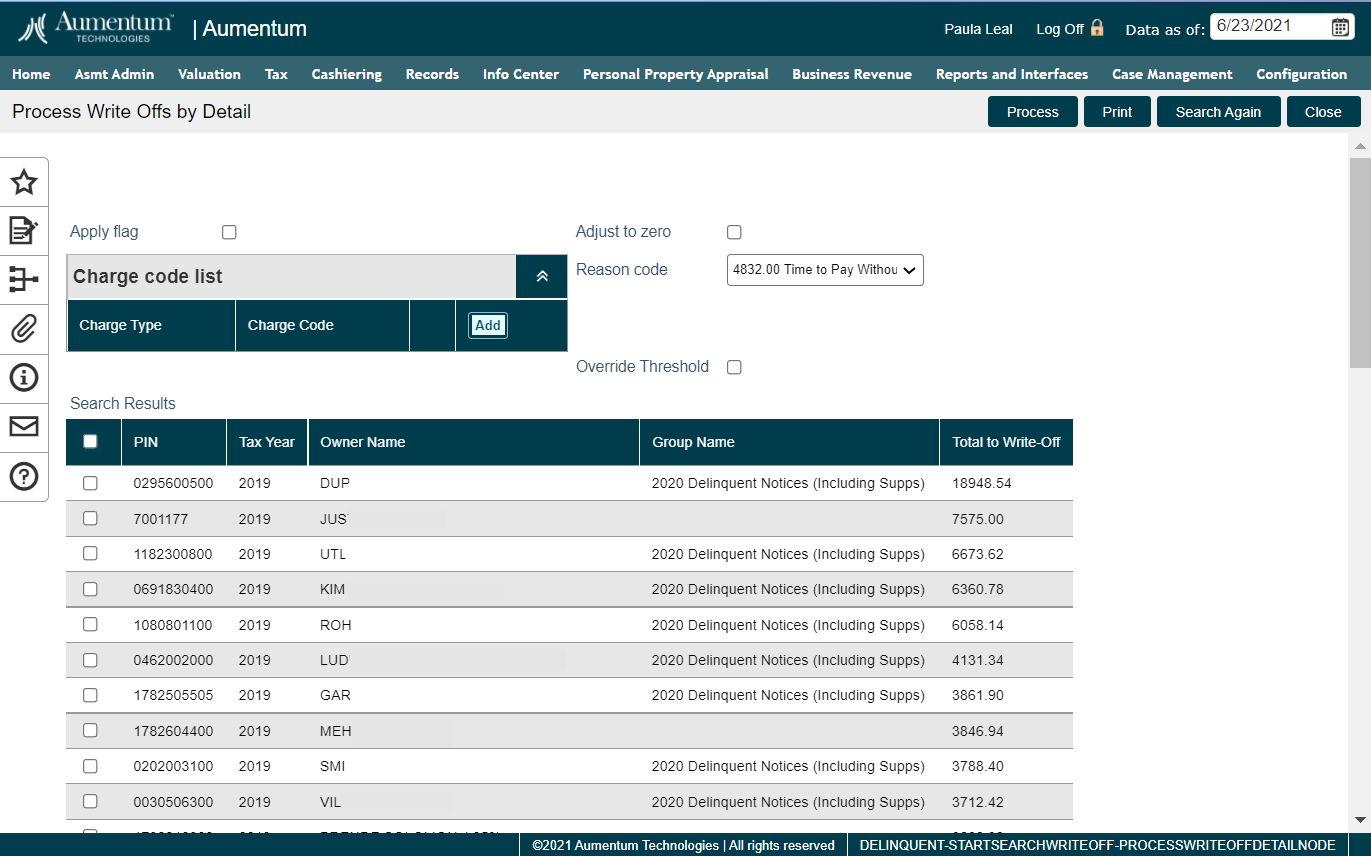

Process Write-Offs by Detail – View the individual revenue objects with delinquencies to write off, and select to process individually.

If a flag should be added to the items then select the Apply Flag checkbox. When the box is checked the Selected Flags panel will appear in which the flag(s) to be added to the item(s) can be identified.

If a reason code should be associated with the write-off items that may be selected as well.

If there is a particular Charge Type and Code that needs to be written off, that may be selected.

Check the adjust to zero check-box when ready to write off and click Process to complete write off the amounts.

The Write-Off report may be printed prior to processing in order to validate the write-offs later.

-

Alternately, click Common Actions to write off by group.

Process Write-Offs by Group

Search for Delinquent Revenue Objects – Select the Common Action Search by Group.

Delinquent Search – Find the previously created group of delinquent charges to write off.

Process Write-Offs by Group – View the selected delinquencies to write off by group, and process the write-offs by group. Print the Write-Off report.

-

Alternately, click Common Actions to write off by detail.

Dependencies, Prerequisites, and Setup

-

Create Groups – Create a delinquent group, if writing off taxes by group.

-

Apply or Remove Delinquent Flags – Flag tax bills to write off, if selecting by flag.

Configuration

-

Application Settings – You must set the following two Accounts Receivable Effective Date application settings as applicable to your jurisdiction to set write-off threshold values to generate the threshold values in the report generated from either the Process Write-Offs by Detail or the Process Write-Offs by Group screen when clicking Print.

-

Secured/Defaulted Secured Write-Off Upper Threshold

-

Unsecured Write-Off Upper Threshold

-

Flag Setup – You must set up Lock Penalty and Lock Interest flags, which are automatically applied when interest and/or penalty is changed during the write-off process. These must use the entity type "taxbill".

NOTE: If not set up, you will get the message Lock penalty flag has not been set up. Unable to lock penalty. during the write off process.

Delinquent

-

Remove charges associated with outstanding debts for the property prior to the forfeiture process.

Tips

If there are fees on one or more bills to be written off that have been calculated but not applied, the write off will adjust the amount of tax, but will change the balance to reflect the amount of the fees. You can perform another write off on the amount of the fees to bring the amount due to zero.

An alternate method for writing off items with unapplied charges is to adjust them first. The delinquent fee detail report can be used to identify those items with fees that have been calculated, but not yet had the charges applied. Once identified, the fees can be either be applied or reversed depending on the requirements of the client. The write off can then proceed and it will process the selected items in a single step.