Paid Listing

Navigate:  Tax > Delinquent > Reports > Paid Listing

Tax > Delinquent > Reports > Paid Listing

Description

Use this report to show by account the bills that were delinquent but are now paid or adjusted. These revenue objects should not currently have a lien against them for the bills listed.

When selecting criteria, use more criteria to pin-point results. Use fewer to return more information. With fewer selections the report will take longer to generate.

NOTE: Use only search criteria that can give you results. If you do not get results from your search, then nothing matched your search criteria. For example, if you search by adjustments and do not get any results, then none of the delinquent bills you are searching through have had adjustments.

Steps

-

Select the options for your report.

-

Select to Report by either payments or adjustments.

-

Payments show accounts that have a balance due of zero.

-

Adjustments show accounts with a tax charge adjustment. Choose a specific Reason code that is associated with the Adjustment. Reason code does not display if you are reporting by Payments.

-

Enter a Group Id to print this report for only one delinquent group. Or leave as 0 to include all groups.

-

Select a From date and To date to include on the report.

-

Enter the Tax year or range of tax years in the From tax year and To tax year fields. If you want all bills of the group to print, leave the tax year blank or enter 0 (zero).

NOTE: The tax year is used for comparison on tax year of the bills in the group.

If a group has 2006 and 2008 bills and you enter 2008, only the 2008 bills will print.

If a group has 2006 bills and you enter 2008 bills, no bills will print. -

Choose a Roll type, such as real property, personal property, special assessment, as offered in the drop-down list.

-

Select the checkboxes for the additional information to include:

-

Include owner address of current owner

-

Include legal description of the revenue object

-

Include F.i.f.a information

-

Select the Group by option to items to determine how the report is sorted. You can choose to group by the Tax Year, the Cadastre Recording District, or the Current Recording District of the revenue object. Totals are also by recording district, when selected.

-

-

Select flags in the Flags to Include grid to determine which cases will be included in the search results.

EXAMPLE

- Select flags in the Flags to Exclude grid to determine which revenue objects will be excluded from the search results.

-

Select the Schedule date and time when you want to process your report. The default date and time is set when you open the task.

-

Click Print to generate your report. Use Monitor Batch Processes to track the progress of the report. After the print file is generated, you can print the reports.

|

PIN |

Flags Applied to PIN |

Flags to Include Grid Settings |

Will PIN be returned in the search? |

|

101 |

Bankruptcy - Chapter 7 |

Match All: |

Yes, matches the criteria for inclusion |

|

102 |

Bankruptcy - Chapter 7 |

Match All: |

No, does not meet criteria for inclusion |

|

103 |

Bankruptcy - Chapter 7 |

Match Any: |

Yes, matches the criteria for inclusion |

|

104 |

none |

Match Any: |

No, does not meet criteria for inclusion |

Follow the same steps as for the Flags to Include grid to add flags until the list is complete.

Select match all or match any. This specifies whether or not an object has to have all the flags or any of the flags attached to it to be excluded from the search.

If all, then the search will exclude from the results bills that match all flags in the grid.

If any, then the search will exclude any bills that have any one of the flags in the grid.

EXAMPLE

|

PIN |

Flags Applied to PIN |

Flags to Exclude Grid Settings |

Will PIN be returned in the search? |

|

101 |

Bankruptcy - Chapter 7 |

Match All: |

No, it meets the criteria for exclusion |

|

102 |

Bankruptcy - Chapter 7 |

Match All: |

Yes, does not meet criteria for exclusion |

|

103 |

Bankruptcy - Chapter 7 |

Match Any: |

No, it meets the criteria for exclusion |

|

104 |

none |

Match Any: |

Yes, does not meet criteria for exclusion |

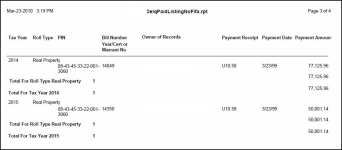

Report Sample

Paid Listing

Tips

When the flag is for a tax bill:

-

Tax bill must fall within the specified tax year.

-

You must select taxbill as the entity type in the flag control if searching for flags applied to bills.

Likewise, select revobj as the entity type in the flag control if searching for flags applied to the revenue object. -

If no date range is selected then flags are not excluded on the basis of date.

-

If flag value is specified, then flag and flag value must be applied to the taxbill. For example:

Entity type = RevObj

Flag type = Bankruptcy

Flag value = Chapter 11