Installment Balance

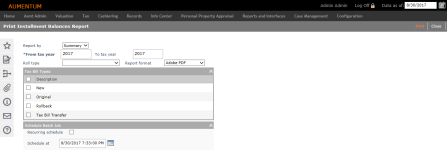

Navigate:  Tax > Delinquent > Reports > Installment Balance

Tax > Delinquent > Reports > Installment Balance

Description

Report on outstanding balances by installment. There are two reports available through this option, a summary report and a detail report.

-

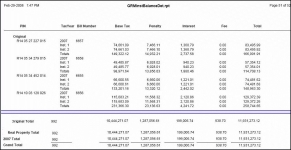

Summary Report – Provides the outstanding balances for the years and roll type selected. Multiple bill types can be included. The report shows installment, bill count, base tax, penalties, interest and fees, and totals for these. There are also totals for roll type and bill type.

-

Detail Report – Shows the information by bill for a single tax year. Totals are per bill for base tax, penalty, interest, and fees.

Steps

-

On the Print Installment Balances Report screen, select to report by summary or detail.

-

Enter the tax year for the detail report or a range of tax years in the From and To fields for the summary report. If you want all bills of the group to print, leave the tax year blank or enter 0 (zero).

NOTE: The tax year is used for comparison on tax year of the bills in the group.

If a group has 2006 and 2008 bills and you enter 2008, only the 2008 bills will print.

If a group has 2006 bills and you enter 2008 bills, no bills will print. -

Choose the roll type, such as real property.

-

Select the report format, such as Adobe PDF or Word DOC, if you want a different format than the default from your user setting.

-

Choose one or more bill types, such as original, new, supplemental, or rollback.

-

Enter the Schedule at date and time in the Schedule batch job panel to schedule when you'd liked to print the report. The default date and time are set to when you entered the screen.

OR

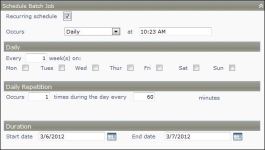

Select the checkbox to schedule recurring batch prints for this report. The Schedule Batch Job panel expands with scheduling options.

-

Click Print to generate your report. Use Monitor Batch Processes to track the progress of the report. After the print file is generated, you can print the report.

Tips

When the sub-group is Roll Back, there will be an additional column reported to show the roll back interest amount.

NOTE: To see the roll back interest, you must select a charge code for the application setting "Rollback interest charge code".

An original bill is the one first created. A new bill is one created for a roll correction in Levy Management.

Report Sample

Installment Balances Report