Forfeiture Listing

Navigate:  Tax > Delinquent > Reports > Forfeiture Report

Tax > Delinquent > Reports > Forfeiture Report

Description

Select from the available choices for the Forfeiture Listing. The report shows a listing of properties in the forfeited group.

IMPORTANT: Forfeiture amounts must be assigned through the Delinquent > Groups > Forfeiture Amounts task before you can print the Forfeiture Listing for a group.

The report includes: city, situs address, PIN, minimum bid (value), special assessments before the forfeiture, special assessments after the forfeiture, and hazardous waste control costs.

Steps

-

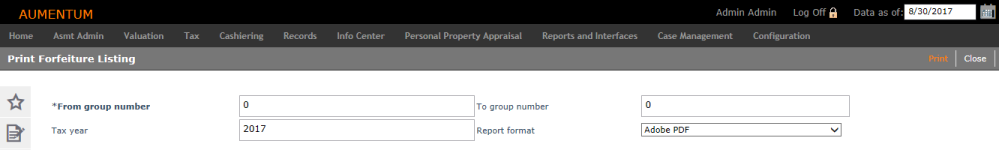

Enter a range of groups in the From group number and To group number fields, or enter a single group number.

NOTE: This report only prints information for Revenue Object Groups.

-

Select the Tax year to report on. If you want all bills of the group to print, leave the tax year blank or enter 0 (zero).

NOTE: The tax year is used for comparison on tax year of the bills in the group.

If a group has 2006 and 2008 bills and you enter 2008, only the 2008 bills will print.

If a group has 2006 bills and you enter 2008 bills, no bills will print. -

Select the Report format to generate.

-

Click Print to generate your report. Use Monitor Batch Processes to track the progress of the batch report.

Report Sample

Forfeiture Listing

Tips

Before printing the report, you must:

-

Create a delinquent group using a list of PINs and with a type of Advertising.

-

Create an advertising template using ForfeitureAdvertising.rpt.