Flag Listing

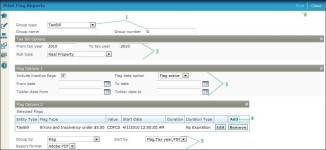

Navigate:  Tax > Delinquents > Reports > Flag Listing > Print Flag Reports

Tax > Delinquents > Reports > Flag Listing > Print Flag Reports

and

Tax > Delinquents > Reports > Flag Detail Listing > Print Flag Reports

and

Tax > Delinquents > Reports > Flag Summary Report > Print Flag Reports

Description

Select from the available choices for the report you want to run.

More than one report uses this same selection screen; however, the selection choices may be different, depending on the report you are running.

When selecting criteria, use more criteria to pin-point results. Use fewer to return more information.

NOTE: Use only search criteria that can give you results. If you do not get results from your search, then nothing matched your search criteria. For example, if you search by group and do not get any results, then that group is not associated with any of the delinquent bills for which you are searching.

-

Flag Listing - Listing of selected delinquents, with flags.

-

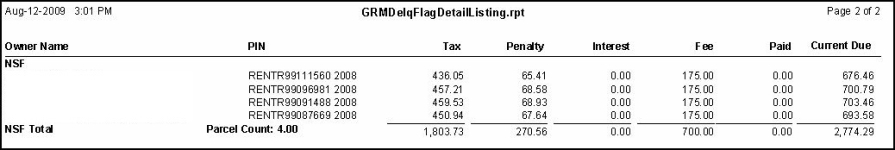

Flag Detail Listing - Detail showing totals of flagged delinquents.

-

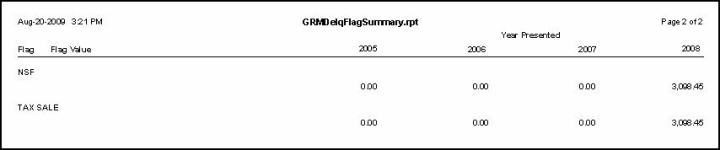

Flag Summary Report - Totals of flagged delinquents.

Steps

-

Select the Group options for your report:

-

Select the Group type of the Flags you want to print. This can be either Tax Bill or Revenue Object.

-

Enter the Group name or Group number to print flags for a specific group.

-

Enter the Tax Bill Options to narrow the results printed on your report.

NOTE: For the Flag Listing report, without grouping, items are filtered by tax bill. For the Object Type filter to work, you must select a Delinquent Group of the same Object Type when running the report. Otherwise, this selection is ignored.

-

-

Select the Tax Bill Options:

-

From tax year and To tax year - Enter the tax year range you want to include on the report. If you want all bills of the group to print, leave the tax year blank or enter 0 (zero).

NOTE: The tax year is used for comparison on tax year of the bills in the group.

If a group has 2006 and 2008 bills and you enter 2008, only the 2008 bills will print.

If a group has 2006 bills and you enter 2008 bills, no bills will print. -

Roll type - Select the tax roll.

-

-

Enter selections in the Flag Options 1 panel to narrow the results printed on your report.

-

Include inactive - Select to report on any inactive flags as well as active flags.

NOTE: This option is not available when printing the Flag Detail Listing.

-

Flag date option - Select "Flag active" to view all the flags that were active within the date range specified (and also includes inactive flags that were active within date range specified, if you select to include inactive) or "Flag applied" to see only flags that have been applied during date range.

-

From date/To date - Enter the date range when the flag was active. Any flags that became inactive during the date range will not be included.

-

Tickler date from/Tickler date to - Enter the date range for the flag tickler.

-

-

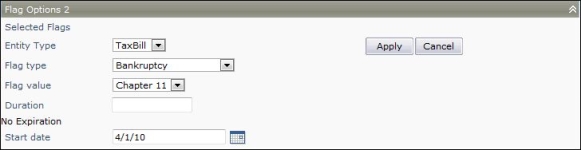

Click Add to select the flag options in the Flag Options 2 panel to narrow the results printed on your report.

-

The Entity Type choices are tax bill, revenue object, or legal party.

-

The choices you see for Flag type depend on the entity type, since the entity type is associated with a flag during flag setup.

-

The choices you see for Flag value depend on the flag type chosen, since the flag value is associated with a flag when it is initially created.

-

Enter a Duration for the flag. The duration type is set up when the Flag is created in Configuration > Flag Setup.

-

The Start date is when the flag will first be applied.

-

Click Apply to save your changes within the panel or click Cancel to cancel the changes without saving.

- Select the formatting options for your report:

-

Select the Group by option. You can choose to group by Flag or by Flag, Flag value.

NOTE: Not all Flags have a Flag Value.

-

Select the Sort by for the way in which the data should be listed.

NOTE: These options vary depending on which flag report you are printing.

-

Select the Report format for the type of report file to generate.

- Click Print to generate your report. A long report may use batch processing to most effectively use the server resources.

Tips

When using a group make sure that the tax year is the tax year of the bills in the group. If you select an incorrect tax year, no data prints on the report.

This report prints the information for each instance in which the flag was applied to an item. For example, if bankruptcy was applied 3 times, then it shows as 3 rows on the report.

Report Sample

Flag Listing

Flag Detail Listing

Flag Summary Report