Delinquent List

Navigate:  Tax > Delinquents > Reports > Delinquent List > Print Delinquent List

Tax > Delinquents > Reports > Delinquent List > Print Delinquent List

Description

Select from the available choices for the Delinquent List report, such as real or personal property. The report shows current due amounts within a tax year, including interest percent, interest amounts, and PIN count.

Steps

-

On the Print Delinquent List screen, enter search criteria to filter the results on your report.

-

From PIN, To PIN – Use a range of PINs to see all PINs within that span.

-

From tax year, To tax year – Enter a tax year or range of tax years. If you want all bills of the group to print, leave the tax year blank or enter 0 (zero).

NOTE: The tax year is used for comparison on tax year of the bills in the group.

-

If a group has 2006 and 2008 bills and you enter 2008, only the 2008 bills will print.

-

If a group has 2006 bills and you enter 2008 bills, no bills will print.

-

User ID of collections officer – Select a user id to list only those that have been assigned to the user login of one collections officer.

-

Owner name – Report on a single owner. Be certain that you have the name exactly right, including middle initial.

-

From amount due, To amount due – selects a range of current amounts due as of the current date.

For example, Bob’s current amount due is 10.00. The amount due range is 15 to 25.

-

The search request does not match Bob's delinquent bill current amount due, and it will not be shown on the report.

-

Amount due date fields 1 through 3 allow you to see current amounts due as of the dates you select.

-

This delinquent bill will be included in the report. Also, the report will show the balance due as of date 1, date 2 and date 3.

-

Roll type - Select a roll, such as real property or special assessments.

-

Collection type - Select the collection type to include.

-

Select the report formatting options:

-

Choose to have the report grouped by tax year or by the recording district of the revenue object. Totals are also by recording district, when selected. (The Recording district supported application setting enables the recording district option.) You can group the report by Cadastre Recording District, Tax Year, or Agent (user ID).

-

Select the sort by option to determine the grouping of data on the report.

-

Select the report format options for the type of report file to generate.

-

-

Select other options for the report:

-

Include alternate communication – You can choose from phone number types, email address, website, or fax number.

-

Include statistics – Print a subreport with statistical information.

-

Suppress main report – Print only the statistical report. The Delinquent List does not print when this option is selected.

-

Include legal description of the revenue object.

-

Include owner address of current owner.

-

Include Situs address of the revenue object.

-

-

In the Other Amount Due panel, select the Include other years amount due checkbox if necessary and enter the last tax year to include on the report. This includes the prior year amount and adds this amount to the total amount due. If the checkbox is not selected, Other amounts due and Total amount due do not print on your report.

-

In the Flags to Include panel, select flags to determine which cases will be included in the search results.

-

Select Match All or Match Any. This specifies whether or not an object has to have all the flags or any of the flags attached to it to be excluded from the search.

-

If all, then the search will exclude from the results bills that match all flags in the grid.

-

If any, then the search will exclude any bills that have any one of the flags in the grid.

EXAMPLE

-

- In the Flags to Exclude panel, select flags to determine which revenue objects will be excluded from the search results.

-

Select Match All or Match Any. This specifies whether or not an object has to have all the flags or any of the flags attached to it to be excluded from the search.

-

If all, then the search will exclude from the results bills that match all flags in the grid.

-

If any, then the search will exclude any bills that have any one of the flags in the grid.

-

In the Group Filter panel, enter search criteria to find groups to include on the report and click Go.

NOTE: Enter no criteria to return all groups.

-

From group ID, To group ID – Enter an id range to search for multiple groups, enter one From group id to search for a single group, or leave blank to search for all groups.

- User ID – Select a User id to search for groups associated to that user.

-

From group name, To group name – Enter a name range to search for multiple groups, enter one From group name to search for a single group, or leave blank to search for all groups.

-

-

In the Search Results panel, select the checkbox next to each group you want to include on the report and click Print.

-

On the Monitor Batch Processes screen, click to select Delinquent List report.

- On the View Batch Process Details screen, click the hyperlink in the Report panel to open the report in a new window.

For example, Bob’s current amount due is 10.00. The amount due range is 10 to 25.

|

PIN |

Flags Applied to PIN |

Flags to Include Grid Settings |

Will PIN be returned in the search? |

|

101 |

Bankruptcy - Chapter 7 |

Match All: |

Yes, matches the criteria for inclusion |

|

102 |

Bankruptcy - Chapter 7 |

Match All: |

No, does not meet criteria for inclusion |

|

103 |

Bankruptcy - Chapter 7 |

Match Any: |

Yes, matches the criteria for inclusion |

|

104 |

none |

Match Any: |

No, does not meet criteria for inclusion |

EXAMPLE

|

PIN |

Flags Applied to PIN |

Flags to Exclude Grid Settings |

Will PIN be returned in the search? |

|

101 |

Bankruptcy - Chapter 7 |

Match All: |

No, it meets the criteria for exclusion |

|

102 |

Bankruptcy - Chapter 7 |

Match All: |

Yes, does not meet criteria for exclusion |

|

103 |

Bankruptcy - Chapter 7 |

Match Any: |

No, it meets the criteria for exclusion |

|

104 |

none |

Match Any: |

Yes, does not meet criteria for exclusion |

NOTE: The Interest Rate (Int Rate) column header on the report is contained within the same line as the Buyer Number. The interest rates show only when you use the Tax Sale Item override rate. If the rate used is determined through other Accounts Receivable rules and the Tax Sale Item interest rate is zero, this column is hidden on the report.

Tips

The parameter selections resulting in fewer records or fewer calculations result in a faster processing speed for the report:

-

A smaller group processes faster than a larger group.

-

When flags are specified to include or exclude, the processing time is faster if there are not many tax bills that have those flags.

-

Prior year searches are faster.

These selections take longer to process:

-

Including the prior year amount due lengthens the search time because the process gathers records with that amount due for all prior year bills.

-

Specifying amount due dates 1, 2, and 3 slows the search because these dates are used for forecasting the amount due. An additional calculation is added to the process for each future date used.

-

Using the current tax year when the delinquent date has not come due is the slowest search because the amount due for the entire year is calculated and considered. For example, if the 1st installment due date has passed but not the 2nd installment due date, then the report process still considers all bills as delinquent since the second installment charges have not yet been paid.

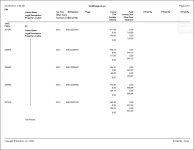

Report Sample

Delinquent List