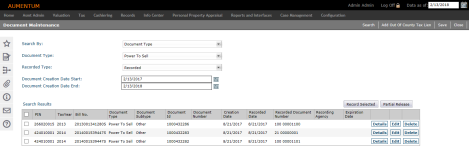

Document Maintenance

Navigate:  Tax > Delinquent > Groups > Document Maintenance

Tax > Delinquent > Groups > Document Maintenance

Description

Maintain recordation information for all Tax Collector initiated Official Documents. Also, enter a range of Instrument Number (Tax Sale) and Recording Date (Tax Sale) for the recording of corrected power to sell, cancellation of power to sell, and rescission of power to sell.

NOTE: Power to Sell and Out of County Liens may not apply to your jurisdiction.

Steps

-

On the Document Maintenance screen, make a selection from the Search By drop-down list.

-

If you select Recorded Document Number, enter the From Recorded Document Number and the To Recorded Document Number. You can enter a number in the From Recorded Document Number field to search for a single number.

- If you select Document Number, enter the From Document Number and To Document Number. Optionally, make a selection from the Recorded Type drop-down list.

- If you select Document Type, make a selection from the Document Type drop-down list and specify a start and end date range for when the document was created.

-

If you select PIN, enter the From PIN and To PIN. You can enter the same number in both fields to search for just one PIN.

-

-

Click Search.

-

Click a header name to sort the results in ascending or descending order.

-

-

In the Search Results panel, click Details for an item in the grid to view details about tax lien charges.

- On the Lien Document Details screen, click Change Mailing Address (if necessary) in the Legal Party Details panel.

- On the Edit Mailing Address screen, enter or edit the address information and click Next.

- On the Confirm Mailing Address screen, make a selection from the Correspondence type drop-down list, enter the beginning and ending dates, and click Next.

- On the Add Address Note screen, enter relevant information for this address change and click Finish.

- The address is displayed in the Alt. Mailing Address column in the Legal Party Details panel.

-

When you change the alternate address, it is used for Print Delinquent Notice.

- Click Change Alt. Mailing Address to open the Edit Mailing Address screen and make your changes.

- In the Search Results panel, click Edit. The row is highlighted and you can make changes in three columns:

- Enter or select the Recorded Date.

-

Enter or edit the Recorded Document Number.

NOTE: Any changes to the Recorded Date and Recorded Document Number are logged as Aumentum Events. These events generate workflows for review in the View My Worklist screen (if applicable and if configured for your jurisdiction).

-

Make a selection from the Recording Agency drop-down list.

NOTE: This drop-down list includes service lenders that are categorized as a Lien Recording Agency.

NOTE: The Expiration Date column date is defined automatically when you click Save based on the document selected and the recorded date.

-

Click Apply.

If the Require Reason Code for Delinquent Lien Release application setting is set to True, the Global reason pop-up is displayed.

-

In the Search Results panel, click Delete for an item in the grid. Click OK on the confirmation pop-up to delete the document. Click Cancel to return without deleting.

- Click Save in the Command Item bar.

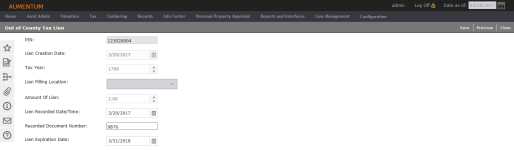

Out of County Tax Lien

Depending on your jurisdiction, Add Out of County Tax Lien is available in the task bar (top of screen).

- On the Out of County Tax Lien screen, fill in the fields. PIN and Lien Creation Date are required.

- Click Save.

To view and edit:

-

On the Document Maintenance screen, select Document Type from the Search By drop-down list and Out of County Tax Lien from the Document Type drop-down list.

- From the search results, click Details on any row for a read-only view, or click Edit to modify the Lien Recorded Date/Time, Recorded Document Number, and Lien Expiration Date.

- Click Save.

- Click Previous to return to the Document Maintenance screen.

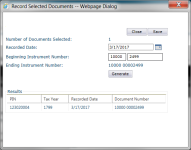

Record Selected Documents

-

Select the checkbox next to one or more records in the search results.

-

Click Record Selected.

-

In the Record Selected Documents dialog box, select the Recorded Date and type the Beginning Instrument Number.

-

Click Generate to show the results.

-

Click Save, then click Close.

NOTE: The Recorded Document Number column field for the selected record then shows the updated document instrument number. This field and functionality related to power to sell may not apply to your jurisdiction.

Partial Release/Removal

Aumentum identifies, for partial free release of lien, active liens on tax bills for which a free release of lien form or a partial free release of lien form was not previously issued.

Setting up the Document

To create a report using the Partial Release data service, you must first set up a partial release document.

- Click Reports and Interfaces > Correspondence > Setup > Report Setups.

- On the Manage Report Setups screen, click New.

- On the Edit Report Setup screen, set parameters for the report.

- Category: Delinquent

- Data Service: Partial Release

- Click Save in the Command Item bar.

Partially Releasing a Legal Party

By Document Type or PIN

- On the Document Maintenance screen, select the checkbox for an item in the Search Results panel and click Partial Release/Removal above the panel.

- On the Partial Release/Removal screen, make a selection from the Partial Notice and Doc Sub Type drop-down lists (required fields).

- Select an item in the Legal Party Details panel and click Print Partial Release/Removal in the Command Item bar.

- In the Change Reason Statutory References pop-up, make a selection from the Change Reason drop-down list.

- Optionally, add a note.

- Click Save.

- The system generates the document, which includes the name of the legal party released and the reason. Click Info Center > Batch Processes to open the Monitor Batch Processes screen.

- Click on your item in the grid to open the View Batch Process Details screen.

- In the Report panel, click the hyperlink to open the document.

- Click Close to end the task.

NOTE: Select the Mailing Address Primary Owner checkbox to identify the Primary Owner for a Tax Bill Lien. This will be used when the primary legal party is released and the client needs to identify the new primary owner.

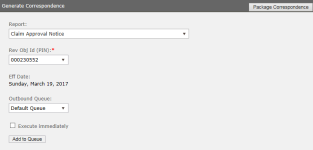

Generate Correspondence

You can select specific correspondence and generate it to the Outbound Document Queue. See the Reports and Interfaces Correspondence topic for details.

- In the sidebar, click the Correspondence (envelope) icon.

- In the Generate Correspondence dialog box, make a selection from the Report drop-down list.

- Click Add to Queue.

Adding Attachments

Certain delinquent correspondence notices and documents are available from the Attachments icon in the sidebar. You must first run the notice via Tax > Delinquent > Correspondence > Notices to make any of these documents available.

-

Abstract of Judgment

-

Power to Sell

-

Lien Notice

-

Lien Release Notice

-

Power to Sell Cancellation

-

Power to Sell Rescission

Common Actions

Send to Recorder Office – (may not be available in your jurisdiction) used to send a batch of documents to a specific clerk at the jurisdiction's Recorder's Office.

NOTE: The Recorder's Office Documents data service must be set up prior to using this task.