Notices

Navigate:  Tax

> Delinquent > Correspondence

> Notices

Tax

> Delinquent > Correspondence

> Notices

Description

Select the variable criteria for a delinquent notice and submit for batch processing, where it is prepared for printing.

NOTE: The Delinquent Additional datasource process prints a notice for each current owner.

Steps

-

On the Delinquent Search screen, make a selection from the Search type drop-down list.

- Enter your search criteria and click Search.

- In the Search Results panel, click to select an item in the grid.

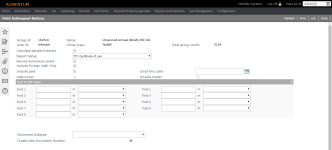

- On the Print Delinquent Notices screen, select the options relevant to your Delinquent Notice.

-

Select the Calculate penalty/interest checkbox to calculate this for each bill before printing the notice.

-

Report Setup (notice) you want to run.

NOTE: The remaining fields may vary based on the setup selected.

-

Select the Record Aumentum event checkbox if you want this process to create an Aumentum event for each notice that is printed. Events can be viewed in Info Center.

- Select the Include Foreign Address Only checkbox for a group of PINs with a foreign or military address. This checkbox is available for Delinquent Notices, Delinquent Additional Notices, and Property Sale Notices. When selected, a certification number is not generated as it would be when selecting Certified Mail. Also, when selected, the Certified Mail panel is no longer visible and the Notice per PIN panel and Print one notice per PIN checkbox become available.

- Make a selection from the Mail Type/Location drop-down list, if needed.

-

Select the Include paid checkbox only if you want to include the paid accounts and those that are still delinquent.

-

Enter or select the Good thru date that prints on the notice. This is the cutoff date for selecting delinquent accounts. Any delinquents earlier than or matching this date are included.

-

Select the Hide Owner checkbox if you do not want this information to appear on the notice.

-

Select the Include lender checkbox if you want this information to appear on the notice.

-

Defendant information is either the current owner or the owner as of the delinquent date.

NOTE: This option displays if you select Delinquent Notices for the Report Setup.

-

Requested Date

- In the Field or UDF Value panel, enter or select relevant information to print on the notice.

-

If you are using UDFs, you must have previously attached the UDF to the delinquent bill via Delinquents > User-Defined Fields > User Data Entry.

-

If both field text and a UDF are selected for one field, the field text is printed on the correspondence.

-

Enter information for the following optional panels.

NOTE: The panels displayed vary, depending on the Report Setup you select.

-

Click Add or Edit in the Description panel to add or maintain legal descriptions you want to include in your notice.

-

Click Add or Edit in the Additional Party Role panel to select any other parties you want to include in your notice.

-

Click Add or Edit in the Exclude from PIN Amount Due panel to select bills to exclude from the amount due based on flags attached to the bill.

-

If applicable, make a selection from the Document Subtype drop-down list.

-

Optionally, select the Create New Document Number checkbox to automatically generate a number for the printed document. When lien notices are generated, the system automatically creates the next delinquent lien notice number.

NOTE: The Starting Lien Number application setting determines the next number that is assigned to a lien. If not defined, no lien number is assigned.

-

If applicable, select one or more items in the Collection Type panel to include in the delinquent notice printing.

-

If applicable, click Validate in the Command Item bar. The Aumentum Platform checks for necessary fields before processing the notice.

-

Click Print in the Command Item bar.

NOTE: When printing a lien correspondence, liens are printed in PIN order (descending).

- On the Monitor Batch Processes screen, click to select the delinquent notice when the Status column shows it is complete.

Jurisdiction

Specific Information

Jurisdiction

Specific Information

California

-

On the Delinquent Search screen, when Group Type is Extension of Lien, the process checks whether the Tax Delinquents application setting Release of Tax Lien requires Supervisor Approval is set to True or False.

-

If True, there are additional checks to validate that supervisor approval was received, then the correspondence is printed.

- If False, then the correspondence is printed.

-

- You can generate a Power to Sell document. To set this up:

-

Go to Configuration > Application Settings > Maintain Application Settings

-

Select the setting type of Effective Date and the filter by module of Tax Delinquents.

-

Click Edit on the Power to Sale Date MM/DD application setting and define the date in the MM/DD format.

Report Sample

Delinquent Notice

Tips

Aumentum Events can be viewed in Info Center on the Event History screen via Info Center > Tax Detail > Records Search > Records Search Results > [Tax Detail button] > Tax Information > [Common action View Event History] > Event History.

User-defined field information must match the variables inserted in the Word document.

The combined application settings for document source, subtype, and type together define the FiFa lien book and page choices for delinquent correspondence. Systypes for each are setup before the application settings, according to user needs.

To be certain that a delinquent group does not contain duplicates before printing notices, open the group in Manage Groups. Any duplicates are automatically removed upon opening.

Use the Info Center to track the delinquent bills through Delinquent Information or Events History.