Advertising Configuration

Navigate:  Tax >

Delinquent > Advertising

> Advertising Configuration

Tax >

Delinquent > Advertising

> Advertising Configuration

Description

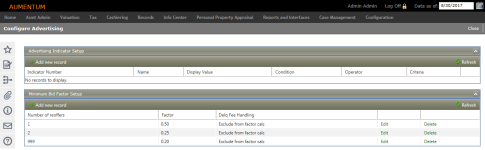

Configure the application for Advertising in your jurisdiction.

-

Set up indicators that map elements to certain advertising circumstances. These indicators are included in the Advertising List when the conditions are met. You can create up to 10 indicators.

NOTE: This task may not apply to your jurisdiction. Contact your Aumentum Support representative for help with Advertising Indicators.

-

Set up the Minimum Bid Factors to calculate the Minimum Bid Amount during Advertising for tax sale items based the number of offering times has been added. In California, the Minimum Bid Calculations for second and third offers have a 50% and 25% factor based on the fact that they have been offered previously and not sold. Aumentum can now calculate the minimum bid upon Advertising the Tax Sale.

Steps

-

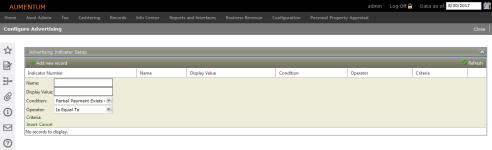

Click Add new record in the Advertising Indicator Setup panel to create a new Advertising Indicator. Or click Edit to update an existing indicator.

-

Enter a Name.

-

Enter a Display Value.

-

Select a Condition. When the condition is met, the Display Value prints on the Advertising List for the bill.

-

Partial Payment Exists on Bill – Accounts Receivable determines if a partial payment has been made on the bill being included in the Advertising List.

-

Tax Authority Fund – the Tax Authority Fund is present on the tax bill.

-

Class Code – The Class Code exists on the Revenue Object.

-

Flag – The specified Flag exists on the entity type specified for that flag (tax bill, legal party, revenue object, etc.).

-

Reason Code – The adjustment Reason Code exists on the tax bill.

-

Modifier – The selected value Modifier exists on the tax bill.

-

Fee – The selected Fee exists on the tax bill.

-

Unpaid Certification on PIN – There are other Certificates on the revenue object that are still unpaid.

-

Prior Year Taxes Due on PIN – Accounts Receivable determines if there are taxes due on other bills besides the one being included in Advertising List.

-

Select an Operator that determines action to take when the Condition is met.

-

Click Insert to create the new indicator. The Criteria drop-down list and Update button now display.

NOTE: The Insert button is not available if you are editing an existing indicator.

- Select criteria for your Condition.

-

Prior year taxes due on PIN – True or False

-

Partial Payment exists on bill – True or False

-

Tax Authority Fund – The list of valid Tax Authority and Fund descriptions including Special Assessments.

-

Class Code – The list of valid Class Codes.

-

Flag – The list of active Flags.

-

Reason Code – The list of valid Reason Codes.

-

Modifier – Value types with 'exempt’ in the description

-

Fee - The list of Delinquent Fees (set up in Tax > Delinquents > Fee Maintenance)

-

Unpaid Certification on PIN – True or False

-

Click Update to save your indicator.

-

Click Delete to remove an indicator.

-

Click Refresh to update the indicator information.

-

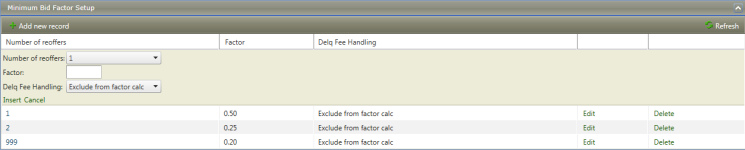

In the Minimum Bid Factor Setup panel, click Add new record to add a new factor setup, or click Edit to update an existing setup.

IMPORTANT: This panel only displays if you have the Tax Delinquents application setting Advertising Use Minimum Bid Factors set to True.

-

Enter the number of reoffers – This drop-down list contains 0, 1, 2, 3, 4, 5, and 999. 0 indicates a first offering and 999 indicates anything greater than the last number configured. In Riverside, set up lines for 0, 1, 2, and 999.

-

Enter the Factor – Enter the factor to be used on the amount due (in decimal format). For example, for a 50% factor, enter .50.

-

Select the Delinquent Fee Handling option – This drop-down list contains two options used during Advertising.

-

Include in Factor Calc – this option includes the amounts for fees in the amount due and base the factor calculation on the full amount due including the fees.

-

Exclude from Factor Calc – this option excludes the fees from the total used in the factor calc. If this option is selected, the fees are added back to the product after the factor calculation is complete.

- Click Insert to create the new factor setup. Or click Update if you are editing an existing factor setup.

-

Click Close to end the task.