Refund Interest Setup

Navigate:  Tax > Accounts Receivable > Surplus Refund Setup > Refund Interest Setup

Tax > Accounts Receivable > Surplus Refund Setup > Refund Interest Setup

Description

Define interest calculation rules. Refund interest setup allows interest to be calculated based on a rate schedule that you set up and can update whenever necessary. This functionality can be used for erroneously sold tax liens.

Steps

-

On the Add or Edit Refund Interest Calculation Rules screen, click Add. Or, click Edit for an existing rule in the grid.

-

On the Set Up Refund Interest Calculation Rule Detail screen, enter an evaluation order for the rule, which means that if there are multiple rules, the order in which each rule is evaluated is based on the value you enter in this field.

-

Enter a short description and description.

-

Check the Prorate Refund Interest to TAF/TIF? checkbox to prorate the refund interest.

NOTE: This checkbox displays only when the Prorate Refund Interest to TAF/TIF and include in Distribution application setting is set to true.

Click here to learn how to apply this application setting.

Click here to learn how to apply this application setting.

- Click Configuration > Application Settings.

- On the Maintain Application Settings screen, select Effective Date from the Setting type drop-down list, and select Tax Accounts Receivable from the Filter by module drop-down list.

- Locate Prorate Refund Interest to TAF/TIF and include in Distribution and click Edit.

- Select the checkbox in the Setting Value column to set it to True.

- Click Apply.

- Click Save in the Command Item bar.

- Click Close to end the task.

See Refund Interest Proration later in this topic.

-

In the Criteria panel, click Add, or click Edit for an existing item in the grid.

- In the Field column, select the reason code. The remaining fields change, depending on your selection. Enter or select the data for the remaining fields.

-

Click Apply.

-

Click Cancel to discard your changes.

-

Click Delete for an item in the grid to remove it. Click OK in the confirmation pop-up.

-

In the Calculation Rates panel, click Add, or click Edit for an existing item in the grid to maintain the calculation rates for the rule.

-

In the Cycle column, make a selection from the drop-down list.

-

Enter a numeric value for the day of the month for the cycle.

-

Select the Compounded? checkbox if interest on the refund is to be compounded.

-

In the Date Range column, click Change Date Rate.

-

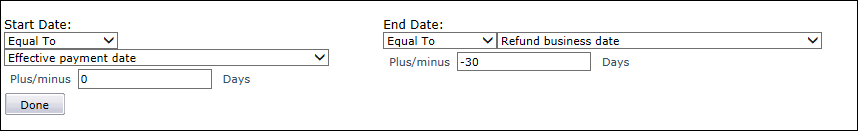

In the Change Date Range pop-up, make selections from the Start Date and End Date drop-down lists.

-

Depending on your selections, additional options may display. Select the applicable values, and click Done to close the pop-up.

-

Make a selection from the Type drop-down list.

-

If you select Rate, enter the amount value (for example, .05 for 5%).

-

If you select Rate Schedule, make a selection from the drop-down list.

-

-

Click Apply.

-

Click Cancel to discard your changes.

-

Click Delete for an item in the grid to remove it. Click OK in the confirmation pop-up.

-

Click Save in the Command Item bar.

-

Click List to return to the Add or Edit Refund Interest Calculation Rules screen.

-

Click Close to end the task.

Refund Interest Proration

When an abatement/correction results in a refund and the refund requires interest, the interest to be refunded is charged back to each of the tax authorities (districts) in the same manner in which the original payment was allocated (in the same proportion as the amounts making up the refund), thereby reducing the amount distributed to the various agencies.

Not all refund interest is charged back to the tax authorities, for example, a refund interest caused by an improperly sold tax lien. Proration of refund interest is controlled by the refund interest calculation rule that you set up on the Set Up Refund Interest Calculation Rule Detail screen.

To accommodate this enhancement, Accounts Receivable has been modified so that:

-

A single row for Refund Interest in FnclDetail is broken out into multiple rows in RefundIntDist by TAF/TIF based on the prorated percentage of the surplus derived from the payment rows created by the charge adjustment.

-

A TIF column was added to the RefundIntDist table.

-

An application setting called Prorate Refund Interest to TAF/TIF and include in Distribution? controls this functionality. When set to true, refund interest is added to a refund transaction, and a proration algorithm is performed that allows the single Refund Interest row in FnclDetail to be broken out and stored in multiple rows in RefundIntDist. When set to true, the Set Up Refund Interest Calculation Rule Detail screen includes a new Prorate Refund Interest to TAF/TIF? checkbox that when checked, prorates the refund interest. Also, when set to true and when processing a refund on the Post Refund screen, the Refund Details grid displays whether refund interest will be prorated. This can be overridden by clicking Edit Refund in the grid and setting to either Y or N. In addition, the Payment Listing Report includes a 'Refund' option for the Payment Management Transactions section if set to true. The rows in RefundIntDist are calculated based on a prorated % of the surplus being refunded, derived from the payment rows of the transaction that created the surplus.

-

Balancing reports now include refund interest information. Functionality already exists to include rows from RefundIntDist into distribution. Distribution has been enhanced to pull information from the new RefundIntDist.TIF column. The ability to override proration with a Y/N respond when the refund is being processed is also available. An association between the refund interest calculation rule and the prorate Y/N selection determines if refund interest should be prorated. If Yes is selected, AR identifies the surplus being refunded, gets the financial transaction Id of the surplus, identifies the difference between the payment amount and the amount reapplied for each TA/TAF/TIF and uses those amounts to divide the refund interest to the TA/TAF/TIFs in equal percentages. For the Collection Summary report, refund interest is included whenever the Charge Type equals Surplus is included in the report.

IMPORTANT: If configuring refund interest to be distributed, review any Distribution Rules that apply to your jurisdiction to ensure that they either bypass Refund Interest or they apportion the Refund Interest amounts appropriately if they should be included in the rule criteria.

Refund Interest Setup for Erroneously Sold Tax Liens

Refund interest setup allows interest to be calculated based on a rate schedule that you set up and can update whenever necessary. This functionality can be used for erroneously sold tax liens.

To accommodate this:

1.) A Criteria panel Field selection was added to the AR Payment Rate Schedule on the Set Up Refund Interest Calculation Rule Detail screen.

2.) an End Date Event was created for the Calculation Rate setup that is controlled by a new End Date field added to the list of available events on the Calculation Rates panel of the Set Up Refund Interest Calculation Rule Detail screen. This date becomes the surplus creation date.

NOTE: The Surplus Creation Date is already available in Aumentum as the Refund Business Date; 3.) A new systype called Tax Sale Refund Interest (systypecatid = 150225) was created that is set to either True or False from the Value field drop-down list in the Criteria panel on the Set Up Refund Interest Calculation Rule Detail screen.

4.) Aumentum code allows the refund interest calculation to use a refund interest rule and rate schedule.

NOTE: The functionality is already available to redeem an erroneously sold tax lien. An erroneously sold item has the certificate information cancelled and a new interest rate applied, and the tax sale payment is refunded to the buyer. Use the Tax Sale Corrections program to void the certificate to cancel the charges, remove all of the tax sale information from the PIN, and create surplus to be returned to the Buyer.

To set this up:

-

Click Configuration > Application Settings > Maintain Application Settings.

-

Select the setting type of Effective Date and the filter by module of Tax Accounts Receivable.

-

Click Edit on each of the following three application settings and set as defined to calculate refund interest based on your defined rate schedule:

-

Certificate Refund Interest Rate = .00

-

Certificate Refund Interest Start Calculation Event Type = blank

-

Use Certificate Interest Rate if Less than Refund Interest Rate = False

-

Next, set up a rate schedule for refund interest via Tax > Accounts Receivable > Payment Terms Mapping and Setup > Payment Terms Rate Schedules > Maintain Payment Terms Rate Schedules. The rate schedule should contain the Percentage rates for every rate change that has occurred back to the earliest certificate date converted on the system. Enter a description that identifies that the schedule is for refund interest calculation (e.g., Refund Interest Schedule). Aumentum looks at the rate schedule you define to determine the rate for refund interest at the time the certificate was sold and uses this rate to calculate the interest.

NOTE: You will need to add new rows to this schedule whenever there are changes in the Federal Reserve Discount rate that result in a change to the refund interest rate (whenever the Federal Reserve discount rate rises to 7% or higher).

-

Next, click Tax > Accounts Receivable > Setup > Refund Interest Setup > Add or Edit Refund Interest Calculation Rules, and create refund interest calculation rules. Select the rate name schedule you created (e.g., Refund Interest Rate schedule) and define the remaining data as applicable.