Tender Type Mappings

Navigate: Tax > Accounts Receivable > Setup > Tender Type Mappings

Tax > Accounts Receivable > Setup > Tender Type Mappings

Description

The Tender Type Mappings task is used to map file content to Aumentum tender types. It allows mapping between anticipated contents of a file and existing tender types from Cashiering setup. The tender type is compared to global, till and cashier settings in Aumentum. When tender type does not match, a default is used. Aumentum uses the information to interpret the data in the payment files and the appropriate tender type.

Steps

-

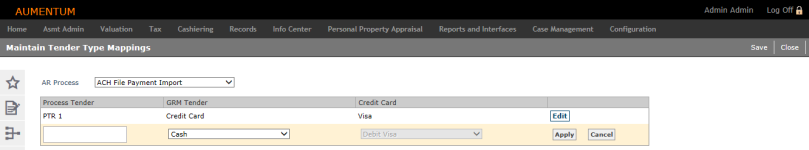

On the Maintain Tender Type Mappings screen, make a selection from the AR Process drop-down list.

- Click Add in the panel title bar, or click Edit for an existing item in the grid.

-

In the Process Tender field, enter a short description.

-

Make a selection from the Aumentum tender drop-down list.

-

Make a selection from the Credit Card drop-down list, if applicable.

-

Click Apply, or click Cancel to discard changes.

-

Click Save in the Command Item bar.

-

Click Delete for an existing tender type in the grid to remove it.

- Click the Close button to end the task.

Logging

To accommodate logging, two application settings were created:

-

eGov extract logging on

-

eGov extract - days to retain data

Click here to learn how to set this up.

Click here to learn how to set this up.

-

Click Configuration > Application Settings.

- On the Maintain Application Settings screen, select Effective Date from the Setting type drop-down list, and select Tax Accounts Receivable from the Filter by module drop-down list.

-

Locate eGov extract logging on and click Edit.

- Select the checkbox in the Setting Value column to set the value to True (default) to enable logging and click Apply.

- Click Save in the Command Item bar.

-

Locate eGov extract - days to retain data and click Edit.

- In the Setting Value column, specify the number of days you want to retain data and click Apply.

- Click Save in the Command Item bar.

- Click Close to end the task.