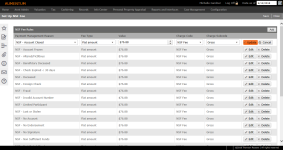

NSF Fee Setup

Navigate:  Tax > Accounts Receivable > Setup > NSF Fee Setup

Tax > Accounts Receivable > Setup > NSF Fee Setup

Description

Use this task to set up NSF fees.

-

The default NSF fee amount setup is mapped to the reason codes available from the Reason Code field on the Manage Payment screens for the Accounts Receivable > Bad Check (NSF) process.

-

The NSF fee setup is also used for Payment Plan Setup, which uses the Plan Start Date with the Effective Dated Plan.

Fees can be added to returned checks. When a check received for payment has been returned from the bank, the county performs a process to cancel the payment related to the check using the Tax > Accounts Receivable > Manage Payments > Bad Check (NSF) process or via Accounts Receivable > Correspondence > Notices.

As part of this process, an NSF notice is generated to the tax payer indicating the reason for the NSF cancellation. The notice includes the bank's NSF check fee, the NSF fee you define using this task, plus the original bill amount and any other fees.

Steps

-

On the Set Up NSF Fee screen, click Add. Or, click Edit on an existing row in the NSF Fee Rules panel.

-

Make a selection from the Payment Management Reason drop-down list.

-

Make a selection from the Fee Type drop-down list.

NOTE: The default systypes for non-sufficient funds fee calculation types are Flat Amount and Percent.

-

Enter or edit the value for the NSF fee rule.

-

Make a selection from the Charge Code drop-down list.

-

Make a selection from the Charge Subcode drop-down list.

-

Click Update.

-

Click Cancel to discard your changes.

-

-

Click Save in the Command Item bar.

-

Click Close to end the task.

-

NOTE: Value is a user-entered amount. If the Fee Type is Flat Amount, then this is a currency field (format as currency). If the Fee Type is Percent, then this is a percent field (up to 10 decimal places).

NOTE: Also define the Flat Amount and Percent on the Edit Payment Terms Rate Schedule screen to define the rate schedule details.

NOTE: The same Charge Code and Charge Subcode can be used for all setup rows if appropriate; they do not have to be unique.

Dependencies, Prerequisites and Setup

Payment Management Reason Codes

Your Aumentum Implementation team helps set up the necessary NSF reason codes (Payment Management Reason Codes) that are used within the Bad Check (NSF) process.

Accounts Receivable

-

Payment Terms Rates must be set up via Tax > Accounts Receivable > Payment Terms Mapping and Setup.

-

Payment Plan Setup must be defined via Tax > Accounts Receivable > Payment Plans.

Configuration

- Set the effective date for the Non-sufficient funds fee calculation type systype via Configuration > Systypes > Select or Add a Systype. The current default systypes available for the NSF fee calculation types are Flat and Percent.

-

Establish the desired flag for the various notices pertaining to NSF and apply the flags during the Bad Check process.

-

Corresponding NSF flags are also set up via Configuration > Flag Setup to link to the Tax Bill/Revenue Object.

-

Any flags required to extend the due date must also be linked to the tax bill during Bad Check processing.

Reports and Interfaces

The jurisdiction is responsible for creating the mail merge NSF notices, which are set up via Reports and Interfaces > Data Services. The data service is optionally downloaded and updated or created using Data Services. Once available, the data service is then associated to the particular report and report template, in this case NSF Notice, via Reports and Interfaces > Correspondence.