Reconciliation

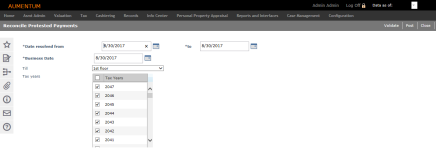

Navigate:  Tax > Accounts Receivable > Protested Payments > Reconciliation > Reconciliation

Tax > Accounts Receivable > Protested Payments > Reconciliation > Reconciliation

Description

This task is used to look for Resolved Protests in a given date range and for selected tax years and can run in both Validate and Post modes. Agencies can refund disbursed (early release) protested payments to taxpayers. The Protested Payment (ProtestedPmt) table includes a reconciled attribute (Yes/No) that indicates if a miscellaneous charge and payment has already been created to return the previously disbursed dollars to the appropriate agency. See Protested Payments for setup details.

Validation Mode

Validation mode produces the following four reports:

-

Protested Payment Reconciliation Report, which shows what the Post process results would be if posted

-

Missing Protested Payment Miscellaneous Source Setup Mappings Report, which shows distinct protested payment object types and object Id combinations that have not been mapped to a PUP Miscellaneous Source in the Protested Payment Miscellaneous Source Group

-

Protested Payment Miscellaneous Sources Report, which shows Protested Payment Miscellaneous Sources that have not been mapped to an Agency under Distribution

-

Missing Protested Payment Resolution Adjustment Report that shows all protested tax bills that have not had a correction processed on them after the protested date of the given bill. This is a validation check to make sure all resolution corrections have been completed.

Post Mode

Post mode:

-

Finds all protested payment Id records marked as Resolved during the specified date range that had not been previously reconciled and that have also been previously distributed. Protested payment records now include a new attribute that indicates whether a payment has been reconciled (a miscellaneous charge and payment was created to return the dollars to the appropriate distribution agency).

-

Compares the summed distribution financial total to the summed financial detail amount for the same protested payment Id. If the financial detail sum is less than the distribution financial total sum, too much money has been distributed and the appropriate agency refunds the money to the taxpayer.

-

Records the revenue object and tax bill Ids, the tax year, object type, object Id and refund amount for each and creates a Protested Payment Miscellaneous Source Setup Mapping record for each distinct Object Type/Object Id combination that does not exist.

-

Checks for missing Protested Payment Miscellaneous Source Setup Mappings and produces the Missing Protested Payment Miscellaneous Source Setup Mappings report if any are missing and creates the required setup records; 5.) Checks for missing PUP Miscellaneous Source Agency Mappings and produces the Missing Protested Payment Miscellaneous Source Agency Mappings report if any are missing. If any source setup mappings or source agency mappings are missing, the process stops until those are defined. 6) For each tax build: a.) creates a receipt, b.) creates a Miscellaneous Charge for each Object Type/Object Id combination captured using the PUP Miscellaneous Source Mapping for the Object Type and Object Id and creates a Receipt Detail to pay that charge; c.) Uses surplus from the PIN as the tender for the receipt. Any remaining surplus remains associated with the PIN to be refunded later to the tax payer; d.) Produces error log entries for PINs that have an insufficient amount of surplus to cover the total for the receipt and does not create the receipt for those PINS; e.) Marks the Protested Payment records as having been reconciled by this process if a receipt was created to prevent running the same records through this process multiple times; and 7) Produces the Protested Payment Reconciliation Report showing the amounts that need to be refunded to the taxpayer by the authority that has already received the disbursement.

SETUP: See Protested Payments for any applicable prerequisites, dependencies and setup information for this task.

Steps

-

On the Reconcile Protested Payments screen, enter or select the Date Resolved From and To dates.

-

Enter or select the Business Date.

-

Make a selection from the Till drop-down list. This is your till by default, but can be changed.

-

Select the checkbox for one or more tax years. All are checked by default.

-

Click Validate to preview the results and generate pre-posting reports, or click Post to post the reconciled payments.

-

Click Close to end the task.

Report Samples

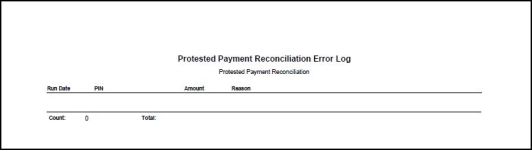

Reconcile Protested Payment Error Log Report

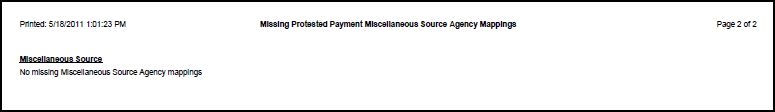

Missing Protested Payment Miscellaneous Source Agency Mappings Report

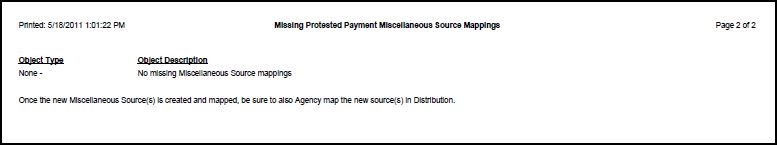

Miscellaneous Protested Payment Miscellaneous Source Mappings Report

Protested Payment Reconciliation Report

Missing Protested Payment Resolution Adjustment Report