Payment Plan Notices

Navigate:  Tax

> Accounts Receivable >

Correspondence > Payment

Plan Notices

Tax

> Accounts Receivable >

Correspondence > Payment

Plan Notices

Description

Use this screen to generate notices to send to all taxpayers with an active payment plan.

There are two versions of this notice:

-

If the taxpayer has not made the annual payment plan installment payment yet, generate a reminder to pay the installment payment. The version of the notice also reminds the taxpayer to pay both installments of the current year's taxes and any secured supplemental tax bills for the account.

-

If the taxpayer has made the annual payment plan installment payment, generate a reminder to pay both installments of the current year's taxes. This version of the notice also reminds the taxpayer to pay any secured supplemental tax bills for the account and gives the taxpayer the option to pay more towards the payment plan installments even if no minimum payment is due.

Steps

-

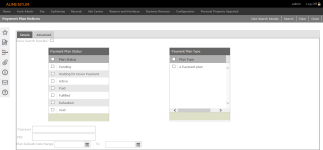

On the Payment Plan Notices screen, click the Simple tab to select or enter your search criteria.

-

Optionally, select the Save Search Results checkbox and enter a name in the Search Name field.

-

Click Search to submit the process to batch.

-

As Of – the date used to determine what payments are included, what plan installments are due, and/or what the starting plan status is.

-

Plan installments due have been paid checkbox

-

If selected, Aumentum verifies that the plan installments that are due by the As Of date have been paid. In the search results, the system indicates what the plan status would be on the As Of date, based on whether the plan installments have been paid.

-

If not selected, Aumentum does not consider this parameter when determining what the plan status would be on the As Of date.

-

Specified tax year bills are current checkbox

-

If selected, Aumentum verifies that the PINs entered for the specified year of the tax bill (not in the payment plan) either has an installment due by the As Of date already paid in full, or the last installment on the tax bill is paid in full if due by the As Of date.

In the search results, Aumentum indicates what the plan status would be on the As Of date, based on whether the criteria was met.

-

If not selected, Aumentum does not consider this parameter when determining what the plan status would be on the As Of date.

-

Tax Year – This field only displays if the Specified tax year bills are current checkbox is selected. "Current" means that the installment has been paid in full by the installment due date.

-

Make an installment selection, if applicable.

-

Plan is Paid in Full checkbox

-

If selected, Aumentum indicates what the plan status would be on the As Of date in the search results panel, based on whether or not the plan installments are paid in full (e.g., Status displays "Fulfilled").

-

If not selected, Aumentum does not consider this parameter when determining what the plan status would be on the As Of date.

-

Click Search.

- Click Clear to reset the search criteria to defaults.

- Click View Search Results to see all saved searches.

- In the Payment Plan Saved Searches grid, click Details for an item in the grid to open the Search Criteria pop-up. Click the X in the pop-up's title bar to close it.

- Click Delete to remove this saved search from the grid.

- Click to select a saved search and click Next.

- Click Close to end the task.

Or, click the Advanced tab to select or enter your search criteria. Fields of note include:

Tips

Payment Plan and Protested Payments

Payment is not accepted via Cashiering > General > Payment Collections or via Tax > Accounts Receivable > Batch Collections > [Daily Remittance Payment Import] when the following two conditions exist simultaneously:

-

An account is in a Payment Plan.

-

The tax payer is protesting one or more tax bills, meaning it is a Protested Payment and the account includes a protest flag.

The Protest flag is set via Cashiering > Setup > Flag Payment Rules to not allow payment when this flag exists on an account and when the account is in a payment plan.

NOTE: Flag Payment Rules can be set at the revenue object level, legal party level, and account level for payment plans.

Cashiering Does Not Allow Payment Flags

When attempting to cashier a payment via Cashiering > General > Payment Collection, a message displays on the Collect Payment screen indicating a Do Not Allow Payment flag exists and payment cannot be accepted. Batch collection payments on accounts meeting both criteria are rejected automatically during batch processing.

Also, Payment Plan Notices recognize the Cashiering Do Not Allow Payment flag and send the notices, depending on whether the flag exists.

When an account is in a payment plan and there is a roll correction to the account, the roll corrected bill is typically excluded from payment plan calculations for 30 days.

After the Do Not Allow Payment flag expires, the payment plan is recalculated via a Payment Plan Recalculation workflow available on the View My Worklist screen, accessed via the Workflow icon on the sidebar of any screen.