Notices

Navigate:  Tax >

Accounts Receivable > Correspondence

> Notices

Tax >

Accounts Receivable > Correspondence

> Notices

Description

Generate Accounts Receivable notices, such as the 10-Day Notice.

NOTE: The 10-Day Notice applies to Riverside, California only.

IMPORTANT: See Correspondence for AR for prerequisite and setup information for correspondence and for information about generating the 10-Day Notice en masse.

Steps

-

On the Search for Payments/Surplus screen, enter your search criteria and click Search.

-

On the Payment Search Results screen, select the checkbox for one or more items in the Search Results panel and click Next.

-

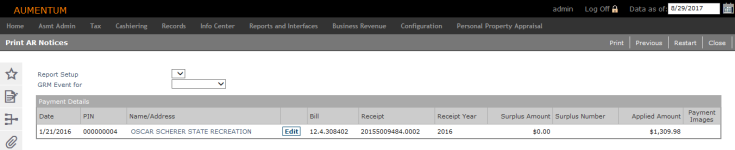

On the Print AR Notices screen, make a selection from the Report Setup and GRM Event for drop-down lists.

-

In the Payment Details panel, click Edit for an item in the grid.

- On the Refund Correspondent Name/Address screen, click Create Correspondent to save your edits.

- Click Print.

-

On the Manage Outbound Document Queue screen, select the correspondence job for processing and click Process Selected to process the correspondence.

-

On the View the Correspondence Process screen:

-

Select the Steps and History tabs to view the steps and historical data of the process.

-

Select the Log tab to download a log file of the process.

-

Select the File tab to download the process file.

-

Click Close to return to this screen.

-

In the Payment Details panel, click Edit for an item in the grid.

- Click Restart to return to the Search for Payments/Surplus so that you can initiate a new search.

-

Click Previous to return to the Search for Payments/Surplus screen.

-

Click Close to end the task.