Collection Type Transfer

Navigate:  Tax >

Accounts Receivable > Collection

Type Transfer

Tax >

Accounts Receivable > Collection

Type Transfer

Description

Use the Collection Type Transfer task to select collection types to transfer from secured to unsecured and vice versa. During a roll correction, Accounts Receivable pulls the new charge information from Levy. This information includes the Assessment Type/Collection Type. AR then runs the charges through the AR Collection Type Secured-to-Unsecured Rulesconfiguration to determine if any should change from secured to unsecured.

Jurisdiction Specific Information

Jurisdiction Specific Information

California

-

As of this writing, this task applies to California only.

-

The Cashiering application setting Required payment in full for Defaulted Secured controls whether payment is required in full for Collection Types of Defaulted Secured. This must be set to True for all California jurisdictions.

-

California statute requires that all bills for a RevObj that are in a Redemption Group (in Aumentum, these are bills with unpaid charges having the Collection Type of Defaulted Secured) to be paid in full together.

-

However counties may permit taxpayers to make partial payments if they wish, as long as the payments are spread across all of the bills in the Redemption Group, according to specific payment allocation rules. Riverside, CA has elected to allow partial payments.

Riverside

-

The Installment Allocation Rule column in the Charge Allocation Rule table for Tax Charge Corrections is set to Final Only. Corrections affect the last installment first when payments exist. If payments do not exist the correction splits the installments evenly.

Steps for Mass Transfer

-

On the Transfer Collection Type screen, select Mass Transfer from the Method drop-down list.

-

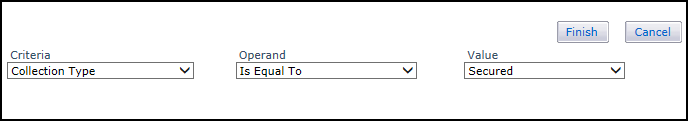

In the Charge Transfer Criteria panel, click Add or click Edit for any item in the grid.

-

In the Transfer Criteria pop-up, make your selections from the drop-down lists and click Finish.

-

The data is updated in the Charge Transfer Criteria panel if you clicked Edit on an existing row. A new row is created if you clicked New.

-

Click Cancel to close the pop-up with making any changes.

-

On the Transfer Collection Type screen, make a selection from the Then transfer Collection Type on unpaid charges to drop-down list.

-

Select the checkbox for one or more items in the grid and click Save Criteria in the Command Item bar.

-

Click Queue Process to submit the transfer to batch.

- Click Remove in the grid to delete the selected items.

- Click Close to end the task.

Steps for Selected Bill Transfer

- On the Transfer Collection Type screen, choose Selected Bill Transfer from the Method drop-down list.

- Make a selection from the Transfer Collection Type on unpaid charges to drop-down list.

- Enter the PIN, Bill Number and Tax Year for an unpaid bill and click Add to List. Recently added bills are displayed at the top of the grid.

- Optionally, in the Selected Bills panel, select the checkbox for one or more items and click Delete All.

Configuration and Setup

-

A cashiering level setting to control the restriction of loading secure/unsecure bills allows restricting of cashiers by collection type. To accommodate this, a Allow payment of the following collection type field on the Set Up Cashier screen includes available selections of All, Secure, and Unsecured. Jurisdictions who do not work with secured/unsecured bills select the default of All. When attempting to load bills on the Collect Payment screen for which they are not set up, a message displays indicating that the bill(s) has been removed from loading due to the setting.

-

If a single defaulted secured bill is loaded into the grid on the Collect Payment screen, and that revenue object has other bills with unpaid charges that are defaulted secured, those bills are retrieved automatically into the grid as well. Certain defaulted secured bills can be removed from the set if in Override mode as defined by security rights. All defaulted secured bills can also be removed from the set. However, a payment transaction cannot be completed with only some defaulted secured bills in the set unless in Override mode. Certain counties work around this by using business processes to retrieve bills by PIN, removing current bills if necessary, and manually enforcing payment of all defaulted secured bills. In this situation, for batch collections, enforcement of full payment of all delinquent secured bills is typically handled by CUBS and manually; Aumentum payment import checks that bills are paid in full, but still allows payment of a single delinquent secured bill even if there are others, if that is what is in the payment file.

-

Tax Charge Corrections need to have the InstAllocRule column set to 'Final Only' (350882) within the ChrgAllocRule table. Riverside requires corrections to affect the last installment first when payments exist. If payments do not exist the correction should split the installments evenly. If 'Final Only' means that the correction will affect the last installment first regardless of a payment existing then a new setting will need to be coded along the lines of 'Final Only When Payments Exist' that splits installments evenly when payments do not exist.

-

California statute requires that all bills for a revenue object that are in a Redemption Group (in Aumentum, these are bills with unpaid charges with the Collection Type of Defaulted Secured) to be paid in full together. However, counties are allowed to permit taxpayers to partial payments if they choose, as long as the payments are applied across all of the bills in the Redemption Group, according to specific payment allocation rules. The Cashiering application setting Required payment in full for Defaulted Secured controls whether payment is required in full for Collection Types of Defaulted Secured. Go to Configuration > Application Settings > Maintain Application Settings. Set the Effective Date and select Cashiering as the Filter by module. Click Edit on the Required payment in full for Defaulted Secured and set as applicable to your jurisdiction.

IMPORTANT: This application setting must be set to true for all California jurisdictions. It can be set as applicable for any other jurisdiction.

-

The Accounts Receivable Boolean effective date application setting Exclude Secured bills in Active payment plan from Collection Type Transfer controls whether bills that are part of a payment plan are included in the collection type transfer. If set to true, payment plan bills are excluded from the collection type transfer. The default is false (payment plan bills are included in the transfer).