ACH Installment Amount Update

Navigate:  Tax

> Accounts Receivable >

ACH Processing > ACH

Installment Amount Update

Tax

> Accounts Receivable >

ACH Processing > ACH

Installment Amount Update

Description

Update installment amounts of all taxpayers using a selected ACH debit payment plan.

NOTE: This process updates installment amounts for all revenue objects in the same plan. Use the Maintain Taxpayer ACH Information screen to update individual plans.

SETUP: See ACH Installment Amount Update for any applicable prerequisites, dependencies and setup information for this task.

Steps

-

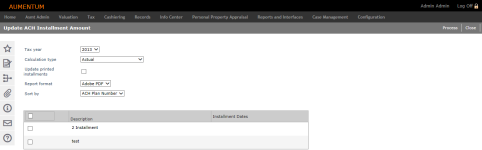

On the Update ACH Installment Amount screen, make a selection from the Tax year drop-down list.

-

Make a selection from the Calculation type drop-down list.

- Actual (taxes owed)

- Based on Truth-in-Taxation (estimated amounts)

- Estimated - Prior Year

- Remaining Amount Due

-

Select the Update printed installments checkbox only if you want to overwrite the previous calculations. This is used when the calculate program was run in error.

-

Make a selection from the Report format drop-down list.

-

Make a selection from the Sort by drop-down list for how you want the report sorted.

-

Select the checkbox for each payment plan to process or select the Description checkbox to select all plans.

-

Select the checkbox for the installment dates for the payment plan, if applicable.

-

Click Process. The Monitor Batch Process screen opens automatically.

-

Click Close to exit without printing.

-

Tips

If taxes have not yet been calculated, the updated amount is an estimate. After the taxes have been calculated, payments are automatically adjusted for the actual due, and the estimate is treated like an advanced payment.