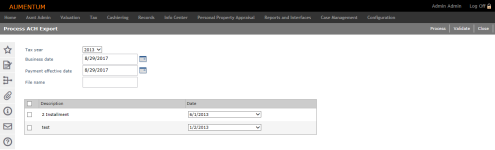

ACH Export

Navigate:  Tax > Accounts Receivable > ACH Processing > ACH Export

Tax > Accounts Receivable > ACH Processing > ACH Export

Description

Create the ACH export file with payment transactions in this batch process. The processing creates the export file and a report of the transactions. It also creates a Cashiering session with the payments, and the session is automatically posted.

Steps

-

On the Process ACH Export screen, make a selection from the Tax year drop-down list.

-

Enter or select the business date to track the day on which you ran this process.

-

Enter or select the payment effective date, which is the date that penalty and interest calculations uses.

-

Enter a file name for the export file.

-

Select the checkbox for one or more items to include in the export.

- Select a date for each item you select.

-

Click Validate in the Command Item bar to print a report of the proposed contents of the ACH file so that you can review the accuracy of the records. No file is produced with this button.

The report lists the taxpayer, PIN, bank, transit routing number, bank account number, account type, cycle, date, amount, and status to be debited.

-

Click Process to create the ACH export file and the report of its contents.

-

Click Close to exit without creating the file.

-

Prerequisites

Setup ACH Installment Cycle Types

Tips

You must manually adjust any ACH payments that are rejected, such as an insufficient funds situation, to reverse the transactions and apply any fees and flags.

The ACH export file follows the file specification from the ACH Rules book.

Transaction codes are:

-

27 Checking Payment

-

37 Savings Payment

The export file includes trace numbers. A 15-character trace number is comprised of the 8 character county transit number plus the batch job number.

The block count of the export file is based on the number of records and the blocking factor. For example, a file containing 20 records has a block count of 2. The blocking factor of 10 is set by NACHA, the publisher of the ACH file format. It cannot be changed.