Redescribe by Minor Subdivision (Split)

Navigate:  Records > Revenue Object Maintenance

Records > Revenue Object Maintenance

Description

A parcel is a revenue object that can split into two or more revenue objects. The parent revenue object is the starting parcel, which may be retained with the same identification. The new revenue object(s) may inherit some characteristics of the parent or may have new information assigned.

The difference between a split and a plat is:

-

Split always has one parent parcel that is generally split into a small number of children.

-

Plat often has one or more large parent parcels that are split into many children (i.e., a new subdivision).

This section of the chapter describes the split workflow. The next section in this chapter describes the plat workflow.

Records provides the same workflow for the following two split tasks:

-

S - Redescribe by Minor Subdivision (Split)

-

E - Redescribe to Create Separate Estate Revenue Object (see the Tips at the end of this topic)

Both tasks begin with one parent. The following table illustrates the differences between the S and E tasks.

|

S - Redescribe by Minor Subdivision (Split) |

Children |

Retire |

Survive |

Transfer (New PIN) |

|

Approved and Recorded Plat Survey |

1 or more |

Yes |

Yes |

No |

|

Court Ordered Partition |

1 or more |

Yes |

Yes |

No |

|

Deed with Subdivision Description |

|

|

|

|

|

Bargain and Sale Deed |

1 or more |

Yes |

Yes |

Yes |

|

Full Covenant and Warranty Deed |

1 or more |

Yes |

Yes |

Yes |

|

Grant Deed |

1 or more |

Yes |

Yes |

Yes |

|

Interspousal Deed |

1 or more |

Yes |

Yes |

Yes |

|

Quit Claim Deed |

1 or more |

Yes |

Yes |

Yes |

|

Special Purpose Deed |

1 or more |

Yes |

Yes |

Yes |

|

Special Warranty Deed |

1 or more |

Yes |

Yes |

Yes |

|

Other Source Document |

1 or more |

Yes |

Yes |

No |

|

Recorded Survey Document |

1 or more |

Yes |

Yes |

No |

|

Right of Way Acquisition |

1 or more |

Yes |

Yes |

No |

|

E - Redescribe to Create Separate Estate Revenue Object |

Children |

Retire |

Survive |

Transfer (New PIN) |

|

Easement - Contract |

1 |

No |

Yes |

No |

|

Easement - Deed |

1 |

No |

Yes |

Yes |

|

Leasehold Estate |

1 |

No |

Yes |

No |

|

Separated or Split Estate |

1 |

No |

Yes |

Yes |

The following instructions illustrate a split using task S. The workflow is the same for task E.

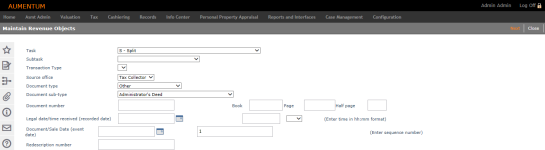

From the Records menu, select Revenue Object Maintenance. The Maintain Revenue Objects screen is displayed.

Steps

-

On the Maintain Revenue Objects screen, select S - Split from the Task drop-down list.

-

Make a selection from the Subtask drop-down list. The Transaction Type and Document Type fields are automatically populated based on your selection.

-

Optionally, make a selection from the Source office drop-down list.

-

Enter the Document Number, Legal Date/Time Received and Document/Sale Date. If known, also enter the Book and Page information (optional).

-

Click Next.

- On the Records Search for Revenue Object screen, enter the search criteria for the PIN to be split and click Search.

- On the Records Search Results for Revenue Object screen, click to select an item in the Search Results grid.

- On the View Revenue Object Balances screen, click Next to continue the workflow.

-

On the Verify Parcel and Start Split screen, verify that you selected the correct revenue object to split, enter the new parcels to create and select the status after the split.

- Click Next.

-

On the Enter New Parcel Information screen, enter the new PIN, AIN, geocode, coordinates, and rights for the child parcels.

-

Enter the new parcel areas for the new parcels (as specified on the previous screen).

- Click Next.

-

On the Enter New Parcel Areas screen, edit descriptions in the New Parcel Area panel, which is used for legal purposes. Or, click Add to include more parcels.

-

Click Next.

-

On the Update Parcel Descriptions screen, verify the information. To add a parcel description:

- In the New Parcel Description panel, make a selection from the Add drop-down list.

- Enter information as needed and click Apply.

-

If there are multiple parcel descriptions, click the up arrow icon to change the display order.

- If a description needs to be removed, click Delete.

- Click Next.

- On the Update Parcel Situs Addresses screen, select an item to edit in the New Location Addresses panel.

- In the New Location Addresses for <PIN> panel, make any necessary changes.

- In the Address Units panel, click the Plus icon. Make a selection from the Unit type drop-down list and enter an identifier. Click the green check mark to save your changes.

- Click Next.

- On the Verify and Complete Split screen, review the information. If there are errors, click Previous to return to the screen that contains the information to be corrected.

- In the Note panel, enter notes or keywords.

- Click Finish in the Command Item bar, which returns you to the Maintain Revenue Objects screen.

IMPORTANT: Some jurisdictions do not process transfers or redescriptions if the revenue object has a tax balance due.

Tips

Use the E - Create Separate Estate Revenue Objects task for long-term leases. It creates a new revenue object just as a split does, and the separate leasehold estate would still be owned by the building owner until a Transfer of Ownership is processed. The Transfer of Ownership would change ownership of the leasehold to the lessee, and it would then appear as a separate line on the assessment roll with the lessee as the owner, allowing a separate tax bill to be sent. The building owner is transferring a leasehold estate to the tenant.

The appraiser would then value the entire building and use an adjustment to reduce its value by 10%, noting the reason as the leasehold. The leasehold revenue object would then need to have that 10% entered as its value with a note relating it to the main building value. At the end of the lease, the ownership would be transferred back to the building owner if the lease is not extended. Then the building owner would have to go through the same process all over again for the next lessee.

-

A message alerts you that it is necessary to transfer ownership of the revenue object at the conclusion of certain split subtasks. The change ownership task, Transaction Serving as Source of Title (Transfer), starts immediately at the conclusion of these split tasks/subtasks:

-

Redescribe by minor subdivision (split) / Deed with subdivision description

-

Redescribe to create separate estate revenue object / Easement and document type is deed

-

Redescribe to create separate estate revenue object / Separated or split estate

-

At the conclusion of the split task, Records updates the Aumentum Event tables.

-

If the revenue object being split is attached to one or more geo-entities, the new revenue objects inherit the same geo-entity attachments based on the effective date of the split. If the effective date of the split falls outside the begin and end attachment dates, the new revenue objects will not inherit the geo-entity attachment.