Create New Revenue Object

Navigate:  Records > Revenue Object Maintenance

Records > Revenue Object Maintenance

Description

A revenue object is any unit that is a potential revenue source for government. It has value or conveys a right and normally, you can define the object as delinquent, if necessary. Examples include:

-

Real property (parcels)

-

Personal property (mobile homes, vehicles, boats, office equipment)

-

Licenses (businesses, natural resources)

Tasks

Aumentum Records provides two tasks to create new revenue objects.

NOTE: Personal Property Appraisal provides a task that initiates the F - Create New Filing Revenue Object task in Aumentum Records. See Tips at the end of this topic for information about the related application settings.

-

On the Maintain Revenue Objects screen, select F - Create New Filing Type Revenue Object from the Task drop-down list to create a new filing.

-

Enter the date and document information.

-

When the Official Doc for Create New Filing Type Revenue Object application setting is set to False, only the Transaction Type drop-down list and Legal date/time received field are available.

- A value cannot be posted before the beginning effective date of a Revenue Object. The effective date can be Document Date or Legal Date and Time Received, depending on the application setting.

-

-

Make a selection from the Transaction Type drop-down list.

- Enter or select the legal date and time.

- Click Next in the Command Item bar.

- On the Set New Revenue Object Type screen, make a selection from the Copy from existing PIN drop-down list.

-

Enter a PIN and Search for a Revenue Object are to determine which PIN to copy information from if copying data from another Revenue Object.

- Make a selection from the Revenue object sub-type and Class code drop-down lists.

-

If there are no selections available, then additional configuration is required in systypes. Contact Aumentum Support.

- Enter a new PIN. For certain class codes, the PIN is generated automatically.

-

NOTE: You can enter a formatted or unformatted PIN value. If a mask was defined, the Records module validates the value against the mask and displays any applicable errors. Also, if you enter an unformatted value, Records validates and formats it when you click or tab out of the PIN field.

- Make a selection from the Ownership type drop-down list.

- If there are no selections available, then additional configuration is required in systypes. Contact Aumentum Support.

- Click Next.

- On the Search screen, search for an existing legal party for owner, or create new legal party(ies) as owners.

- In the Legal Party panel, click to select an item in the grid.

- On the Select the Situs Address screen, enter or edit necessary information and click Next.

- On the Add or Edit Revenue Object Information screen, associate a new PIN to an existing Revenue Account, or select the appropriate TAG for the new revenue object. Enter or edit necessary information.

- Click Finish.

-

On the Maintain Revenue Objects screen, select N - Create New Parcel Type Revenue Object from General Parcel from the Task drop-down list.

- Make a selection from the Transaction Type, Source office, and Document sub-type drop-down lists.

- When the Official Doc for Create New Parcel Type Revenue Object application setting is set to False, only the Transaction Type drop-down list and Legal date/time received field are available.

- Enter the document number, book and page information.

- Enter or select the legal date and time, and the document/sale date.

- Click Next.

- On the Set New Revenue Object Type screen, make a selection from the Copy from existing PIN drop-down list.

- Make a selection from the Revenue object sub-type and Class code drop-down lists.

- Enter a new PIN.

- Make a selection from the Ownership type drop-down list.

- Click Next.

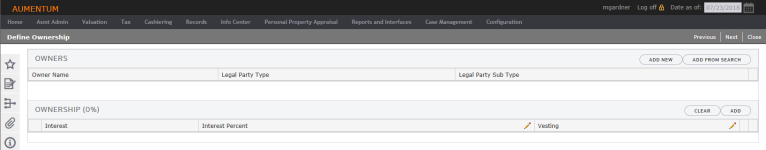

- On the Define Ownership screen, click Add New in the Owners panel.

- On the Maintain Legal Party screen, fields with the red asterisk are required.

- Click Finish.

- In the Change Reason and Statutory References pop-up, make a selection from the Change Reason drop-down list and click OK.

- Click Add in the Ownership panel and enter the necessary information and specify the Primary Owner.

- Click Next.

- On the Select Situs Address screen, click Next.

- On the Add or Edit Revenue Object Information screen, click Finish.

F - Create New Filing Type Revenue Object

F - Create New Filing Type Revenue Object

This task creates personal property (filing) revenue objects.

N - Create New Parcel Type Revenue Object from General Parcel

N - Create New Parcel Type Revenue Object from General Parcel

This task creates a parcel revenue object by copying standard data from a pre-defined default parcel General Parcel. The New parcels are created from the general parcel application setting must be set to True for this task to be available. If set to False, you will not see this task on the Maintain Revenue Objects screen. Also, the General parcel PIN application setting establishes the default parcel PIN as General Parcel.

NOTE: See Tips at the end of this topic to learn how to create a sub parcel revenue object.

NOTE: The total of BI Percent for the group should match the interest percent for the revenue object, and at least one Primary Owner must be selected.

Tips

-

Each installation may choose to establish user-defined revenue object fields. UDFs are defined via Configuration > UDFs.

-

The following two application settings determine whether or not official document information is entered with these tasks:

-

Official Doc for Create New Revenue Object - for parcels

-

Official Doc for Create New Filing Type Revenue Object - for filings

- When set to True, you must enter official document information; if set to False, only an effective date is required.

-

-

From a parcel, you can also create a sub parcel revenue object.

NOTE: This is dependent on configuration and is determined by your Aumentum Implementation team. You may not see this option in your instance of Aumentum.

- On the Set New Revenue Object Type screen, select Sub Parcel from the Revenue object sub-type field and continue with the task flow to create the new revenue object sub parcel.

- To define the Sub Parcel systype, click Configuration > Systypes.

- On the Select Systype screen, enter or edit the effective date.

- Start typing Revenue Object Sub Type in the Systype Category field and select it.

- Click to select a Sub-parcel systype.

- On the Edit Systype screen, make sure the Selectable checkbox is selected and define the remaining information.

- Click Save.

-

Define role security for sub parcel revenue objects in Info Center > Tax Detail.

- Click Configuration > Security and User Maintenance > Roles.

- On the Maintain a Role screen, click Edit on the role.

- On the Edit Role Details screen, click Data Items in the Command Item bar.

- On the Edit Data Item Role Details screen, expand REVOBJ (records) > RevObjSubType > Sub-parcel (102209).

- In the Rights panel, select the Allow Access checkbox to allow rights. Clear the checkbox to deny viewing rights for sub parcel revenue objects in Info Center.