Change Revenue Object Status

Navigate:  Records > Corrections > Revenue Object Status Changes > Change Revenue Object Status

Records > Corrections > Revenue Object Status Changes > Change Revenue Object Status

Description

IMPORTANT: This feature is not designed to correct retire/survive status errors after a split, plat, or merge transaction. Use the Retire/Survive Status task (Records > Corrections > Retire/Survive Status) to correct this type of error.

The Revenue Object Status Change task enables you to reactivate or deactivate revenue objects. When you reactivate a revenue object, it is reinstated as an active property. When you deactivate a revenue object, it is marked as an inactive property; it is not deleted from the database.

- An active property has an effective status of A.

- An inactive property has an effective status of I.

NOTE: Not all jurisdictions have this task. An API (application program interface) might automatically manage this task.

SETUP: See Records and Revenue Object Maintenance for any applicable prerequisites, dependencies and setup information for this task.

Steps

-

Enter a PIN and click Next.

NOTE: You must enter the full PIN, but it can be formatted or unformatted.

-

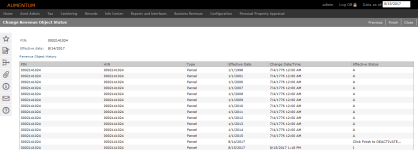

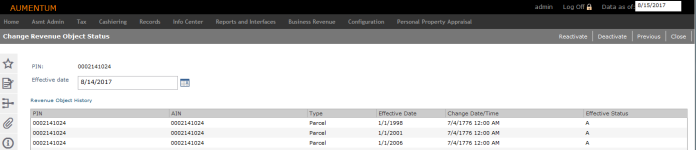

In the Change Revenue Object Status screen, the Revenue Object History grid displays the effective status of the revenue object. An effective date field also appears. Depending on the effective status of the PIN, you can either reactive or deactivate it.

NOTE: If the PIN does not exist, an error message displays. Correct the PIN or cancel processing the original requested PIN.

Reactivate a PIN

Steps

-

Enter the Effective date. Be sure to enter the actual date the revenue object first became active; the system will ensure this is applied to the correct tax year and cadastre.

-

Select the Reason.

The list of items available are systypes and are set up via Configuration > Systypes > Select or Add a Systype. Select the systype of RevObj Status Change Reason. Set the effective date. Click New to navigate to the Edit a Systype screen to create new reasons.

-

Click Reactivate and Click Finish to continue with the reactivation.

NOTE: If there was a PIN change in the history of the PIN you want to reactivate, you must select the PIN you want to reactivate.

-

Click Previous to clear the screen and enter a different PIN to work with.

-

Click Close.

Deactivate a PIN

Steps

-

Enter the Effective date. Make sure to enter the actual date the revenue object first became inactive; the system ensures this is applied to the correct tax year and cadastre.

-

Select the Reason.

NOTE: The list of items available are systypes and are set up via Configuration > Systypes > Select or Add a Systype. Select the systype of RevObj Status Change Reason. Set the effective date. Click New to navigate to the Edit a Systype screen to create new reasons.

-

Click Deactivate and then Finish to continue with the deactivation.

-

Click Previous to clear the screen and enter a different PIN to work with.

-

Click Close.

Tips

At the conclusion of the reactivate and deactivate tasks, Records updates the Aumentum Event tables. See Records.

To deactivate, the revenue object must be active on the effective date specified.

To reactivate, the revenue object must exist and be inactive on the effective date specified.

Deactivating a revenue object does not remove its address from the MailAddr table because it may still have a balance due that requires a tax bill.

Records is designed to record the date and time that factual, real-world events occur so that flexible Aumentum Assessment Administration rules are properly applied to build cadastres. Make sure to enter the actual effective date the revenue object becomes inactive. The system ensures it is applied to the correct tax year. See Records for information about effective dating.

When a revenue object is inactivated, its geo-entity attachments, if any, are not removed.