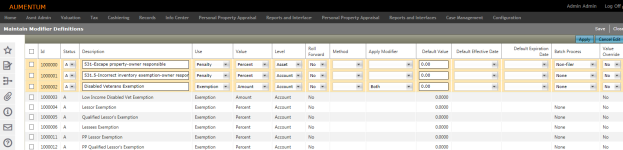

Modifier Definitions

Navigate:  Personal Property Appraisal > Setup > Modifier Definitions

Personal Property Appraisal > Setup > Modifier Definitions

Description

Use this task to maintain Personal Property modifier definitions from within the application.

Steps

- On the Maintain Modifier Definitions screen, make a selection from the Effective tax year and Filter by drop-down lists.

- Select the checkbox for one or more items in the grid and click Edit.

- Make selections from the drop-down lists to edit the modifiers.

-

Status: A for Active or I for Inactive.

-

Enter a description.

-

Use: How the modifier is used, such as for an exemption, fee, exclusion, etc.

-

Value: None, Amount or Percent.

-

Level: The level at which the modifier is applied (account or asset level).

-

Roll Forward: Choose whether or not to roll forward the modifier to the next year when rolling forward the account.

-

Method: Increase, Decrease, or Replace the value.

-

Apply Modifier: Defines how to apply the modifier when reviewing accounts on the Maintain PPA Accounts screen.

-

Enter the Default Value: Either an amount or percent, depending on your Value field selection.

- Default Effective Date:

- Default Expiration Date:

-

Batch Process: value of either none, non-filer, or minimum value to determine whether accounts flagged as non-filer or with a minimum value are included in batch processing.

- Value Override:

-

Click Apply to save your edits, or click Cancel Edit to close the drop-down lists without saving changes.

-

Click Save in the Command Item bar.

-

Click Close to end the task.

-