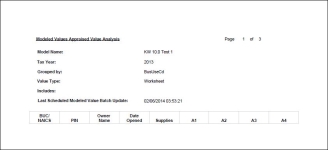

Modeled Values Appraised Values Analysis Report

Navigate:  Personal

Property Appraisal > Reports > SRS Personal

Property Reports > Modeled Values Appraised Values Analysis

Report

Personal

Property Appraisal > Reports > SRS Personal

Property Reports > Modeled Values Appraised Values Analysis

Report

Description

NOTE: This report is specific to the State of California.

This report is used for errors and escape assessments to compare the total appraised value variance between the current tax year worksheet value and the current tax year peer group averages to see if the set tolerances are exceeded. This information is used to confirm the personal property assessment value.

Prerequisites and Setup

Application Settings

-

Click Configuration > Application Settings.

- On the Maintain Application Settings screen, select Effective Date from the Setting type drop-down list, and select Personal Property from the Filter by module drop-down list.

-

Click Edit on the following three application settings and enter the Setting Value as applicable to your jurisdiction and reporting threshold requirements:

-

Appraised Value Variance Tolerance Default Flag

- Appraised Value % Variance From Peer Group Average

- Value Model for Appraised Value Variance Tolerance

Account Flag

-

Click Personal Property Appraisal > Search > Personal Account.

-

On the Advanced Search screen, select Personal Account from the Search By drop-down list.

- Click the Flags tab, click Add New Flag To Include to add a Modeled Values Appraised Value Variance Tolerance flag on the account(s), create a PIN list, and generate a report, such as XML or PDF, of the PIN list for comparison purposes to this report.

Batch Valuation

-

When processing batch valuations, click Personal Property Appraisal > Batch Processes > Valuation.

-

Select the Check Cost and Value Variance Tolerances checkbox to process any accounts with the Appraised Value Variance Tolerance default flag according to the application setting tolerance and value model defined.

Steps

-

On the Custom Reports Selection Options screen, choose a selection method and click Next.

- On the Custom Reports - Account Selection screen, make a selection from the Tax Year drop-down list and enter or select other information.

- Click Row Count at the bottom of the screen, then click Next.

-

On the Enter Report Parameters screen, enter or select the Effective Date.

-

Make a selection from the Select Value Model drop-down list.

-

Click Submit to Batch in the Command Item bar.

- On the Monitor Batch Processes screen, select the process to open the View Batch Process Details screen and select the report.

-

Click Close to end the task.

Report Samples

NOTE: This sample shows report layout only; no report data was available at time of writing.