Statutory Valuation

Navigate:  Personal

Property Appraisal > Batch Processes

> Statutory Valuation

Personal

Property Appraisal > Batch Processes

> Statutory Valuation

Description

NOTE: This task may not apply to your jurisdiction.

Use the Statutory Valuation task to schedule a batch process to apply a statutory value (also called an estimated value) to a group of personal property accounts prior to the year-end tax roll. This process places an override value on each account.

In September or October, the jurisdiction finalizes the tax roll by posting values and rolling to AA. Before this occurs, run the statutory valuation process to assign a statutory override value to accounts that require it. This process is typically performed for accounts where the taxpayer fails to provide the information needed to determine value. It is, in essence, a penalty to the taxpayer for not providing the proper information. The value to apply to the accounts can be either a specified amount or a percentage of a related dwelling's value. CAMA (ProVal Plus) is required in order to calculate a value based on a related dwelling.

You can run the Statutory Valuation process repeatedly if necessary.

Security for Statutory Valuation

NOTE: Only users with the required security privileges can schedule the Statutory Valuation process. If you cannot access this task, see your System Administrator.

SETUP: See Personal Property Appraisal, Personal Property Appraisal Setup, and Batch Processes for any applicable prerequisites, dependencies and setup information for this task.

Fixture Split Asset Statutory Valuation

The ability to assign a fixture split ratio to a property statement schedule is available. Assets that qualify are set up for your jurisdiction based on preconfigured criteria.

The fixture split percentage can be manually edited on an individual account on the Maintain PPA Accounts screen if necessary once fixture split assets are associated with the account, either defined on the Maintain Assets page, or imported via various batch import processes, also unique to each jurisdiction, then processed using the statutory valuation task.

IMPORTANT: You must set up the following to perform fixture split asset processing, such as importing of fixture split assets, as well as valuation of fixture split assets.

-

Set the Personal Property Appraisal Tax Year Boolean application setting Fixture Split Enabled to true to perform batch valuation processing for Fixture Split assets.

-

Configure a Fixture Split asset category for any Fixture Split asset batch imports and valuation via Personal Property Appraisal > Setup > Asset Categories > Maintain Asset Categories. This screen includes a Fixture Split Ratio field for the purpose of entering the fixture split ratio percentage. Default property statement fixture split, schedule factors, and economic life can also be defined based on business type.

-

Allocate the assessed value for certain classes of business personal property between resulting BPP value and Fixture value.

-

Override the otherwise determined fixture allocation on individual assets, and the fixture value as a whole, when overriding the full account value.

-

Create a PIN (revenue object) list via Personal Property Appraisal > Search > Personal Account. Search/select the desired account(s) and click PIN List to name and save the list.

-

Batch value the fixture splits via Personal Property Appraisal > Batch Processes > Batch Valuation > Process Statutory Valuation. Select Revenue Object List as the Selection Method and click Selection Criteria to advance to the Select Revenue Object List screen.

-

Select the Tax Year and the Revenue Object List. Click Row Count . After a row count is returned, click Previous to return to the Process Statutory Valuation screen.

-

Select the processing options and schedule and click Finish to submit the fixture split processing to batch process (Info Center > Batch Processes).

NOTE: The Maintain Assets screen (Personal Property Appraisal > Assets > search/select accounts > Maintain Assets) displays any fixture split asset value in a Split Ratio column on the Assets Tab as well as on the Valuation Tab in the Fixture Split Summary Group field. The Valuation Tab also includes:

-

A Fixture Split Ratio field for defining or overriding the ratio (1 to 100)

-

An Economic Life field for defining the economic life

-

A Valuation Method field that displays the valuation method (defined during statutory valuation processing)

Also, when fixture splits are enabled, depending on your jurisdiction, additional account level override fields display, including:

-

Override Structure Appraised

-

Override Land Appraised

-

BPP and Fixture (available regardless of whether fixture split enabled)

-

Display order:

-

BPP

-

Fixture

-

Structure

-

Land

The behavior for the above fields is the same as for the BPP and Fixture field, which is:

-

Disabled until Override Type is selected

-

Contribute to Override Appraised Total field

Override Appraised Total field:

-

Represents total of all Component Override Appraised fields

-

Formatted as numeric, read-only field

The Maintain PPA Accounts screen also displays the fixture split value in the Summary Group and Account Totals panel for the particular selected account.

NOTE: The ability to review submitted accounts for tax filer acquisition cost accuracy is available. Based upon the findings, the ability to route the account to the appropriate queue so that the reconciled costs can be reviewed and/or approved is also available. The existing maintenance, valuation and posting processes are used for processing, with workflow enhancements accommodating equipment acquisition cost maintenance. During processing, appraisers review properties and confirm costs on properties. The final step of this process is to perform a value calculation either individually or in batch. This causes the account to be moved to a review queue in the processing workflow. A Aumentum Event is initiated to start workflow processing. To accommodate this, a Enable Event creation upon valuation application setting was created and must be set to true to generate the Aumentum Event during valuation.

SETUP: Go to Configuration > Application Settings > Maintain Application Settings. Select the setting type of Effective Date and the filter by module of Personal Property. Click Edit on the Enable Event creation upon valuation application setting and set to true to create valuation events.

Jurisdiction

Specific Information

Jurisdiction

Specific Information

California

-

Set the Personal Property Appraisal Tax Year Boolean application setting Fixture Split Enabled to true to perform batch valuation processing for fixture splits as follows:

-

Create a PIN (revenue object) list via Personal Property Appraisal > Search > Personal Account. Search/select the desired account(s) and click PIN List to name and save the list.

-

Batch value the fixture splits via Personal Property Appraisal > Batch Processes > Batch Valuation > Process Statutory Valuation. Select Revenue Object List as the Selection Method and click Selection Criteria to advance to the Select Revenue Object List screen from which you can select the Tax Year and the Revenue Object List. Click Row Count then Previous to return to the Process Statutory Valuation screen. Select the processing options and schedule and click Finish to submit the fixture split processing to batch process (Info Center > Batch Processes).

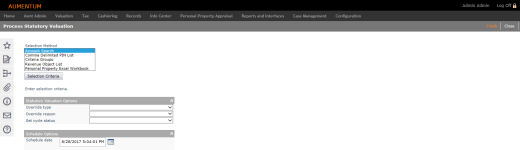

Steps

-

On the Process Statutory Valuation screen, click to select an item in the Selection Method panel and click Selection Criteria.

- Account Search – Opens the Select Accounts for Valuation screen.

- Comma Delimited PIN List – Opens the Search PIN List screen.

- Criteria Groups – Opens the Search Criteria Group List screen.

- Revenue Object List – Opens the Select Revenue Object List screen.

- Personal Property Excel Workbook – Opens the Select Excel Workbook screen.

-

Enter the applicable information on each screen, scroll to the bottom, and click Row Count to get a count of records. Click Previous to return to the Process Statutory Valuation screen.

-

In the Statutory Valuation Options panel, make selections from the drop-down lists.

NOTE: Valuation options may vary, depending on your jurisdiction.

-

Select the Override type (required), which determines how the statutory value is applied to the accounts.

Selections of note

Selections of note

-

Dwelling basis – (not all jurisdictions) Enter a percentage to apply to a related dwelling value. Use this option only when the Aumentum Platform is integrated with ProVal Plus.

IMPORTANT: If you do not use ProVal for real property valuation, you must use the direct override type instead of dwelling basis.

-

Add Asset – Select the entry code and asset value to update.

-

Assessor estimate – Processes the valuation as an estimate

-

Clear override – Undo a previously applied direct or dwelling basis override.

-

-

Make a selection from the Override reason drop-down list.

-

Make a selection from the Set cycle status drop-down list (required), which specifies the value each account's cycle status field will contain at the conclusion of the process. You can view the account's cycle status on the Maintain Personal Property Accounts screen.

-

In the Schedule Options panel, enter or select a schedule date and time. This is when you want the batch process to run. The default is now (current date and time). Optionally, you can use the date picker to select a different date and time.

-

Click Finish to send the process to the batch processor. When the schedule date and time arrives, the statutory valuation processing begins.

-

Monitor the batch process or check its status using Info Center > Batch Processes. Be sure to double-click the ConfirmationDetail.pdf file when the process is complete. This report provides warning and error messages.

NOTE: For accounts that have a statutory override applied, the Value Override Type and Override Value display on the Maintain Personal Property Accounts screen. This gives the user an at-a-glance indication that an account-level override is in place for the account being viewed.

Processing Details

The Statutory Valuation task schedules a process to apply an account-level value override to the selected personal property accounts.

Exceptions

The account is skipped and an exception is written to the Confirmation Detail report if:

-

The account has not been rolled to the current tax year (no cycle record).

-

The dwelling basis method is being used but the related real property does not exist, has no posted value, or has no dwelling value.

-

The account is locked by another batch process or a user.

Direct Amount Processing

When Direct is selected from the Override type drop-down list, the following occurs for each account:

-

Set the account's override value to the user-entered value.

-

Calculate the assessed value.

-

Create a Aumentum Event - statutory value event.

-

Set the account's Need to Post flag.

-

Set the account's cycle status to the user-selected value.

Dwelling Basis Processing

When Dwelling basis is selected from the Override type drop-down list, the following occurs for each account:

-

Set the account's override value to the total value of Dwell type structures from the most recent posting on the related real property record, multiplied by the user-entered dwelling basis percentage. The total value of Dwell type structures is the total of Dwell, MHome, and Addn dwelling type records on the real property.

-

Calculate the assessed value.

-

Create a Aumentum Event - statutory value event.

-

Set the account's Need to Post flag.

-

Set the account's cycle status to the user-selected value.

Clear Override Processing

When Clear Override is selected from the Override type drop-down list, the following occurs to each account:

-

Clear the account's value override type.

-

Set the account's override value to zero.

-

Calculate assessed value based on normal account value.

-

Create a Aumentum Event - clear statutory value event.

-

Set the account's Need to Post flag.

-

Set the account's cycle status to the user-selected value.

Tips

See Batch Processes in Aumentum for more information about running and monitoring batch processes.