Posting Options

Navigate:  Personal Property

Appraisal > Batch Processes

> Posting

Personal Property

Appraisal > Batch Processes

> Posting

Description

IMPORTANT: Because batch processes require system resources, schedule them to run during off-peak hours.

Use the Batch Posting task to schedule a batch process to post values for a group of personal property accounts. This task typically occurs in October.

The county finalizes the tax roll by posting values and modifiers (exemptions and penalties), which rolls the data to the Aumentum Assessment Administration (AA) module for inclusion on an assessment role.

IMPORTANT: You can access the Batch Posting process only if you have the required security privileges. If you cannot access this task, see your System Administrator.

SETUP: See Personal Property Appraisal, Personal Property Appraisal Setup, and Batch Processes for any applicable prerequisites, dependencies and setup information for this task.

Steps

-

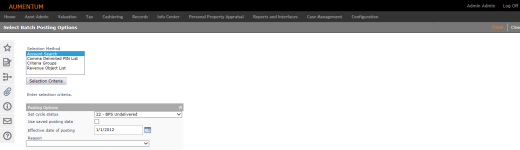

On the Select Batch Posting Options screen, choose a Selection Method and click Selection Criteria.

-

Account Search – Opens the Select Accounts for Posting screen.

-

Comma Delimited PIN List – Opens the Search PIN List screen.

-

Criteria Groups – Opens the Search Criteria Group List screen.

-

Revenue Object List – Opens the Select Revenue Object List screen.

- In the Posting Options panel:

-

Make a selection from the Set cycle status drop-down list (required), which specifies the value each account's cycle status field will contain at the conclusion of posting. You can view the account's cycle status on the Maintain Personal Property Accounts screen.

- Select the Use saved posting data checkbox to allow the batch process to use previously saved posting data on an account so you don't have to post each account individually.

-

Enter or select an effective date of posting. A date is required to post the account.

- Make a selection from the Reason drop-down list (required) to identify the reason you are posting a value. Values are maintained in the Valuation Change Reason systype, which is maintained via Configuration > Systypes. Only those reasons that are relevant to personal property accounts (based on class code) display for selection. The association of value change reasons and class codes is set up using a script; there is no user interface for this function.

- Select the checkbox for one or more items in the Statutory References panel.

- Add a note if desired.

-

Optionally, select the Re-post previously posted accounts checkbox to post accounts whose Need to post checkbox is not selected. These are accounts that have already been posted in the current tax year. Select this option to re-post the accounts during this posting run.

-

In the Schedule Batch Job panel, enter or select a schedule date and time for the batch process to run. The default is the current date and time.

- Click the Recurring schedule checkbox to display scheduling options.

-

Click Finish to send the process to the batch processor.

When the schedule date and time arrives, the batch posting process begins and posts those accounts that meet the selection criteria. The value conclusions are posted and made available to the Aumentum Assessment Administration (AA) module. The following updates occur:-

The cycle status is set to the user-selected value.

-

An Aumentum event is created for Posted Value with the user-selected value change reason in the description.

-

The Needs notice checkbox is selected.

-

The Needs posting checkbox is cleared.

-

Posting information is stored for the asset(s), with components of value identified by appraised value, override value, and prorated value. Exemptions and penalties are also recorded for the posting. Note that exemptions and penalties apply to a given tax year; they are not rolled from one year to the next.

-

-

The account does not meet the selection criteria.

-

The Needs posting checkbox is blank (already posted) and the Re-post previously posted accountsoption is not selected. (If the Re-post previously posted accounts option is selected, the account is re-posted.)

-

The account has a motor vehicle asset that is missing the plate expiration date. This date can be seen on the Maintain Assets page.

-

Monitor the batch process or check its status using Info Center > Batch Processes. Double-click the ConfirmationDetail.pdf file when the process is complete. This report provides warning and error messages.

On the subsequent screen, enter the selection criteria and click Row Count on that screen to get a count of records. Click Previous to return to the Select Batch Posting Options screen.

Exceptions that could occur to prevent posting are:

Tips

This task posts value conclusions for a group of personal property accounts. See Post Values for instructions on how to post a value conclusion for a single personal property account.

When personal property accounts are posted, a Aumentum event is created for each account. To view an account's events, go to Info Center, Tax Detail, and select the View Event History common action.

See Batch Processes in Aumentum for more information about running and monitoring batch processes.