Modeled Values Update

Navigate:  Personal Property Appraisal > Batch Processes > Modeled Value Update

Personal Property Appraisal > Batch Processes > Modeled Value Update

Description

Update modeled values tax year, group and valuation status. Appraisers use this task to perform a comparative analysis on personal property reporting data. This enables the appraiser to:

-

Determine reasonableness thresholds.

-

See how individual filings compare to the filings of similar businesses in the county.

-

Determine how a filing compares to the filing of the subject taxpayer last year.

This data benefits processes to

-

Apply statutory values to non-filers

-

identify audit candidates

-

Automate the filing confirmation process.

Steps

-

On the Update Modeled Values screen, enter the model name.

-

Select the Tax year.

-

Select how to group it from the Group by drop-down list. Options are:

-

Business use code (BUC)

-

North American Industry Classification System (NAICS) cod.

-

-

Select the Valuation status. Options are:

-

Certified value

-

Worksheet value

-

-

Click the Include overrides checkbox to include overrides in the value update.

-

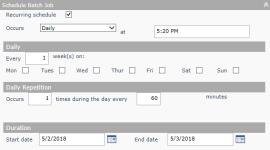

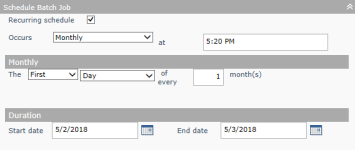

In the Schedule Batch Job panel, enter or select the date and time you want to schedule the job.

OR

Select the Recurring schedule checkbox and make a selection from the Occurs drop-down list to define a recurring schedule.

Daily

Monthly

Functional Calendar

- Click Finish.