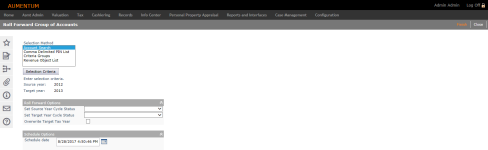

Group Roll Forward

Navigate:  Personal Property

Appraisal > Batch Processes

> Group Roll Forward

Personal Property

Appraisal > Batch Processes

> Group Roll Forward

Description

Use the Batch Roll Forward task to roll a group of assets forward to the next year so that they are available for valuation and taxation. This is typically the first task performed after processing the year-end tax roll. Personal property accounts must be rolled to the new tax year before you can process and value them.

In September or October, the county finalizes the tax roll by creating and locking a cadastre roll. All changes after this point must be made by an official correction and change reason. Then the Batch Roll Forward task runs. This copies records from the current tax year to the next tax year.

NOTE: An application setting called Roll forward accounts with no active assets provides the ability to inactivate an account during the roll forward process when all assets are disposed or inactive. If the application setting value is true, accounts are rolled forward regardless of whether they have active assets in the target tax year. If the application setting is set to False, accounts with no active assets in the target tax year are not rolled forward and they are inactivated as of 1/1 of the target tax year.

- Click Configuration > Application Settings.

- In the Maintain Application Settings screen, select Effective Date from the Setting type drop-down list, and select Personal Property from the Filter by module drop-down list.

- Locate Roll Forward accounts with no active assets and click Edit.

- Select the checkbox in the Setting Value column to set the value to True. Clear the checkbox to set the value to False.

- Click Apply, then click Save in the Command Item bar.

IMPORTANT: You can schedule the Batch Roll Forward process only if you have the required security privileges. If you cannot access this task, see your System Administrator.

IMPORTANT: Do not include Motor Vehicles in the Batch Roll Forward process.

NOTE: On the Maintain PPA Accounts screen, when the Inactivate during roll forward checkbox in the Property Information panel is selected, the Group Roll Forward process looks at that checkbox as well as the Date out of business/Sold date to determine how to process the roll forward. When set to inactivate, the effective date of the inactivation is equal to the first day in the new Tax Year based on the Personal Property Functional Calendar set via Configuration.

SETUP: See Personal Property Appraisal, Personal Property Appraisal Setup, and Batch Processes for any applicable prerequisites, dependencies and setup information for this task.

Jurisdiction

Specific Information

Jurisdiction

Specific Information

All Jurisdictions and Santa Cruz, California

-

The Personal Property effective date boolean application settings Roll Forward Worked by Appraiser and Roll Forward audit and appeal date determine whether to roll forward the auditor information and the audit and appeal dates when batch rolling forward accounts. If set to true, the appraiser information and dates are rolled forward when performing the Personal Property Appraisal > Batch Processes > Group Roll Forward task and the Worked By drop-down list and the Needs Notice and Needs Audit checkboxes on the Maintain PPA Account screen are cleared of data for the accounts selected for the group roll forward.

IMPORTANT: Santa Cruz, California must set this setting to false.

Steps

-

On the Roll Forward Group of Accounts screen, make a selection in the Selection Method box and click Selection Criteria. If you select:

-

Account Search, the Select Accounts screen opens.

-

Comma Deliminted PIN List, the Search PIN List screen opens.

-

Criteria Groups, the Search Criteria Group List opens.

-

Revenue Object List, the Select Revenue Object List screen opens

-

Make a selection from the Tax Year and Revenue Object List drop-down lists, then click Row Count on that screen to get a count of records.

-

In the Roll Forward Options panel:

-

Make a selection from the Set Source Year Cycle Status drop-down list. The cycle status field in each rolled account is set to the value you select. For example, if you are rolling accounts from 2008 to 2009, the cycle status field in each account's 2008 record is set to this value.

-

Make a selection from the Set Target Year Cycle Status drop-down list. This option sets the cycle status field in each rolled account for the new, target tax year. For example, if you are rolling accounts from 2008 to 2009, the cycle status field in each account's 2009 record is set to this value.

-

Only check the Overwrite target tax year checkbox when an account already exists in the target year. Using the roll from 2008 to 2009 example, an account is found with a 2009 cycle record. For these accounts, this option controls whether the account is overwritten by the roll. If blank, the account is not overwritten; if checked, the account is overwritten by the roll. If the account has already been posted in the new tax year, the account is not overwritten. Also note that assets that exist in the target year but not the source year will be preserved.

-

-

In the Schedule Options panel, enter or select a schedule date and time for the Roll Forward batch process to run. The default is the current date and time.

-

Click Finish in the Command Item bar to send the process to the batch processor. When the scheduled date and time arrives, the process runs. Monitor the batch process or check its status using Info Center > Batch Processes.

Processing Details

The Batch Roll Forward task schedules a process to roll selected personal property accounts from one tax year to the next.

Accounts Not Processed

There are several conditions in which a personal property account is not rolled, including:

-

The account is locked by another batch process or a user.

-

The account has already been posted in the target tax year.

-

The account exists in the target tax year, it is not posted in the target tax year, and the overwrite target tax year option is not selected.

-

The account became inactive or all assets were disposed in the source year.

-

Disposed assets in source year are not rolled.

If the account or asset record is not processed, a message appears on the Confirmation Detail Report.

Roll Processing

The following occurs when an account is rolled to the new tax year.

-

Set cycle status of target year to user-selected field.

-

Set cycle status of source year to user-selected field.

-

Clear the following fields in target year record:

-

Account.Posting flag

-

Account .Appraised value

-

Account.Assessed value

-

Account.Needs Notice

-

Account.Needs NoticeType

-

All Account.Audit fields if AuditStatus = ”Audit Complete”

-

Account.filingdatefiled

-

Account.fullassetlistfileddate

-

Account.Workedby

-

Account.FilingExtendedDate

-

Account.FilingExtendedApprovedBy

-

Account.CycleOptionalReferenceNote

-

Account.Flag = DMVRegistration or DMVInsurance

-

Remove all value modifiers except DOR 100% exemption

-

AssetCycle.AssetNeedsValuing

-

AssetCycle.AssetNeedsPosting

-

AssetCycle.AssetLateFiledDate

-

AssetCycle.AssetProrateAmount

-

AssetCycle.AssetProrateDuration

-

If the account attribute RollAppraised is selected, each asset's appraised value for the source year is moved to the target year's Value Basis. If the appraised value is zero or less, a warning message displays in the Confirmation Detail report. Note that the RollAppraised checkbox should only be selected for accounts that have one asset and the asset valuation type is set to Value Basis, Less Depreciation.

-

If the account attribute RollAppraised is not selected, each asset's Value Basis for the source year is moved to the target year's Value Basis.

-

Set Tax Year to Target tax year.

-

Create GRMEvent PersonalAccountRoll with effective date of processing and RevObjID, UserName.

-

Create Note on Account/Asset indicating date rolled forward.

-

Warning messages are written to the Confirmation Report if the account's cycle status is not set to Roll to Next Year in the source year and there is either no appraised or a zero appraised value.

Tips

The account's cycle status field displays on the Maintain Personal Property Accounts screen.