Tax Detail

Navigate:  Info Center > Tax Detail

Info Center > Tax Detail

Description

Use Tax Detail to view the Aumentum Tax and CAMA information from a revenue object perspective, print a single tax bill, apply or remove flags, and perform various activities via links and the Common Actions icon in the sidebar.

Steps

Tax Detail begins with the Records Search screen, then you proceed to the Tax Information screen.

-

On the Records Search screen, enter your search criteria and click Search.

- In the RevObj grid, select one or more items, then do one of the following:

-

Click Search by Tax Sale to open the Search by Tax Sale screen.

-

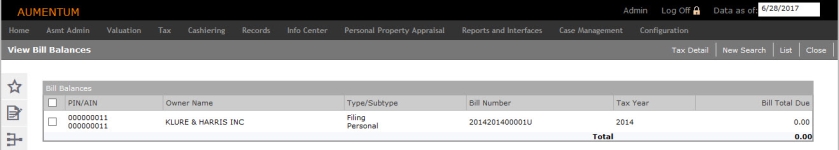

Click Balance to open the View Bill Balances screen.

- Click Close to end the task.

- Detail > Tax Information

- Appraisal > Appraisal Information

- Legal Party > Legal Party Information

- Public Inquiry > Public Inquiry - Tax Information

Click Next to open the Tax Information screen.

Click Next to open the Tax Information screen.

If you follow links from here, click Tax Info or Previous to return to this screen.

Click Search by Tax Bill to open the Search by Bill screen.

Click Search by Tax Bill to open the Search by Bill screen.

Enter a tax bill number and click Tax Detail to open the Tax Information screen. Click List to return to the Records Search screen showing your search results.

OR

Click Balances to open the View Bill Balances screen.

Click List to return to the Records Search screen showing your search results.

OR

Click Switch to Records Search to return to the Records Search screen showing your search results.

NOTE: For Tax Detail, Appraisal, Legal Party, and Public Inquiry, if only one result is returned, you advance directly to the applicable screen as follows:

See Tax Information for descriptions related to the header and Common Actions.

Dependencies, Prerequisites, and Setup

IMPORTANT: Info Center pulls information from most other modules in the system and is dependent upon correct data and setup within those various modules to provide accurate and complete information. The Aumentum Engineering, Implementation, and Support teams initially configure and set up the application for your jurisdiction upon installation. Contact your Aumentum Support representative if you need assistance with configuration and setup.

Application Settings

Various Information Center application settings affect display of data on the Tax Detail screen.

- Click Configuration > Application Settings.

- In the Maintain Application Settings screen, select Effective Date from the Setting type drop-down list, and select Information Center from the Filter by module drop-down list.

- In the Effective Date Application Settings panel, click Edit to change setting values for the module.

Also, select Tax Accounts Receivable from the Filter by Module drop-down list.

- Locate Display nominal overages in the Adv/Surplus area in info center and click Edit.

- Select the checkbox in the Setting Value column and click Apply to set this to True. Clear the checkbox to set it to False.

Other Settings

- In the Maintain a Role screen, choose a role and click Edit.

- If necessary, add items from the Available Menu Items panel to the Granted Menu Items panel.

- In the Granted Menu Items panel, click Info Center > Tax Detail > Details.

- In the Details panel, click on a description in the Details panel and set the appropriate rights.

- Click Save.

- In the Select or Add a User screen, choose a user and click Edit.

- In the Roles panel, click to highlight an item in the Available roles list and click Add to.

- Click Save.

Flag Type

Flag Type

New flag types should be added via Configuration > Flag Setup, so that attributes, associated systypes, and entities are assigned properly. Thereafter, flag values (associated systypes) can be edited.

- Click Configuration > Systypes.

- Specify the effective date and select Flag Type from the Systype category drop-down list.

- In the Select or Add a Systype screen, click on an item in the grid.

- In the Edit a Systype screen, make the necessary changes and click Save.

- Click List to return to the Select or Add a Systype screen, or click Close to end the task.

Flag

Value

Flag

Value

Options assigned to flag types in Flag Setup are added to Flag Values here.

Value

Type Process Code

Value

Type Process Code

Use this systype Info Center Values when setting up the value mapping types.

Workstation

Workstation

A Cashiering workstation must be set up in order to print a receipt on Transaction History - Revenue Object.

Configuration > Security and User Maintenance > Roles

Configuration > Security and User Maintenance > Roles

NOTE: When security setup restricts access, the user will not see the link on the Tax Details screen.

Configuration > Security and User Maintenance > Users

Configuration > Security and User Maintenance > Users

Common Actions > Manage Flags

Common Actions > Manage Flags

See Manage Flags.

Functional

Calendar

Functional

Calendar

Dates used for billing must be previously set up. See Functional Calendar.

Systypes

Systypes