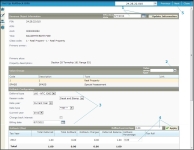

Deferred Tax Viewer

Navigate:  Info Center > Tax Detail > Records Search > Records Search Results > View Deferred Taxes > Set Up Rollback Bills

Info Center > Tax Detail > Records Search > Records Search Results > View Deferred Taxes > Set Up Rollback Bills

OR

Tax > Levy Management > Deferred Tax > Select Revenue Objects for Rollback > Set Up Rollback Bills

Description

View the deferred tax and value information for the revenue object, using a toggle to view by either tax year or value type. Deferrals are a result of agricultural, conservation, or other contracts. This screen can only be accessed when you are viewing the Tax Information for a revenue object with deferred taxes.

NOTE: The common action for View Deferred Tax only displays when there is deferred tax on the revenue object.

Steps

-

View the deferred tax information. By default, the grid is sorted by tax year. Click By Value Type to switch to sorting by value type. Click By Tax Year to toggle back to the tax year view.

-

Tax year (if sorted by tax year) – The tax year when the deferment and/or rollback tax was calculated.

-

Value type – A code that identifies a particular value associated with a revenue object. Value type/value combinations are provided by Aumentum Assessment Administration and are used with tax rates to calculate taxes.

-

Total deferred value – The total amount originally deferred; the amount going into the deferred inventory.

-

Total rollback value – The total amount to be taxed at a later date; the amount going out of the deferred inventory.

-

Total rollback tax – The amount of taxes billed based on the rollback value.

-

Current deferred balance – The deferred value minus the rollback value.

-

Click a button or link to navigate to another screen.