What is Aumentum?

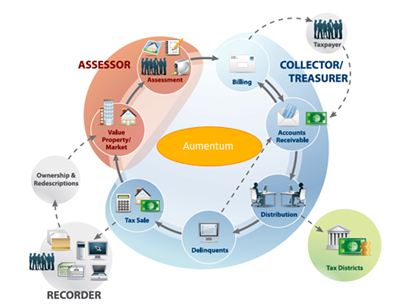

The Aumentum Platform is an integrated property tax generation and collection solution that, depending on licensing, can support a jurisdiction's entire property tax lifecycle from recordation, through valuation and taxation. The Aumentum pack comprises Aumentum Recorder, Aumentum Valuation (including Case Management), Aumentum Tax and Aumentum Public Access. Click here for more details on Aumentum and the solutions it comprises. Note that Aumentum Recorder is described separately.

Aumentum delivers functionality around:

- Recording (Deeds recordation)

- GeoAnalyst module – Mapping using embedded GIS (Geographic Information Systems) functions. The GIS functionality uses Esri’s ArcGIS technology platform.

- Valuation

- Assessment Administration

- Tax Levy

- Cashiering/Collection

- Accounts Receivable

- Tax Distribution

- Delinquents

- Tax Sale

It automates the operational, informational and planning needs of:

- Recorders

- Assessors/Appraisers

- Auditors

- Treasurers

- Tax Collectors

- Other state and local governmental officials

Standard Modules

Aumentum comprises a set of standard and optional modules. Included as standard are:

- Info Center – This module uses a general query interface and displays revenue objects, tax bills and data of legal parties. It provides information regarding property tax and tax billing data, and lets you search based on many different attributes including: situs and mailing addresses, phone numbers, email addresses, PIN, owner and tax bill.

- Records – This module provides a single data entry source for data accuracy in your jurisdiction. It is the core component of Aumentum and provides a complete inventory of the parcels, filings, business revenue or motor vehicles along with a list of the legal parties who have an interest in the inventory.

-

Assessment Administration – This module handles property assessment rules and maintains the property inventory and valuation data used to determine assessed values for the assessment roll. These functions include a calculation engine and triggering of automatic correction events.

- Special Assessments – In this module, you can create, maintain and calculate amounts for special assessment districts and projects. Various methods are used to accommodate different requirements for the jurisdictions, including amortization of entire projects over many years.

-

Levy Management – This module provides the calculation engine to compute payment terms, rate management, tax, charges, and revenue forecasting from taxable values.

- Billing – This module is used to format and produce property tax bills, business licenses, motor vehicle documents, assessment notices and other bills. You can sort and group bills, include messaging on the bills based on user-defined flags, and determine how charges and descriptions will appear on the bills.

-

Cashiering – The Cashiering module provides user and batch processes to calculate appropriate interest, penalties and fees, and to collect and record payments in real time over the counter or through remote cashiering devices. Cashiering can be configured to collect many different types of revenue.

-

Accounts Receivable – This is the repository for all charges, payments and credits. It calculates late payment interest, penalties and fees. It also provides methods to manage changes, correct payments, and process surplus monies.

- Distribution – Here you calculate the tax revenue due to the taxing authorities for a given time period based on amounts levied and monies collected. You can also calculate withholding commissions from disbursements to agencies, and produce disbursement records.

-

Delinquents – Determine what bills are delinquent, automatically calculate additional interest, penalties and fees, and create notices. It includes write-off functionality, payment plans and has a bankruptcy program that allows you to create the filing.

- Tax Sales – This module facilitates activities leading up to and including the auction of liens or the auction of the property itself due to severe delinquency. You can maintain buyer information and details, local or Internet tax sales, redemption of properties and redemption payouts via ACH, e-mail notification to lienholders or certificate holders, and support 1099 processing.

- Tax Accounting – A Tax menu modules that tracks financial transactions by fund and account for interface with third party accounting packages an exports/imports general ledger transactions and payment information. Payment information is used to disburse collected taxes to the various tax authorities and to generate taxpayer refunds

- Configuration – A module that, depending on the particular item, accepts various user-defined configurations for application settings (for example, unique settings for certain tasks and certain jurisdiction-dependent tasks). You can configure certain systypes while others are system-defined and User-Defined Fields (UDFs).

Optional Modules

Aumentum also includes a number of optional, requiring additional licensing, these include:

- Personal Property Appraisal – A module used to assess/appraise movable or personal property such as watercraft and vehicles

-

Business Revenue – This module includes Business Tax and Trust Tax or self-reporting taxes. It has a complete import and discovery/preview tool for accepting data from external sources. It also integrates with reporting services, and supports customization of standard system reports, filings, and extracts using templates.

- Valuation (including Case Management) – A module to accurately and fairly value any property, and manage it efficiently.