Flag Setup

Navigate:  Configuration > Flag Setup

Configuration > Flag Setup

Description

Flags are used in Aumentum to mark different entities for identification and tracking. Flags can be applied to various types of entities such as revenue objects, revenue accounts, legal parties, or tax bills. Also, flag controls are used throughout Aumentum to include or exclude flagged records when running a process.

Aumentum comes with some pre-set flags that have functionality behind them.

You can define any additional flags that are useful to you. However, they will not have any functionality associated with them. Any process in which you want to use these flags needs to be done manually. The flag could be an alert of some kind - anything you need to mark for easy identification when searching and processing.

Steps

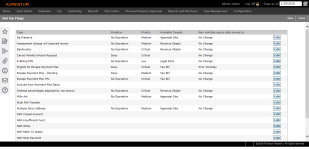

Current flags are shown in the grid. Use this screen to create and edit flags.

Add a New Flag Type

EXAMPLE: Jurisdictions often get a lot of returned mail due to address failures. You can create a Returned mail flag for bills that were returned as undeliverable for the purpose of correcting their associated mailing addresses.

-

On the Set Up Flags screen, click New in the Command Item bar.

-

On the Add a New Flag Type screen, enter a short description (code) and description to define the new flag type.

-

Make a selection from the Duration type drop-down list. (See Tips at the end of this topic.)

-

Make a selection from the Priority drop-down list. There are four priority level systypes and each is displayed in a different color on the Tax Detail screen.

-

Optionally, set the flag to expire on the next or previous workday from the Non workday moves to drop-down list when the expiration falls on a non-working day. The following tasks recognize the setting you define for this to control and assign the flag based on workday:

-

Info Center > Tax Detail > Manage Flags

-

Tax > Accounts Receivable > Manage Payments >

-

Penalty Interest Cancellation

-

Manage Surplus

-

Bad Check

-

-

Tax > Accounts Receivable >

-

ACH Processing

-

Batch Collections

-

-

Info Center > Custom Batch Job

-

-

Select the checkbox for one or more flag values in the grid to associate the flag type.

NOTE: You must associate the flag values with the flag type so that processes that use flags to filter selections can work correctly.

-

In the Entity Type panel, click Add to make a selection from the drop-down list, then click Apply. For example, select taxbill as the entity type in the flag control when the flag will be applied to bills; select revobj as the entity type in the flag control when the flag will be applied to the revenue object. Certain flags require specific entity types; for example, Lock Interest and Lock Penalty require an entity type of taxbill.

NOTE: Surplus is an available entity for selection when configuring Aumentum Flags for Pending Unclaimed or Refund to Title Company. Surplus is then an available option on the Manage Flags screen in Info Center (Info Center > Tax Detail > search/select > Tax Information > Common Actions > Manage Flags).

-

Click Save in the Command Item bar.

Maintain a Flag

-

On the Set Up Flags screen, click Edit for the desired flag.

-

On the Maintain a Flag screen, make a selection from the Duration type drop-down list. (See Tips at the end of this topic.)

-

Select the Priority level. There are four different priority level systypes. Flags of different priorities display in different colors on the Tax Detail screen.

-

Select the Selectable checkbox (checked by default) to make the flag as an available selection from flag drop-down lists on screens. If not selected, the flag will not be available for selection.

-

Optionally, set the flag to expire on the next or previous workday from the Non workday moves to drop-down list when the expiration falls on a non-working day. The following tasks recognize the setting you define for this to control and assign the flag based on workday:

-

Info Center > Tax Detail > Manage Flags

-

Tax > Accounts Receivable > Manage Payments >

-

Penalty Interest Cancellation

-

Manage Surplus

-

Bad Check

-

-

Tax > Accounts Receivable >

-

ACH Processing

-

Batch Collections

-

-

Info Center > Custom Batch Job

-

-

Add or edit the entity types to which this flag can be attached. For example, select taxbill as the entity type in the flag control when the flag will be applied to bills; select revobj as the entity type in the flag control when the flag will be applied to the revenue object. Certain flags require specific entity types; for example Lock Interest and Lock Penalty require an entity type of taxbill.

NOTE: Surplus is an available entity for selection when configuring Aumentum Flags for Pending Unclaimed or Refund to Title Company. Surplus is then an available option on the Manage Flags screen in Info Center (Info Center > Tax Detail > search/select > Tax Information > Manage Flags [Common Action]). NOTE: Changing the entity of an existing flag may cause unwanted results.

-

Click Apply to save your changes within the grid.

-

Click Cancel to cancel the changes.

-

ClickDelete in the grid row of an entity type to delete it and click OK in the confirmation message.

-

Click Save to finalize the flag setup.

-

Click List to return to Set Up Flags.

-

Click Close to end the task.

-

-

Tips

Duration is for information only unless specific functionality has been added for it. Check with your Aumentum Support representative on what is available for the specific use of the flag you are setting up. For example, when you attach a flag on the Manage Flags screen of Info Center, the system will calculate an ending date using the starting date and user-provided duration, when the flag duration type is days, weeks, months, or years.

Flag types can be associated with multiple flag values. A system administrator can maintain possible the flag values associated with a flag type through Systype Categories.

Critical (or Priority 1) flags are displayed in red on the Tax Detail screen. You can set or change the colors of the different flag priorities in Systype Maintenance for the systype priority.

Prerequisites

Configuration Module

-

Flag Value – Each Flag Type should have at least one Flag Value, though it is not required. Add additional Flag Values as needed and associated Flag Types with Flag Values in Systype Maintenance.

Dependencies

Many Aumentum processes require or use flags. Here are some examples.

|

Module/ |

Flag |

Entity Type |

Action |

Process type |

Comment |

|

Accounts Receivable/ |

Lock Interest Charges |

Tax bill |

Apply |

|

Used in interest calculations when the interest dollar values should be let alone at their current (locked) value. |

|

Accounts Receivable/ |

Lock Penalty Charges |

Tax bill |

Apply |

|

Used in interest calculations when the penalty dollar values should be let alone at their current (locked) value. |

|

Accounts Receivable/ |

NSF (default for bad check) |

Tax bill |

Select by |

Batch |

Default flag for the application setting "Default bad check flag". |

|

Accounts Receivable/ |

Collect Max Payment Pending |

Revenue object |

|

|

Must be configured via (Cashiering > Setup > Payment Rules) in order to not allow payments to be made on a PIN for which there is a payment pending in eGov. |

|

Accounts Receivable/ |

Refund Created With Outstanding Taxes |

Revenue object |

|

|

Generates a remark on the Refund/Overpayment Report for any PIN that has received a refund despite outstanding delinquent, current, or future taxes. |

|

Accounts Receivable/Surplus |

Valid Flag Object Type |

Revenue Object |

Select by |

|

Ensures that Surplus is an available entity for selection on the screen (Configuration > Flag Setup) when selecting the Flag type of Pending Unclaimed or Refund to Title Company. |

|

Accounts Receivable/ |

Appealed Bankruptcy |

Tax Bill |

Y/N indicator |

Batch |

Used for Lender Export, Delinquent Export, or Remit (Hot File) Export |

|

Billing/ |

NSF (non-sufficient funds, or bad check) |

Tax bill |

Apply |

|

Attach any user-defined flags to tax bills. Flags are then used to select or filter bills for printing. |

|

Billing/ |

User-defined flags |

Tax bill Billing groups |

Select by |

|

Use to add or remove certain revenue objects from billing groups prior to printing bills. |

|

Billing/ |

User-defined flags |

Revenue object |

|

|

Add a message on a tax bill. |

|

Billing/ |

any flag |

Revenue object |

Apply Remove |

Batch |

Use to add or remove flags on multiple revenue objects |

|

Business Revenue/Apply Flag to Group |

User-defined flags |

Tax Bill |

Apply Remove |

None |

Use to add or remove flags based on tax bill to a business group. |

|

Cashiering/ |

NSF |

Revenue object and/or legal party |

View only |

None |

Payment information includes NSF information. |

|

Delinquent: All delinquent flags are user-defined. |

|||||

|

Delinquent/Groups/Book and Page |

Certificate of Lien Flag |

Tax bill |

Apply |

Batch |

Apply or remove a lien flag based on bill to a delinquent group through a batch process. |

|

Delinquent/ |

Bankruptcy or other |

Tax bill, revenue object, legal party |

Apply Remove |

Batch |

Apply or remove any flag based on bill to a delinquent group through a batch process. |

|

Delinquent/ |

Status reports Delq List |

Any |

Select by |

|

Filter selections for reports by any flag. |

|

Delinquent/ |

Foreclosure or other |

Tax bill, revenue object |

Option to apply |

Batch |

Can search by flag to select revenue objects to write off. Additional flag can be applied. |

|

Distribution/ |

Final Accounting PT11 PT90 |

Tax bill |

Select by |

|

These reports include flagged bills. |

|

Inquiry/ |

Shows flag indicator |

Any |

View only |

None |

Red flag is priority 1 flag set; blue flag is priority 2 or 3 flag set. |

|

Inquiry/ |

All |

All |

Add, edit or remove |

Single |

View all flags not removed for a revenue object, either all or by value. Attach a flag to a revenue object, inactivate a flag, or remove an erroneous flag from association with the revenue object. |

|

Inquiry/ |

Hold Penalty; |

Tax bill |

Apply or remove |

Single |

When set, penalty and/or interest on delinquent bills is not added into total due. If removed, all penalty and interest on delinquent bills is calculated and added into the total due. |