Flag Payment Rules

Navigate:  Cashiering > Setup > Flag Payment Rules

Cashiering > Setup > Flag Payment Rules

Description

Set up cashiering and batch process payment rules for specific flags. Current rules are:

-

Do not allow payment

-

Remove at bill level when charges are paid

-

Remove at PIN level when all charges are paid

-

Do not allow payment by tendered type (indicate eligible types)

-

Do not allow payment on zero due bills by service (indicate services)

-

Do not allow partial payment by revenue object (indicate revenue object subtype)

Steps

-

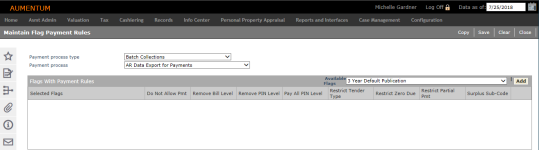

On the Maintain Flag Payment Rules screen, set up or modify the cashiering payment rules associated with flags. The rules can be associated with either cashiering or batch collections process type.

NOTE: Tax Sale items can now be blocked from being paid if payments are not allowed during a Tax Sale. Go to Cashiering > Setup > Flag Payment Rules, select the Tax Sale Participation Flag and set 'Do not allow payment' to true. The Tax Sale Participation Flag is selected in Delinquents > Tax Sale > Tax Sale Settings.

-

On the Maintain Flag Payment Rules screen, select Cashiering from the Payment process type drop down. Select a flag from the Available flags drop down and click Add.

On the Maintain Flag Payment Rule Details screen, select the Do not allow payment checkbox if no payments should be allowed on this flag type. Since this option is a comprehensive rule for all payment situations, if you select this option, the only other options available are:

-

Route Payments attempted to specific Surplus sub-code. If you select this checkbox, the following is also available:

-

Apply overpayments to specific surplus sub-code. Select the specific sub-code to which to apply the overpayments.

NOTES

NOTES

When an overpayment is made on a bill and the bill or revenue object contains a flag linked to a specific surplus sub-code, the overpayment created is made with the surplus sub-code specified for that flag. When a payment is attempted on a property with a flag that indicates payments are disallowed, check the flag payment rules to determine if the attempted payment is to be routed to a specific surplus sub-code. If so, a surplus payment will be created, using the specified surplus subcode in the flag rule for the flag. If not, use current Aumentum functionality for the disallow payment flag rule.

For batch processing payment collections, a process field called Suspense Exception affects the following batch import processes:-

IVR Payment

-

Lockbox Payment

-

Remittance payment

-

Web Payment File

If the payment import file contains a suspense exception, Suspense Exception takes precedence over any flag payment rules on the property. If Suspense Exception contains a valid surplus subcode systype ID that is set up within Tax > Accounts Receivable > Setup > Suspense Setup as a valid surplus subcode for that batch collection payment import process, then apply the payment directly as a surplus suspense with the specified subcode. Associate the surplus suspense to the Rev Obj of the payment row, if available.

If Suspense Exception does not contain a valid systype id meeting the aforementioned criteria, then the field is ignored and the row processed as a standard payment row

-

-

Select the checkboxes describing what to allow and when to remove flags when charges are paid. A removed flag is actually deactivated, so that the history of the flag is retained. The appropriate flags must be previously set up and applied.

-

Allow partial payments- This flag allows cashiering to accept partial payments.

-

Remove at bill level when charges are paid? - The flag is inactivated when the bill is fully paid. The flag displays on the Manage Flags screen with a status of I.

-

Remove at PIN level when all charges are paid? - When all bills of a flagged PIN are paid, the flag is automatically inactivated. The flag displays on the Manage Flags screen with a status of I.

-

Require payment of all charges at PIN level - This setting may not apply to your jurisdiction. It prevents paying a portion of the outstanding bills on a PIN. It is used in association with any flag that might be put on a PIN, not on Flags associated to Bills only. When checked, and when attempting to collect payments, the following message displays if you attempt to pay just part of what is owed for a PIN, along with the option to override and continue (if overrides are configured): Please enter override information and click pay to continue.

-

-

Fill in the lists restricting certain payments by various criteria by selecting an item from the drop-down below the list and clicking Add. Repeat until each list is complete.

-

Do Not Allow Payment by Tendered Types - Select the tender types for which payments are not to be accepted. Some sample tender types are cash, check, and credit, and this might be restricted when flagged for bankruptcy, tax sale to certified funds only, or to not allow payment by check on items with NSF Flags.

-

Do Not Allow Payment on Zero Due Bills by Service - Select the service types for which payments are not accepted when the bill equals zero dollars. Some sample service types are advance and bankruptcy.

-

Do Not Allow Partial Payment by Revenue Object - Select the revenue object types for which partial payments are not accepted. Some sample revenue object types are business license and motor vehicles.

-

Select any item in a panel and click Remove to remove it from the panel list.

-

Click Finish to Maintain Flag Payment Rules, then click Save.

- Click Copy in the Command Item bar to copy the existing flag payment rules of a process type to another process type.

Payment Plan, Protested Payment, and Cashiering Do Not Allow Payment Flags

Payment is not accepted, either via Cashiering > General > Payment Collection or via Tax > Accounts Receivable > Batch Collections > Daily Remittance Import, when the following two conditions exist simultaneously:

-

An account is in a Payment Plan

-

The tax payer is protesting some or all of one or more tax bills, meaning it is a Protested Payment and the account includes a Protest Flag.

The Protest Flag is set via Cashiering > Flag Payment Rules to not allow payment when a Protest Flag exists on an account and when the account is in a payment plan.

NOTE: The Flag Payment Rules can be set at the revenue object level and legal party level as well as the account level for payment plans.

When attempting to cashier a payment via Cashiering > General > Payment Collection, a message displays on the Collect Payment screen indicating a Do Not Allow Payment flag exists and payment cannot be accepted. Batch collection payments on accounts meeting both criteria are rejected automatically during batch processing.

Also, Payment Plan Notices recognize the Cashiering Do Not Allow Payment flag and send the notices appropriately, depending on whether the flag exists.

When an account is in a payment plan, and there is a roll correction to the account, the roll corrected bill is typically excluded from payment plan calculations for 30 days.

After the Cashiering Do Not Allow Payment flag expires, the payment plan is recalculated via a Payment Plan Recalculation workflow available on the View My Worklist screen, accessed via the Workflow icon on the sidebar of any screen.

Dependencies, Prerequisites, and Setup

Cashiering

Collect Payments - In order for flags to be visible on the Collect Payments screen, they must be set up here and associated with the Cashiering process type, even if they are not associated with any rules.