Collect Payments

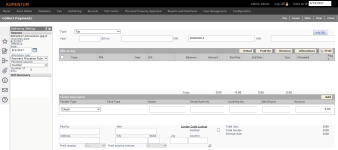

Navigate:  Cashiering > General > Payment Collection > Collect Payments

Cashiering > General > Payment Collection > Collect Payments

Description

Cashiers use the Collect Payments screen to process various types of payments.

-

Payments imported into the system via Accounts Receivable batch process imports.

-

Counter payments from walk-in customers.

-

Mail-in payments.

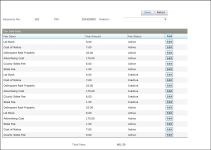

Payment processing kicks off data for reports, such as for a collections summary report, showing payment collection activities and details.

Screen Features

See these sections for information about the various screen features:

-

Click Configuration > Application Settings.

- On the Maintain Application Settings screen, select Cashiering from the Filter by module drop-down list.

- Locate the Use custom receipt functionality setting and click Edit.

-

Select the checkbox in the Setting Value column to set it to True and click Apply.

- Click Save in the Command Item bar.

-

Click Reports and Interfaces > Correspondence > Setup > Report Setups and select the category of Receipt to set up the custom receipt.

-

To create a mail merge document to use for custom receipts, follow these steps:

-

Download a receipt datasource from Reports and Interfaces > Data Services > Manage Data Services. Select a receipt Data Service. You advance to the View Data Service screen. Select the file type to Download As and click Download.

-

Create a Mail Merge document using Microsoft Word and the data service you downloaded for the notices.

-

Upload the document via Reports and Interfaces > Correspondence > Report Setups > Manage Report Setups. Click the Manage Templates button to advance to the Manage Templates screen. Click Upload and navigate to your mail merge file and upload the file.

-

Create a Report Setup via Reports and Interfaces > Correspondence > Report Setups > Manage Report Setups. Select a custom receipt setup or click New to create it. You advance to the Edit Report Setup screen. Enter/edit a Description, select the Receipt Category, select a receipt Data Service, select the EngineMail Merge, and select the Template you uploaded in step 3.

-

Click Save.

-

-

Click Custom Receipt to display the Custom Receipts pop-up window.

-

Select the receipt(s) to print and click Print to submit the custom receipt to batch process where you can monitor it on the Monitor Batch Processes screen.

-

Simple Search: Retrieve bills by entering/selecting information in the available fields.

-

The information needed varies with theService type: (service types vary, depending on your location)

For a Tax bill, enter the year and bill number, PIN, or alternate identification number (AIN).

-

Advance – Advance type, PIN, alt PIN, amount

-

Miscellaneous – Miscellaneous type, receipt number, permit number

-

Motor Vehicle – Tax Year, VIN, license plate number

-

Tax and Tax Sale – Year, bill number, PIN, AIN

-

Repay reversal – Receipt number, receipt year

-

State Credit – Revenue account

-

Click Add Bill. The bill information displays in the Bills to Pay panel. Repeat until all desired bills are displayed in the grid.

-

Detailed Search: Perform a detailed search using other information related to the bill or revenue object.

-

Click the Common Actions icon in the sidebar.

-

Click the Use Detailed Search link to access the Records Search screen. If your jurisdiction uses the Aumentum Personal Property (PPA) module, the Records Search screen will have a Search for Personal Property Account button you can optionally use to search for personal accounts. Enter the information you know and click Search. On the search results screen, select one or more revenue objects to make payments and click Next to return the bills for the selected revenue objects to the Bills to Pay grid.

-

Scan the Bill: If your office has the proper equipment, you may also scan the bill to receive payment. The bill automatically displays in the Bills to Pay grid. Continue scanning additional bills until all of the items for this payment are included in the panel.

Cashiering Settings Sidebar

Cashiering Settings Sidebar

Includes information about payment sources and allocation rules to use.

The Cashiering Settings sidebar displays automatically with the Collect Payments screen. To hide it, click the X in its upper right corner. To display it again, click the Cashiering Settings icon above the Common Actions icon.

The sidebar includes business date, effective pay date, allocation rule, payment source, number of bills, bill summary, and universal misc source summary. These settings apply to the payment as a whole, although you can modify the choices for a particular bill.

IMPORTANT: The effective pay date, allocation rule, and payment source can be changed (if you have security rights) before bills are brought into the grid. If bills have already been displayed you can check the box in the appropriate row(s) and then change the effective date and allocation rule for the selected bills. Once the transaction has completed, the session information will revert to what was originally set up. You can also change the effective date at any time, even if you have generated receipts. However, the new receipt numbers will re-sequence to the beginning number again.

If you are working with alternate payment sources, make a selection from the Payment source drop-down list. Lockbox and Web payments are processed on the Collect Payments screen. Changing the payment source to Mail opens the Process Mail Payments screen; changing the payment source to Lender opens the Process Lender Payments screen.

The Bill Summary and Universal Misc Source Summary sections are updated automatically as bills are added to the payment.

Generating Custom Receipts

Generating Custom Receipts

Details how to generate custom receipts.

The Custom Receipts panel displays at the bottom of the screen. You can print custom receipts from the Collect Payment screen if it is applicable to and set up for your jurisdiction.

To set this up:

Generating Custom Receipts

Searching

for Bills

Searching

for Bills

Simple Versus Detailed via Common Actions – Describes the two types of bill searches and how to perform a detailed search.

Select the bills to pay using one of three different methods:

NOTE: For jurisdictions using the collection type attribute, the Secured and Unsecured charges have been separated and display both Current and Delinquent subtotals for each collection type in the panel.

Override Security

Override Security

Shows how to define the required security information for overriding amounts, based on user security level and if allowed in the jurisdiction.

If a cashier or if the global cashiering is set up to allow overrides, then an override icon displays when conditions are applicable. Click on the icon to open the Override Security dialog and enter your Username and Password to authorize the change. Click Finish to enable the override.

Types of Payments

The primary, or most frequently received, payments are property tax payments.

NOTE: See the Tax section for detailed instructions for the entire screen. The other forms of payment described include steps applicable to that particular type of collection that precede normal tax collection steps.

The various forms of payments accepted are:

-

Advance – A pre-payment of, for example, future taxes or escrow payment when no balance is due on the revenue object account. Subtypes can include, depending on your jurisdiction.

-

Bankruptcy/litigation – A payment collection for revenue objects in bankruptcy or litigation for which an official case exists in the system.

-

Business license – For jurisdictions that use the system to collect and process business license payments and fees.

-

Miscellaneous – Used to collect a wide variety of payments, perhaps unique to jurisdictions, e.g., photocopies, notary services, license fees, other office charges. See special notes about:

NOTE: The Accounts Receivable > Payment Listing Report (Tax > Accounts Receivable > Reports > Payment Listing Report) includes a Recap: Print Miscellaneous Source UDF checkbox that when selected includes all UDF information for miscellaneous payments in the report.

-

Motor vehicle – A payment received from the Department of Motor Vehicles (DMV) in jurisdictions that use batch processes to import DMV payments.

-

Payment plan – A payment made against a payment plan in which a revenue object is enrolled, typically due to late or delinquent tax payments. See special notes about:

-

Payment Plan Recalculation of Unpaid Plan Installments if Tax Bill Charges are Changed

-

Payment Plan, Protested Payment, and Cashiering Do Not Allow Payment Flags

-

State credit – Certain jurisdictions allow any tax credits applied by the state to the revenue object to be processed and applied as a payment against the account.

-

Tax – The most commonly used type for collecting property tax payments.

-

Tax sale – When real property payments are delinquent, the property goes to tax sale in some jurisdictions. There are various subtypes of Tax Sale payments, depending on your jurisdiction. See special notes about the following:

Special Notes about All Types of Payments

-

Cashiering honors the Accounts Receivable setup of advance payment types for Surplus Subcodes (starting with Aumentum v 9.00.05). Only Advance payment types are shown on the Map Advance Surplus screen (Tax > Accounts Receivable > Setup > Advance Surplus Mapping > Map Advance Surplus) that are:

-

Active and selectable based on the systype configuration

-

Mapped to a surplus subcode on the Map Advance Surplus screen. The Collect Payments screen displays all mapped types of suspense that are configured in Tax > Accounts Receivable > Setup > Suspense Setup to be enabled and valid for Cashiering and that are mapped in Tax > Accounts Receivable > Setup > Advance Surplus Mappings. Cashiering shows all advance payment types and gets the appropriate surplus subcode from the Accounts Receivable mapping screen, which then applies the applicable suspense setup for the revenue account. Also, Cashiering knows to cashier advance surplus mappings with a surplus subcode with a category of suspense differently from regular advance types.

NOTE: Set up the Advance Payments systype for each advance payment type via Configuration > Systypes > Select or Add a Systype. Select the Advance Payments systype to navigate to the Edit a Systype screen To designate specific advance payment types as unavailable for selection on the Collect Payments screen, check the Unselectable checkbox when setting these up. Any advance payment types you designate as Unselectable also display as unselectable on the Map Advance Surplus screen.

IMPORTANT: Other validations also exist that remove certain advance payment types from the list on the Collect Payments screen even if designated as selectable and even if the Surplus Subcode is valid. selected Verify your original list before making items unselectable on the Edit a Systype screen.

-

The type of payments accepted depend on your jurisdiction. For example, your jurisdiction may not be set up to collect payments for motor vehicles or business licenses.

-

If a revenue account is in foreclosure status, it remains in foreclosure status until the delinquency is paid in full.

-

Many options are available when paying each item: full payment, partial payment, allocation change, effective date change, and waive interest and/or penalty. You can also print a bill, view details of the revenue object, or add a note. This is described in the Action Buttons section.

-

If a session has not been opened, the system automatically shows the Open Session by Cashier screen where you select the session to use to accept payments. From that screen, you can select an existing session or create a new session and click Set as Default to return to the Collect Payments screen. However, you will also first need to set up a till via Cashiering > Setup > Tills > Maintain Tills.

-

A Delinquent message is printed on cashiering paid receipts when back taxes remain unpaid. To set this up, go to Configuration > Application Settings, and set the effective date for the new application setting Print delinquent message on small receipt and set it to True.

-

Redemption payments for items assigned to the Agency can also be collected through Cashiering using the Type of Tax. Any redemption fees are removed from these items. Set up late payment rules and penalty/interest criteria via Accounts Receivable > Payment Terms Mapping and Setup. When setting up late payment rule criteria on the Set Up Payment Terms Rule Details screen, Add bill application rules, and select Apply When Tax Bill is in Tax Sale Agency.

-

A cashiering level setting to control the restriction of loading secure/unsecure bills allows restricting of cashiers by collection type. To accommodate this, a Allow payment of the following collection type field was created on the Set Up Cashier screen with available selections of All, Secure, and Unsecured. Jurisdictions who do not work with secured/unsecured bills select the default of All. When the cashier attempts to load bills on the Collect Payments screen for which they are not set up, a message displays indicating that the bill(s) has been removed from loading due to the setting.

NOTE: See Collection Type Transfer and Transfer Collection Type for information about transferring collection types from secured to unsecured and vice versa. If a single defaulted secured bill is loaded into the grid, and that revenue object has other bills with unpaid charges that are defaulted secured, those bills are retrieved automatically into the grid as well. Certain defaulted secured bills can be removed from the set if in Override mode as defined by security rights. All defaulted secured bills can also be removed from the set. However, a payment transaction cannot be completed with only some defaulted secured bills in the set unless in Override mode. Certain counties work around this by using business processes to retrieve bills by PIN, removing current bills if necessary, and manually enforcing payment of all defaulted secured bills. In this situation, for batch collections, enforcement of full payment of all delinquent secured bills is typically handled by CUBS and manually; Aumentum payment import checks that bills are paid in full, but still allows payment of a single delinquent secured bill even if there are others, if that is what is in the payment file.

Here are examples of what happens when bills are defined as secured/unsecured, corrections, and how payment collection is affected.

Partial Payment of Secured with a Correction

Bill original charges are $1000. Original bill is Secured, and is $1000

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$500 |

|

Charge |

Secured |

2nd |

$500 |

Partial payment of $200 is made before the Defaulted Date. Payment is recorded as Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$500 |

|

Charge |

Secured |

2nd |

$500 |

|

Payment |

Secured |

1st |

-$200 |

Remainder of bill is unpaid past the Defaulted Date. County runs process to move remaining unpaid charges to Defaulted Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$200 |

|

Charge |

Defaulted Secured |

1st |

$300 |

|

Charge |

Secured |

2nd |

$0 |

|

Charge |

Defaulted Secured |

2nd |

$500 |

|

Payment |

Secured |

1st |

-$200 |

Roll/process correction occurs, lowering the charges on the bill to $800. The $200 in charges that were Secured (and paid while Secured) should remain secured. Levy must ensure that the charges on the 1st installment remain $500, the charges on the 2nd installment are reduced by $200. The remaining unpaid $600 ($300 on 1st, $300 on 2nd) should remain Defaulted Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

Comment |

|

Charge |

Secured |

1st |

$200 |

1st inst is unchanged |

|

Charge |

Defaulted Secured |

1st |

$300 |

1st inst is unchanged |

|

Charge |

Secured |

2nd |

$0 |

|

|

Charge |

Defaulted Secured |

2nd |

$300 |

2nd inst is reduced |

|

Payment |

Secured |

1st |

-$200 |

|

Partial Payment of Secured and Defaulted Secured; Correction.

This example intentionally does not add penalty/fees

Original bill is Secured, and is $1000

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$500 |

|

Charge |

Secured |

2nd |

$500 |

Partial payment of $200 is made before the Defaulted Date. Payment is recorded as Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$500 |

|

Charge |

Secured |

2nd |

$500 |

|

Payment |

Secured |

1st |

-$200 |

Remainder of bill is unpaid past the Defaulted Date. County runs process to move remaining unpaid charges to Defaulted Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$200 |

|

Charge |

Defaulted Secured |

1st |

$300 |

|

Charge |

Secured |

2nd |

$0 |

|

Charge |

Defaulted Secured |

2nd |

$500 |

|

Payment |

Secured |

1st |

-$200 |

Partial payment of $300 is made after the Defaulted Date. Payment is recorded as Defaulted Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$200 |

|

Charge |

Defaulted Secured |

1st |

$300 |

|

Charge |

Secured |

2nd |

$0 |

|

Charge |

Defaulted Secured |

2nd |

$500 |

|

Payment |

Secured |

1st |

-$200 |

|

Payment |

Defaulted Secured |

1st |

-$300 |

Roll/process correction occurs, lowering the charges on the bill to $800. Levy must ensure that the charges on the 1st installment remain $500, the charges on the 2nd installment are reduced by $200. The $200 in charges that were Secured (and paid while Secured) should remain secured. The $300 in charges that were paid while Defaulted Secured should remain defaulted secured. The remaining unpaid $300 should remain Defaulted Secured, and the $300 payment made while the charges were Defaulted Secured should remain Defaulted Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$200 |

|

Charge |

Defaulted Secured |

1st |

$300 |

|

Charge |

Secured |

2nd |

$0 |

|

Charge |

Defaulted Secured |

2nd |

$300 |

|

Payment |

Secured |

1st |

-$200 |

|

Payment |

Defaulted Secured |

1st |

-$300 |

Reallocating a payment on a bill that was partially paid as Secured, and partially paid as defaulted secured must keep payments associated to the appropriate collection type.

-

If a payment was originally made as a secured payment, that amount must stay secured unless there are no longer secured charges to which to apply it.

-

If a payment was originally made as a defaulted secured payment, that amount must stay defaulted secured unless there are no longer secured charges to which to apply it.

-

If the bill is adjusted so that there is now an excess payment, that amount becomes surplus and the secured or defaulted secured buckets are adjusted accordingly.

Here are some examples of this:

Partial Payment of Secured and Defaulted Secured with a Correction

Original bill is Secured, and is $1000

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$500 |

|

Charge |

Secured |

2nd |

$500 |

Partial payment of $200 is made before the Defaulted Date. Payment is recorded as Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$500 |

|

Charge |

Secured |

2nd |

$500 |

|

Payment |

Secured |

1st |

-$200 |

Remainder of bill is unpaid past the Defaulted Date. County runs process to move remaining unpaid charges to Defaulted Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$200 |

|

Charge |

Defaulted Secured |

1st |

$300 |

|

Charge |

Secured |

2nd |

$0 |

|

Charge |

Defaulted Secured |

2nd |

$500 |

|

Payment |

Secured |

1st |

-$200 |

Partial payment of $300 is made after the Defaulted Date. Payment is recorded as Defaulted Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$200 |

|

Charge |

Defaulted Secured |

1st |

$300 |

|

Charge |

Secured |

2nd |

$0 |

|

Charge |

Defaulted Secured |

2nd |

$500 |

|

Payment |

Secured |

1st |

-$200 |

|

Payment |

Defaulted Secured |

1st |

-$300 |

Roll/process correction occurs, lowering the charges on the bill to $800. Levy must ensure that the charges on the 1st installment remain $500, the charges on the 2nd installment are reduced by $200. The $200 in charges that were Secured (and paid while Secured) should remain secured. The $300 in charges that were paid while Defaulted Secured should remain defaulted secured. The remaining unpaid $300 should remain Defaulted Secured, and the $300 payment made while the charges were Defaulted Secured should remain Defaulted Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$200 |

|

Charge |

Defaulted Secured |

1st |

$300 |

|

Charge |

Secured |

2nd |

$0 |

|

Charge |

Defaulted Secured |

2nd |

$300 |

|

Payment |

Secured |

1st |

-$200 |

|

Payment |

Defaulted Secured |

1st |

-$300 |

Partial Payment of Secured and Defaulted Secured; Correction resulting in surplus

Original bill is Secured, and is $1000

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$500 |

|

Charge |

Secured |

2nd |

$500 |

Partial payment of $200 is made before the Defaulted Date. Payment is recorded as Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$500 |

|

Charge |

Secured |

2nd |

$500 |

|

Payment |

Secured |

1st |

-$200 |

Remainder of bill is unpaid past the Defaulted Date. County runs process to move remaining unpaid charges to Defaulted Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$200 |

|

Charge |

Defaulted Secured |

1st |

$300 |

|

Charge |

Secured |

2nd |

$0 |

|

Charge |

Defaulted Secured |

2nd |

$500 |

|

Payment |

Secured |

1st |

-$200 |

Partial payment of $300 is made after the Defaulted Date. Payment is recorded as Defaulted Secured.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

|

Charge |

Secured |

1st |

$200 |

|

Charge |

Defaulted Secured |

1st |

$300 |

|

Charge |

Secured |

2nd |

$0 |

|

Charge |

Defaulted Secured |

2nd |

$500 |

|

Payment |

Secured |

1st |

-$200 |

|

Payment |

Defaulted Secured |

1st |

-$300 |

Roll/process correction occurs, lowering the charges on the bill to $100. Levy must ensure that the charges on the 1st installment become $100, the charges on the 2nd installment are reduced by $500 to zero. The payment should go to the Secured charges first and the remainder become surplus.

|

Charge/Pmt |

Collection Type |

Inst |

Amount |

Comment |

|

Charge |

Secured |

1st |

$100 |

Reduced to $100 |

|

Charge |

Defaulted Secured |

1st |

$0 |

Reduced to $0 |

|

Charge |

Secured |

2nd |

$0 |

|

|

Charge |

Defaulted Secured |

2nd |

$0 |

Reduced to $0 |

|

Payment |

Secured |

1st |

-$100 |

Secured pmt reduced by $100 |

|

Payment |

Defaulted Secured |

1st |

$0 |

Def Sec pmt reduced by $300 |

|

Surplus |

n/a |

n/a |

$400 |

Surplus is $400 |

This issue is further complicated by the presence of calculated interest/penalty or fee amounts. If the original penalty calculated on the original basis was $100 and was partially paid as secured, but after correction the penalty is less than was paid, then there is an amount that is free to be reapplied to other charges. It would then be reapplied using payment allocation rules to remaining charges.

Partial Payment of Secured w/Penalty with Correction after Defaulted Date reduces Tax/Penalty

Bill is $1000 and is past both installment Due Dates (but before Defaulted Date) so has $100 in Penalty. A partial payment of $570 is made. Payment allocation rules allocate by installment, penalty then tax.

|

Charge/Pmt |

Collection Type |

Charge Type |

Inst |

Amount |

|

Charge |

Secured |

Tax |

1st |

$500 |

|

Charge |

Secured |

Penalty |

1st |

$50 |

|

Charge |

Secured |

Tax |

2nd |

$500 |

|

Charge |

Secured |

Penalty |

2nd |

$50 |

|

Payment |

Secured |

Tax |

1st |

-$500 |

|

Payment |

Secured |

Penalty |

1st |

-$50 |

|

Payment |

Secured |

Tax |

2nd |

-$0 |

|

Payment |

Secured |

Penalty |

2nd |

-$20 |

After the Defaulted Date has passed, the remaining unpaid charges become Defaulted Secured

|

Charge/Pmt |

Collection Type |

Charge Type |

Inst |

Amount |

|

Charge |

Secured |

Tax |

1st |

$500 |

|

Charge |

Secured |

Penalty |

1st |

$50 |

|

Charge |

Secured |

Tax |

2nd |

$0 |

|

Charge |

Defaulted Secured |

Tax |

2nd |

$500 |

|

Charge |

Secured |

Penalty |

2nd |

$20 |

|

Charge |

Defaulted Secured |

Penalty |

2nd |

$30 |

|

Payment |

Secured |

Tax |

1st |

-$500 |

|

Payment |

Secured |

Penalty |

1st |

-$50 |

|

Payment |

Secured |

Tax |

2nd |

$0 |

|

Payment |

Secured |

Penalty |

2nd |

-$20 |

After the unpaid charges have been moved to Defaulted Secured, a correction occurs, lowering the tax charges on the bill to $600. So the 1st installment will have penalty (because it is paid in full) but the 2nd installment will not have penalty. Results for the charges and payments are:

-

1st installment Secured Tax charge remains $500, with matching payment

-

1st installment Secured Penalty charge remains $50, with matching payment

-

2nd installment Secured Tax charge remains $0

-

2nd installment Defaulted Secured Tax charge is reduced by $500 to $100

-

2nd installment Secured and Defaulted Secured Penalty becomes $0

-

Remaining $20 payment that had been applied towards 2nd installment Secured Penalty is lifted and applied to 2nd installment Defaulted Secured Tax.

-

Balance owed by taxpayer is $80 2nd installment Defaulted Secured Tax. (After 30 days, Aumentum will calculate the 10% penalty, adding it as $8 Defaulted Secured Penalty.)

|

Charge/Pmt |

Collection Type |

Charge Type |

Inst |

Amount |

Comment |

|

Charge |

Secured |

Tax |

1st |

$500 |

Unchanged |

|

Charge |

Secured |

Penalty |

1st |

$50 |

Unchanged |

|

Charge |

Secured |

Tax |

2nd |

$0 |

|

|

Charge |

Defaulted Secured |

Tax |

2nd |

$100 |

Reduced by $400 correction |

|

Charge |

Secured |

Penalty |

2nd |

$0 |

Removed due to 30 day grace |

|

Charge |

Defaulted Secured |

Penalty |

2nd |

$0 |

Removed due to 30 day grace |

|

Payment |

Secured |

Tax |

1st |

-$500 |

Unchanged |

|

Payment |

Secured |

Penalty |

1st |

-$50 |

Unchanged |

|

Payment |

Secured |

Tax |

2nd |

$0 |

Unchanged |

|

Payment |

Defaulted Secured |

Tax |

2nd |

-$20 |

Reapplied to remaining charge – 2nd inst Defaulted Secured Tax |

Partial Payment of Secured w/Penalty with Correction after Defaulted Date increases Tax

Bill is $1000 and is past both installment Due Dates (but before Defaulted Date) so has $100 in Penalty. A partial payment of $570 is made. Payment allocation rules allocate by installment, penalty then tax.

|

Charge/Pmt |

Collection Type |

Charge Type |

Inst |

Amount |

|

Charge |

Secured |

Tax |

1st |

$500 |

|

Charge |

Secured |

Penalty |

1st |

$50 |

|

Charge |

Secured |

Tax |

2nd |

$500 |

|

Charge |

Secured |

Penalty |

2nd |

$50 |

|

Payment |

Secured |

Tax |

1st |

-$500 |

|

Payment |

Secured |

Penalty |

1st |

-$50 |

|

Payment |

Secured |

Tax |

2nd |

-$0 |

|

Payment |

Secured |

Penalty |

2nd |

-$20 |

After the Defaulted Date has passed, the remaining unpaid charges become Defaulted Secured

|

Charge/Pmt |

Collection Type |

Charge Type |

Inst |

Amount |

|

Charge |

Secured |

Tax |

1st |

$500 |

|

Charge |

Secured |

Penalty |

1st |

$50 |

|

Charge |

Secured |

Tax |

2nd |

$0 |

|

Charge |

Defaulted Secured |

Tax |

2nd |

$500 |

|

Charge |

Secured |

Penalty |

2nd |

$20 |

|

Charge |

Defaulted Secured |

Penalty |

2nd |

$30 |

|

Payment |

Secured |

Tax |

1st |

-$500 |

|

Payment |

Secured |

Penalty |

1st |

-$50 |

|

Payment |

Secured |

Tax |

2nd |

$0 |

|

Payment |

Secured |

Penalty |

2nd |

-$20 |

After the unpaid charges have been moved to Defaulted Secured, a correction occurs, increasing the tax charges on the bill to $1200. So the 1st installment will have penalty (because it is paid in full) but the 2nd installment will not have penalty.

Results for the charges and payments are:

-

1st installment Secured Tax charge remains $500, with matching payment

-

1st installment Secured Penalty charge remains $50, with matching payment

-

2nd installment Secured Tax charge remains $0

-

2nd installment Defaulted Secured Tax charge is increased by $200 to $700

-

2nd installment Secured and Defaulted Secured Penalty becomes $0 (because of grace days)

-

Remaining $20 payment that had been applied towards 2nd installment Secured Penalty is lifted and applied to 2nd installment Defaulted Secured Tax.

-

Balance owed by taxpayer is $680 2nd installment Defaulted Secured Tax. (After 30 days, Aumentum will calculate the 10% penalty, adding it as $68 Defaulted Secured Penalty.)

|

Charge/Pmt |

Collection Type |

Charge Type |

Inst |

Amount |

Comment |

|

Charge |

Secured |

Tax |

1st |

$500 |

Unchanged |

|

Charge |

Secured |

Penalty |

1st |

$50 |

Unchanged |

|

Charge |

Secured |

Tax |

2nd |

$0 |

|

|

Charge |

Defaulted Secured |

Tax |

2nd |

$700 |

Increased by $200 correction |

|

Charge |

Secured |

Penalty |

2nd |

$0 |

Removed due to 30 day grace |

|

Charge |

Defaulted Secured |

Penalty |

2nd |

$0 |

Removed due to 30 day grace |

|

Payment |

Secured |

Tax |

1st |

-$500 |

Unchanged |

|

Payment |

Secured |

Penalty |

1st |

-$50 |

Unchanged |

|

Payment |

Secured |

Tax |

2nd |

$0 |

Unchanged |

|

Payment |

Defaulted Secured |

Tax |

2nd |

-$20 |

Reapplied to remaining charge – 2nd inst Defaulted Secured Tax |

NOTE: These examples are not all inclusive. There are potentially various other charges, such as delinquent fees, NSF fees, and other kinds of penalties/interest that may be secured or delinquent secured.

-

Every payment-related transaction in Aumentum is associated with a payment allocation rule (ReceiptDetail.AllocId), and the Cashiering Collect Payments screen allows a user with proper security to manually override the payment allocation rule and assign payments to specific charges. Starting with Aumentum v 9.00.04, this has been enhanced so that when this occurs, an override indicator is set at the ReceiptDetail level in a new field called 'ReceiptDetail. AllocOverrideYN' so that the user information for the individual performing the override is stored with the transaction. This information is also stored for manual readjustments to the allocated amounts at the roll type, charge type, charge code, or charge subcode level. NOTE: Verify this onsite by querying generated receipts.

-

Use the Cashiering > Setup > Related Revenue Object Rules task to define types of tax against which not to accept payments and/or to allow overrides. When attempting to collect payment against which a rule has been set not to collect payment, the message XXX Tax is Delinquent - Cannot Collect Payment (where XXX is the type of tax) is displayed.

-

Important Notes about Special Assessment Posted Project Payoff. See also the following topics:

Special Assessment Posted Project Payoff, a common action from the Payment Collection screen, uses the application setting 'Value Change Reason for Special Assessment Corrections' to trigger a tax bill correction when paying off an amortized special assessment. Previously, if this setting was set to a value change reason that did not trigger a correction, an 'object reference' error would occur. The payoff process has been updated to no longer throw the error and instead sets the Special Assessments to 'paid in full' and to change the values in Assessment Administration. However, no changes are made to the Tax Roll or the Tax Bill. A message indicating this is also displayed.

If you receive the message "Values Successfully posted to AA, but no Correction was created. Tax Bill not yet updated," you must go to Assessment Administration > Assessment Maintenance > Valuation Maintenance, select the PIN and continue on to the Maintain Revenue Object Valuation Information screen. Make sure to select the appropriate effective year (the assessment year for the most current tax bill). Select a change reason that triggers a correction. Change reasons are configured via Assessment Administration > Setup > Value Change Reason Mappings. Click Save to trigger the correction. If you selected a change reason that requires manual acceptance, you will need to accept the correction via Assessment Administration > Roll Corrections > Roll Correction.

Once you have successfully corrected the tax bill, you can return to Cashiering > General > Payment Collections and pay off the corrected tax bill with the special assessment payoff amount. To avoid these steps for future special assessment payoffs, go to Configuration > Application Settings > Maintain Application Settings and set the tax year Special Assessment setting 'Value Change Reason for Special Assessment Corrections' to a value change reason that triggers a correction.

NOTE: If the selected change reason is not specifically configured in Assessment Administration, the 'default' value change reason is used during the Special Assessment Payoff process.

Contact your Aumentum Support representative if you require assistance with the payoff process.

-

Pay Off Non-Posted or Deferred Amortized Special Assessments – Pay off amortized special assessments for a revenue object when the special assessment has not yet been posted to Assessment Administration.

-

Pay Off Posted Amortized Special Assessments – Pay off amortized special assessments for a revenue object that has already been billed. If the special assessment is a ditch, you can select the tract(s) to pay off.

See Common Actions for additional tasks you can perform.

NOTE: The numbering on the following screens shows typical sequence of operation, which may vary depending on the various scenarios as described below.

SETUP: See Cashiering and Payment Collection for any applicable prerequisites, dependencies and setup information for this task.

Jurisdiction Specific Information

Jurisdiction Specific Information

All sites

-

The Default Interest Calc Display application setting determines the text displayed on an F/I (full payment or installment) toggle button in Info Center > Tax Information screen, Bill Detail screen, and View Delinquents screen as well as on the Cashiering Collect Payments screen. The button toggles between viewing balances for a full payment versus a partial payment.

-

The toggle button displays only when set to Installment or Full. If set to None, the toggle button does not display.

-

If set to Installment, when first viewing a Revenue Object in Info Center, the button is labeled Inst Pmt and the interest calculated is based on the taxpayer paying by installment.

-

If set to Full, and when first viewing a Revenue Object in Info Center, the button is labeled Full Pmt and the interest calculated is based on the taxpayer paying the bill(s) in full.

-

You can click on the button to toggle the interest calculation from being based on installment payments to being based on a full payment for all bills with a balance due.

-

If the displayed interest is based on installment payments, the button displays Inst Pmt.

-

If the displayed interest is based on full payments, the button displays Full Pmt.

-

NOTE: Non-PTOC customers should accept the default of None.

California

-

Defaulted Secured: A Cashiering application setting Required payment in full for Defaulted Secured requires full payment on the tax bill if set to true.

IMPORTANT: This must be set to true for all California jurisdictions and can be set as applicable for other jurisdictions. Any overpayment in the system is automatically applied to delinquent/defaulted unpaid bills. -

A Real Property Transfer Fee Excel Import is available to import an Excel spreadsheet of real property transfer fees. These fees are cashiered as Miscellaneous payments. Import the spreadsheet via Tax > Accounts Receivable > Batch Collections. Select the Miscellaneous Payment Import process.

SETUP: The File I/O import process must be configured with two additional fields for Miscellaneous Sources and for Amount. Contact your Support Representative for assistance setting this up.

Riverside, California

-

Teeter Loss: The ability to cashier a payment using teeter loss calculations is available.

-

Allocation rules must be set up via Tax > Accounts Receivable > Payment Allocation Setup > Payment Allocation Rule Setup for:

-

Pre-sale and redemption fees

-

Charges other than pre-sale and redemption fees

For both of these, use the Property Sale Teeter TAF Rule custom rule. Make sure the pre-sale and redemption fees is sequence #1 to ensure that fees get paid first.

-

Go to Accounts Receivable >Payment Allocation Setup > Payment Allocation Configuration Setup and select the setups in Step 1 and specify that the rule application setup in be used for the Cashiering Buyer Service. Check the Is Default checkbox and click Save.

-

Use Property Sale Settings to set up the tax sale item fees that need to be calculated, making sure the fees match the allocation rule setup

-

When cashiering, use the Type of Tax Sale and Advanced Type of Buyer Service.

-

Pass-Throughs: When redevelopment pass-through amounts are returned to the county by the RDAs, they are reallocated to the tax authorities that contributed to the RDAs. Since these amounts are not tied to a specific PIN they require a method for redistributing them to the contributing TAF. Cashiering allows a payment to be allocated to TAFs so that when pass-through amounts are repaid by RDAs they can be cashiered and allocated to the specific TAFs the are due the funds.

-

The Secondary Rule List panel on the Manage Distribution Rules screen was created specifically for the district net apportionment amount (prior year secured). The system calculates the net amount to be apportioned to a district by factoring current year total adjustments (if any), Refunds (if any), and administrative fees (if any) during current tax year. The District Net Apportioned Amount = General Purpose +/- Debt +/- Adjustments +/- Penalty +/- Interest +/- .25 Percent Admin Fees +/- Cost +/- PTAC +/- Redevelopment Pass-Through +/- Tax Losses Reserve Fund +/- Accounting Fees +/- Treasurer-Tax Collector Fees +/- Teeter Debt Service +/-.

-

IMPORTANT: You will also need to set up TIF Adjustment Limits via Distribution > Setup > TIF Adjustment Limits > Maintain Redevelopment Limits

-

Set up Cashiering Miscellaneous Sources for this via Cashiering > Setup > Miscellaneous Sources. Select the Misc type of Payment in lieu of taxes and the Distribution method of TAF.

-

The CA Distribution Rule Allocation Report (Distribution Reports > SRS Distribution Reports) includes the secondary schedule defined. If amounts are adjusted you should see them in SubDistDetail where the SecondaryDistCalcRuleId != 0 for your DistHeaderId. Those amounts match the amount shown on the report for the secondary rule in the bottom section of the report. The top section shows the Pre-Distribution data that qualified for the Secondary Rule.

-

PTAC Costs: Aumentum Distribution calculates the distribution of PTAC Costs for each district. The formula for calculation is PTAC Costs Allocation Factors X Total Administrative Costs = PTAC Costs. The calculation of the commission pulls in the original charges and applies apportionment factors to spread the 1% general tax across TAFs. The calculation prioritizes so that the direct credit commission is calculated first, then the PTAC cost commission calculates second and uses the results of the first commission in its calculation. As with other commissions, the PTAC commission amount shows as a reduction to gross distributions on all distribution process and distribution history reports. However, the commission sums together on these reports with other calculated commission since only a single column exists to show all distributions.

SETUP: Set up an administrative (commission) PTAC fee via Tax > Distribution > Setup > Advanced Commission Setup. Set up the entitled distribution schedule via Tax > Distribution > Distribution Setup > Entitled Distribution Schedule > Set Up Entitled Distribution Schedule.

-

Unclaimed excess proceeds: These can be distributed back to taxing authorities using the prior year’s AB8 apportionment factors. To accommodate this, a distribution override rule was configured to distribute the tax sale excess proceeds. An EP Distribution process applies the Treasurer-Tax Collector’s costs to outstanding excess proceeds (aka surplus) amounts and applies the remainder of the proceeds to make them available for distribution. A distribution override rule has been configured that distributes the remaining applied unclaimed excess proceeds to taxing districts. A distribution commission to represent the .25 administrative fee was configured on Special Districts, County Fire, County Library, and County Road districts.

SETUP: Configure the distribution override rule via Tax > Distribution > Setup > Distribution Rules. For Collection Criteria, include the Charge Code of Tax Sale: Excess Proceeds. Go to Tax > Distribution > Setup > Agencies > Edit Agencies. Click Add in the Commission Fee panel to navigate to the Edit Fee Criteria screen. Click Add in the Commission Criteria List panel, select the item type of Charge Code, and select the .25 Administrative Fee Rule.

-

TAG Area Distribution Rule: A new distribution rule collection called TAG Area and four new distribution calculation rules were added to accommodate tax distribution to specific TAFs within a TAG using predetermined percentage breakdowns for:

-

Racehorse Tax

-

Non-commercial Aircraft Tax

-

Highway Rental

Aircraft tax is configured as a tax type in Aumentum and is used in distribution rule collection criteria to identify non-commerical aircraft tax payments. Incorporated TAGs used to cashier racehorse and non-commercial aircraft have been configured to include at least one city tax authority with at least one general fund. Unincorporated and incorporated TAGs used to cashier racehorse and non-commercial aircraft have been configured to include at least one school tax authority with at least one general fund. Incorporated TAGs used to cashier highway rental have been configured to include at least one supervisory road district tax authority with at least one general fund.Unincorporated TAG’s used to cashier highway rental have been configured to include at least one road tax authority with at least one general fund.

-

TAG/TA - City

-

TAG/TA - Schools

-

TAG/TA - Supervisor Road District

-

TAG/TA - Road

To utilize theTAG Area rule collection and associated rules, you will need to configure six new distribution rules, one each for incorporated and for unincorporated for racehorse tax, non-commercial aircraft tax, and highway rental on the Edit Calculation Rule screen (Distribution > Setup > Distribution Rules > Manage Distribution Rules > Edit Distribution Rules > [Add/Edit – Calculation Rule List panel] > Edit Calculation Rule > [Add/Edit]).

Racehorse Tax is configured as a miscellaneous source in Aumentum Cashiering (Cashiering > Setup >Miscellaneous Sources > Set Up Miscellaneous Sources). When setting this up the Set Up Miscellaneous Sources screen, the Misc Type should be Standard, the Tie to PIN checkbox must be checked, and the Rate Type should be Certified.

Highway Rental is configured as a miscellaneous source in Aumentum Cashiering (Cashiering > Setup > Miscellaneous Sources >Set Up Miscellaneous Sources). When setting this on the Set Up Miscellaneous Sources screen, the Misc Type should be Standard, the Tie to PIN checkbox must be checked, and the Rate Type should be Certified.

NOTE: Also see Sample Distribution Rule Calculation and Rule Configuration for TAG Area in the Edit Calculation Rule topic.

- Redemption Group Bad Check: When cashiering a payment for a redemption group with multiple defaulted secured bills as well as secured bills, the oldest bill in the redemption group includes the bad check fee on the receipt while the remaining items do not have the fee applied.

Cashiering Sidebar, Settings, and Calculator

The Session information on the Cashiering tab in the sidebar displays automatically when you open the screen. You have the option to dock the side bar so it is not displayed by clicking the calculator icon, which is a toggle to display/hide the sidebar. The sidebar includes Business date, Effective pay date, Allocation rule, Payment source, Number of bills, Bill Summary, and Universal Misc Source Summary. These settings apply to the payment as a whole, although you can modify the choices for a particular bill.

IMPORTANT: The effective pay date, allocation rule, and payment source can be changed (if you have security rights) before bills are brought into the grid. If bills have already been displayed you can check the box in the appropriate row(s) and then change the effective date and allocation rule for the selected bills. Once the transaction has completed, the session information will revert to what was originally set up. You can also change the effective date at any time, even if you have generated receipts. However, the new receipt numbers will re-sequence to the beginning number again.

If you are working with alternate payment sources, change the Payment source in the sidebar to another source. Lockbox and Web payments are processed on the Collect Payments screen. Changing the payment source to Mail switches to the Process Mail Payments screen, and changing the payment source to Lender switches to the Process Lender Payments screen.

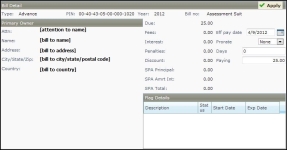

Collect Advance Payments

An Advance Payment is made when there is no balance due, such as a pre-payment of future taxes or escrow payment.

Advance Payments, Surplus, and Workflow

An advance payment often creates an account surplus. Surplus payments are managed via Tax > Accounts Receivable > Payment Management > Surplus Management. Certain surplus account items are accessed via workflows, if applicable to your jurisdiction, on the View My Worklist screen via the Workflow icon on any screen.

NOTE: Workflows available the Surplus Management task vary. The Aumentum Engineering team and Aumentum Implementation team set up each workflow specific to your jurisdiction setup and requirements.

IMPORTANT: When a surplus item has an active workflow associated with it, and you are attempting to use Surplus as tender for payment, you cannot do so if the item is in a workflow. Instead, a warning message displays indicating that the surplus is in an active workflow.

Paid By

NOTE: The Paid By defaults to the Account Contact for Advance Payment. Advance retrieves the data differently than Tax because it doesn’t have a tax bill ID. Advance retrieves by account ID rather than by revenue object bill ID. If the Cashiering Global setting Use Current Owner is defined, the same query is executed, except this one uses the revenue object ID. If that setting is off, a Levy API requires the tax bill ID, and Advance Payment uses the Contact by Account ID information for the Contact Party Information.

NOTE: A Tax Sale task is also available that pulls current year taxes and penalties into the Tax Sale and calculates the minimum bid. To accommodate this, Cashiering creates two surplus amounts in the event in which there is a Current Tax and an Overbid amount on a record.

The Advance type of Tax Sale Surplus is available for this purpose.

-

If the property is redeemed, the amount is refunded to the Buyer.

-

If the property is unredeemed and is conveyed to the Buyer, the surplus is used to pay the current taxes and any residual amount remains in surplus waiting to be refunded to the Tax Payer when they have completed all of the required steps.

NOTE: For surplus being applied to a bill, if the amount tendered is more than amount due for all the bills selected to pay, upon clicking Pay, a message is displayed, indicating the surplus amount is greater than the total bill amount due. This prevents a new surplus from being created from an existing surplus. -

If the Tax Sale setting of Create Advance Pay Surplus for Tax Sale is set to true, Cashiering puts the amount in the Current Tax Amount field, into the new Advance Pay –Tax Sale surplus type. Any amount that is Overbid is placed in Surplus as an Overbid type.

-

If bundled items are associated with the particular record, the overbid amount from tax sale is used to pay the delinquent taxes on the bundle items. Anything remaining is placed in Overbid Surplus. Agency Items will have no buyer payment associated with them after the tax sale.

-

If the item being redeemed is an Agency item, the Tax Sale process sends the full Minimum Bid Amount to Cashiering as the amount that is due, interest is calculated on the amount never exceeds the amount, and the amount to pay the taxes/penalties/fees is applied accordingly. Any overage is applied to the Advance Pay Surplus Type, which is then refunded to the Buyer as usual.

Fee Bank

Fee Bank accommodates the Treasurer Deed process to apply for and add endorsements and to allow payments using a surplus payment for the fee bank amount. The Info Center > Tax Detail > [Common Actions - View Delinquents] > Apply For or Add Endorsements includes a Fee Bank Remaining field that contains the remaining balance of the fee bank surplus when applicable.

Escrow

To accommodate dealer escrow, the Advance type ofEscrowis available for certain jurisdictions. This enables accepting payments towards escrow, using escrow as tender towards FRVIS charges, and accurately tracking balances in escrow accounts for each dealer. When the escrow Account Number is entered, the associated escrow Account Name displays. The Cashiering Session Reconciliation, Back Office Reconciliation, and Daily Balance reports as well as the Accounts Receivable Payment Listing, Surplus, and Collection Summary reports all include escrow information.

The following systype categories/systypes are associated with escrow: 1.) 'Escrow Type' (user definable), 2.) 'Dealer' (FL only), 3.) 'Escrow Account' (systype in 'Object Type and Legal Party Role Type' category), 4.) 'Escrow Account Contact’ (systype in 'Legal Party Role Type' category), 5.) 'Escrow’ (systype in 'Surplus Category' category), and 6.) ‘Dealer Escrow Deposit’ (systype in 'Surplus Subcode' category).

NOTE: MVP Tax Manager currently includes this functionality, which has now been implemented in Aumentum for those jurisdictions switching from MVP to Aumentum.

-

When using escrow money to pay a bill, first load the bill, then change the Tender Type to Escrow. Enter the escrow account number in the Account Number field to look up available the fund and pay the bill.

-

When adding money to an escrow account, enter the escrow Account Number and Amount, add and then pay the bill. Perform mapping setup for this via Tax > Accounts Receivable > Setup > Advance Surplus Mappings. Select Escrow and select the mapping.

Advance Pay Surplus

This payment allows taking advance pay surplus for unsecured tax sale payment. You can cashier buyer payments as advance payments for unsecured sales, and you can print a Bill of Sale at the time of payment collection. A close out process is run on unsecured sales that have been collected that applies the payments to the applicable items and runs all of the calculations to allocate the teeter amounts appropriately.

IMPORTANT: A Cashiering Use custom receipt functionality application setting displays a Custom Receipts grid of selectable Report Setup names at the bottom of the Cashiering Collect Payment screen when set to True. This enables selection of a custom receipt report to print for a Bill of Sale, for example. The selected document(s) prints in addition to the receipt. You can also print the receipt via the Collect Payments screen and the Print Mass Receipt screen as well as from the Tax Information screen. A Report Setup tied to a Receipt data service category must be set up using the Reports and Interfaces > Data Services and Correspondence tasks. Contact your Aumentum Support representative if you need assistance setting this up.

Advance Surplus

An Advance Surplus task pulls surplus and surplus subcodes. Accounts Receivable processes Treasurer-Tax Collector trust account payments and for all trust account payments posts the amount applied to the Collection Type for the trust account. To accommodate this:

-

Surplus subcodes were created in Cashiering as an Advance payment type.

-

Suspense Setup (Tax > Accounts Receivable > Setup) allows multiple types of suspense.

-

Three Surplus Sub Code systypes were created and must be set up via Configuration > Systypes.: 1.) Pre-Deposit - When a wire or physical checks is received for payment files the PINs/Bills to which to apply the payment is unknown; 2.) Tract Map Bond Trust - Money received for Tract Maps before final charges are known but for which at least one PIN is known at the time of payment receipt, and 3.) Replacement Payment - The county knowingly receives a replacement check for a known PIN before processing an NSF and the replacement check is placed in the surplus subcode until the NFS is processed.

-

The Set Up Suspense screen (Tax > Accounts Receivable > Setup > Suspense Setup) includes a Suspense Surplus Subcode Configuration panel with a Surplus subcode field for selecting the surplus subcode.

-

A Map Advance Surplus screen (Tax > Accounts Receivable > Setup > Advance Surplus Mappings) is available for mapping advance payment types with the surplus subcode.

-

SETUP: Go to Configuration > Systypes > Select or Add a Systype. Select the Surplus Sub Code systype category and set the Effective Date. Click Edit on each of the three new systypes respectively, Pre-Deposit, Tract Map Bond Trust, and Replacement Payment, to navigate to the Edit a Systype screen and define details for each as applicable to your jurisdiction.

NOTE: The 'Advance Payment-Suspense’ and ‘Pre-Deposit’ systypes should be configured as ‘suspense’ subcodes. Currently, Pre-Deposit is available for Riverside, CA only. Go to Tax > Accounts Receivable > Setup > Suspense Setup to associate default revenue accounts with the new Advance Payment - Suspense surplus subcode or with the new Pre-Deposit surplus subcode available from the Set Up Suspense code field. Go to Tax > Accounts Receivable > Setup > Advanced Surplus Mappings > Map Advance Surplus and map the advance payment types with the surplus subcode.

Advance Surplus - Wire Transfer

An Advance Payment - Wire Transfer type of advance surplus mapping must be set up on the Map Advance Surplus screen and then selected as the Surplus subcode on the Set Up Suspense screen to set up details for wire transfer payment and to associate the revenue account to the wire transfer. Also, the File I/O for Accounts Receivable batch collection payment types of wire transfer must be set up via Configuration > File Input/Output Configuration. When collecting payments, the Collect Payment screen includes a selection of payment type of Advance Payment - Wire Transfer.

Collecting Advance Payments

See Escrow (above) for additional steps.

-

Select the Advance Type of Advance Surplus - Wire Transfer.

-

Define the PIN and Amount.

-

Click Add Bill. The amount field clears when the Bills to Pay grid is populated.

-

Continue as for a regular tax payment beginning with Step 3 in the Collect Tax Payment section to enter the tendered and paid by information and complete the payment.

NOTE: Accounts Receivable applies advance payments, and when the bill is produced for the property, it shows a payment corresponding to the advance.

Assessment Suit, Bankruptcy Escrow, Deferred, HX Tax Lien, Tax Sale Surplus, ProRation/Eminent Domain, Regular, Specials, Tangible Personal Property

For these payments:

-

Select the Advance Type.

-

Define the PIN, AIN, Year, and Amount. Minimally, the PIN must be defined.

-

Click Add Bill. The amount field clears when the Bills to Pay grid is populated.

-

Continue as for a regular tax payment beginning with Step 3 in the Collect Tax Payment section to enter the tendered and paid by information and complete the payment.

NOTE: Accounts Receivable applies advance payments, and when the bill is produced for the property, it shows a payment corresponding to the advance.

Pre-Pay

This type of payment is for advance pre-payments as allowed by certain jurisdictions. This is used for future estimated taxes for installment plans. Collected money is placed into a separate fund from real estate or manufactured homes and may be requested and returned to the taxpayer at any point in time prior to the posting to real estate.

After the end of each collection cycle, the money is posted to the taxpayer’s real estate (or Manufactured Home) taxes. An account can consist of multiple properties. This type of pre-pay installment plan is for current money only and does not include delinquencies.

NOTE: The State of Ohio accepts three types of payments: Delinquent, Pre-Pay, and Current Year. A taxpayer can be on a delinquent payment plan in addition to being in a pre-pay plan. Thus if the taxpayer has pre-paid more than the installment amount, that amount is not associated with any pre-payment for delinquents. Instead the money is held in the advance pay status to be available for the next set of advance pre-payments.

-

Enter the Plan Number.

-

Enter the Name

-

Enter the Amount.

-

Click Add Bill. The amount field clears when the Bills to Pay grid is populated.

-

Continue as for a regular tax payment beginning with Step 3 in the Collect Tax Payment section to enter the tendered and paid by information and complete the payment.

Buyer Transfer Surplus

This Advance type is used to process a certificate transfer in the amount greater than the amount of the transfer.

NOTE: Buyer Transfer Surplus is associated to the surplus subcode Buyer Transfer Surplus on the Map Advance Surplus screen via Tax > Accounts Receivable > Setup > Advance Surplus Mapping.

-

Select the Advance Type of Buyer Transfer Surplus.

-

Define the PIN and Amount.

-

Click Add Bill. The amount field clears when the Bills to Pay grid is populated.

-

Continue as for a regular tax payment beginning with Step 3 in the Collect Tax Payment section to enter the tendered and paid by information and complete the payment.

NOTE: Accounts Receivable applies advance payments, and when the bill is produced for the property, it shows a payment corresponding to the advance.

Collect Bankruptcy/Litigation Payment

Steps for Collecting Bankruptcy/Litigation Payments

-

Select the Type of Bankruptcy/Litigation.

-

Enter the Case number and Claim number.

-

Continue as for a regular tax payment beginning with Step 3 in the Collect Tax Payment section to enter the tendered and paid by information and complete the payment.

Collect Business License Payment

Steps for Collecting Business License Payments

-

Select the Type of Business License.

-

Enter the Year, Bill number and License number.

-

Continue as for a regular tax payment beginning with Step 3 in the Collect Tax Payment section to enter the tendered and paid by information and complete the payment.

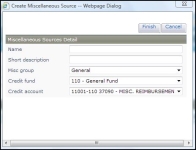

Collect Miscellaneous Sources Payment

IMPORTANT: The ability to associate each Miscellaneous Source to distinct GL Fund/Account information is available, depending on your state/jurisdiction. This allows the GL Export to include the Miscellaneous Source transactions mapped to the appropriate GL Fund/Account when exporting. To enable this functionality, two checkboxes need to be selected on the Set Up Global Cashiering screen. 1.) When checked on that screen, the Allow creation of new misc source from Collect Payments checkbox provides the ability to create a new source on the Collect Payments screen by selecting the type Miscellaneous, and then clicking + next to the Misc type drop-down list; 2) When checked, the Allow miscellaneous source free form fund mapping checkbox provides the ability to select GL fund/account information on the Collect Payments screen when creating a new source. When checked, this setting also provide the ability to select GL Fund/Account information on the Set Up Miscellaneous Sources screen.

Miscellaneous payments are used for a variety of non-tax payment collections, such as copies, notary services, license fees, or other office charges. Set Up Miscellaneous Sources defines the amounts to collect and the distribution for each miscellaneous type.

NOTE: A DAC (Data Access Control) setting in the application uses your login Effective Tax Year and Effective Date to retrieve data. Changing the date/year either from the login/security settings, or using the day/year picker in the toolbar changes the DAC Effective Tax Year and DAC Effective Date. These dates are used by some processes to determine the records to retrieve based on the Beginning Effective Year or the Beginning Effective Date of the record. Some transactions may also specifically set the DAC date/year. Currently, Miscellaneous Source uses DAC to determine the effective-dated record retrieved. Fees, such as NSF fees and credit card fees are retrieved as of the DAC date in effect in the toolbar date picker, which can be modified, and is the date the payment is made.

IMPORTANT: Miscellaneous Source payments cannot be made on the Collect Payments screen until all UDFs are defined for any UDFs created with the Required checkbox selected on the Set Up Miscellaneous Sources screen.

NOTE: The Accounts Receivable > Payment Listing Report (Tax > Accounts Receivable > Reports > Payment Listing Report) includes a Recap: Print Miscellaneous Source UDF checkbox that when selected includes all miscellaneous payments in the report.

HOX Subvention Payments

NOTE: HOX Subvention payments are cashiered using two miscellaneous sources:

-

HOX current secured is used to cashier the current secured portion of each payment.

-

HOX current supplemental is used to cashier the current supplemental portion of each payment.

See Setup for 601 Homestead Claim Allocation in Distribution for details.

MHTCC Request Payments

Mobile Home Tax Clearance Certificate request payments are received using Miscellaneous Sources. Prior to collecting payments for MHTCC:

-

Set up the applicable MHTCC reissue fee via Configuration > Fee Maintenance.

-

Go to Configuration > Application Settings > Maintain Application Settings.

-

Selecting the Setting Type of Effective Date and the Filter By Module of Tax Billing.

-

Click on the Reissue Tax Clearance Certificate Request. Add Reissue Request Miscellaneous Source prior to posting payment application setting and set to True to active the automatically apply miscellaneous fees.

-

Go to Cashiering > Setup > Flag Payment Rules > Maintain Flag Payment Rules, select the flag of the same name as the application setting and set as applicable to your jurisdiction.

NOTES: -

Once the flag is configured and set up, apply the flag to the specific revenue object account(s) via Info Center > Manage Flags.

-

After entering the PIN with the flag applied and clicking Add Bill, the message Reissue Tax Clearance Certificate Request. Add Reissue Request Miscellaneous Source prior to posting payment displays. Define the miscellaneous amount prior to posting.

Steps for Collecting Miscellaneous Sources Payments

-

Select the Type of Miscellaneous.

NOTE: If your jurisdiction has a Cashiering Web Services Interface, the associated URL opens based on the URL you defined on the Set Up Miscellaneous Sources screen.

-

Select the Misc Group.

-

Select the Misc type and fill out the other fields, including the Amount. Depending on how the miscellaneous source was set up, there may be more than one amount to enter.

NOTE: Various additional fields display based on the Type and Misc Type selected. For example, if FRVIS Payment is select, additional fields include Batch Number, Transaction User ID, and Dealer License Number. If you select Hunting/Fishing, an Input File Location field becomes available with a Browse button for searching for/selecting the input file.

NOTE: A flat amount is view-only; no entry is allowed. -

To define miscellaneous source details for a payment type of Miscellaneous, click the plus+sign to open the Create Miscellaneous source pop-up dialogue.

-

Enter a Name and Short Description.

-

Select the miscellaneous group from the Misc group drop-down list.

-

Select the Credit fund or Debit fund from the drop-down list.

-

Select the Credit Account or Debit Account from the drop-down list.

-

Click Finish to save the information.

-

Click Add Bill to add the payment as a line item in the Bills to Pay panel.

-

Continue as for a regular tax payment beginning with Step 3 in the Collect Tax Payment section to enter the tendered and paid by information and complete the payment.

Collect Motor Vehicle Payment

Steps for Collecting Motor Vehicle Payments

-

Select the Type of Motor Vehicle.

-

Enter the Year, Bill number, License plate number and VIN number.

-

Continue as for a regular tax payment beginning with Step 3 in the Collect Tax Payment section to enter the tendered and paid by information and complete the payment.

Collect Payment Plan Payment

NOTE: This may not apply to your jurisdiction.

NOTE: The ability to apply plan payments directly to tax bills included in the plan is available. When setting up the plan select Apply plan payments to bills from the Apply Payments field on the Edit Payment Plan Type screen, and select the Payment Allocation Rule from the drop-down list in the Calculation Detail panel. When collecting the payment, payments are applied directly to the bills. When the plan is paid off the status of the plan is Fulfilled rather than Paid because the apply payments process does not need to be used with plans that take payments against bills.

Since a payment plan record can potentially include both regular charges (Principal and Interest on the plan) as well as fee charges (Plan Fees), the collect payment plan process now creates 2 receipt detail records if these conditions are met:

-

installmentHeader.Inst == 0 && // Down Payment;

-

installmentHeader.PaymentPlan.PaymentPlanType.AddlFeeType ==

-

installmentHeader.PlanFeeAmountCharge +

Payment Plan Recalculation of Unpaid Plan Installments if Tax Bill Charges are Changed

An option when editing the payment plan type allows payment plan recalculation when a change occurs to a tax bill, such as a roll correction. See Edit Payment Plan Type for scenarios how unpaid plan installments are recalculated if bill changes occur.

If your jurisdiction accepts recalculations to payment plans if a change occurs to a tax bill, for a declining balance payment plan, the bills are pulled into the grid in sequence of oldest bill on top. The line shows all penalty, interest, and fees, and you are also allowed to edit any line and change the PIN as well as the Allocated Amount.

If a payment plan exists on an account and payment plan recalculation is allowed on a roll change based on your setting on the Edit Payment Plan Type screen, the Info Center Tax Information and Event History screens show an information icon next to the Pmt pln field in the header.

Payment Plans in Pending/Void Status

The ability to create and set the status of a payment plan as Pending as well as to Void a plan that has been in the Pending status a defined length of time is available. Aumentum permits enrollment in an installment payment plan (IPP) if certain eligibility requirements are met. If not met, an IPP can still be created manually, in which case a deficiency/denial notice is generated and the plan is marked as Pending.

If the plan has been Pending for the user-defined period of time, for example 30 days, Aumentum automatically sets the status to Void. Two Payment Plan Status systypes of Pending and Void were created and are available for selection from the Plan Status drop-down list in the Defaults section of the Edit Payment Plan Type screen (Tax > Accounts Receivable > Payment Plans > Plan Type Setup > Set Up Plan Type > [New/Edit] > Edit Payment Plan Type). A Void if not active within X days field on the Edit Payment Plan Type screen is used to define the number of days the plan remains in Pending status before defaulting to Void status.

The Edit Payment Plan screen (Tax > Accounts Receivable > Payment Plans > Payment Plan Setup > Set Up Payment Plans > [Edit or New] > Edit Payment Plan) also includes the Void if not active within X days field for the purpose of overriding the original number of days defined in the setup. Data changes can be made and saved on the Edit Payment screen, but calculations cannot be performed if the status is Pending. The plan status is updated to Void if the number of days exceeds the predefined number.

Info Center shows any PINs that are in a payment plan with a Pending status. The Balance Due calculations treat Pending status plans the same as a Void. For example, a bill that is in a payment plan with a status of Pending does not have Plan Fees added, no Plan Maintenance Fees added, and does not have standard Pen/Int deferred. Info Center includes a hyperlink to the Payment Plan Setup task for the purpose of performing a calculation to see what the balance due for a plan would be.

The Cashiering service types that check to see whether a bill is in a payment plan does not treat Pending status like a Void. Instead, a bill in Pending status cannot accept payments using the service type of Payment Plan or Tax. The Collect Payments screen instead presents the message,Bill is in a Payment Plan in Pending status. Activate or Void the plan before taking payment.

For batch collections payment import, the payment is rejected; or, if suspense is turned on, the payment goes into Surplus-Suspense. In any other situation (e.g., roll correction, reduced/increased charges, removing/reapplying a previously made payment on a tax bill now in a Pending state), the payment is applied to the bill as if the plan did not exist or was Void.

SETUP: Go to Configuration > Systypes > Select or Add a Systype. Select Payment Plan Status from the drop-down list and set the effective date. Click Pending to navigate to the Edit a Systype screen and define any details as applicable, click Save, then click List to return to the Select or Add a Systype screen and repeat this for Void.

Payment Plan, Protested Payment, and Cashiering Do Not Allow Payment Flags

Payment is not accepted, either via Cashiering > General > Payment Collection or via Tax > Accounts Receivable > Batch Collections > Daily Remittance Import, when the following two conditions exist simultaneously:

-

An account is in a Payment Plan

-

The tax payer is protesting some or all of one or more tax bills, meaning it is a Protested Payment and the account includes a Protest Flag.

The Protest Flag is set via Cashiering > Flag Payment Rules to not allow payment when a Protest Flag exists on an account and when the account is in a payment plan.

NOTE: The Flag Payment Rules can be set at the revenue object level and legal party level as well as the account level for payment plans.