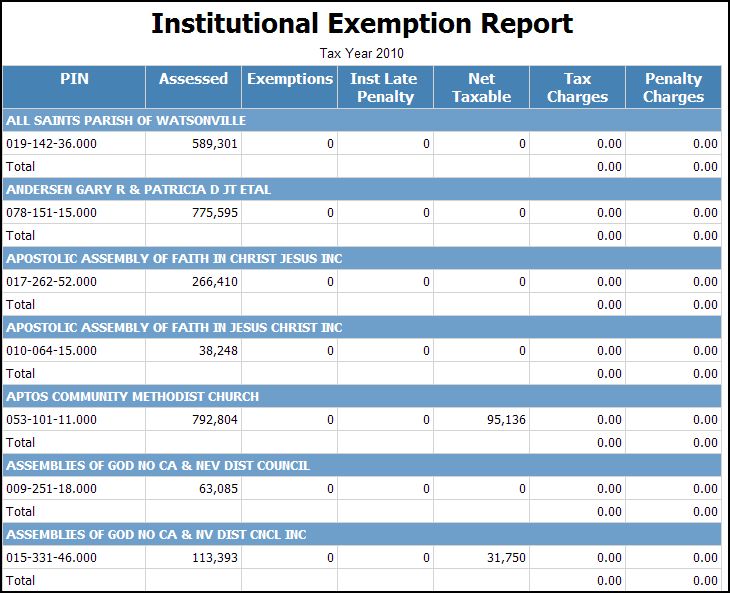

Institutional Exemption Report

Navigate:  Asmt Admin

> Reports & Extracts > Run Reports & Extracts >

Assessment Administration Reports

Asmt Admin

> Reports & Extracts > Run Reports & Extracts >

Assessment Administration Reports

Description

NOTE: This report may not apply to your jurisdiction.

Generate a report that identifies groups of parcels by Legal Party having the Institutional Exemption associated with them for auditing purposes. Once a Legal Party is identified as owning a parcel that has an institutional exemption associated to it, all parcels owned by the Legal Party are included in the report so that the auditor can identify potential parcels not identified or penalized correctly.

NOTE: When there is real property that qualifies for an Institutional Exemption and that real property has personal property that also qualifies for the exemption, the Institutional Exemption is applied to both, the real and personal property.

Steps

-

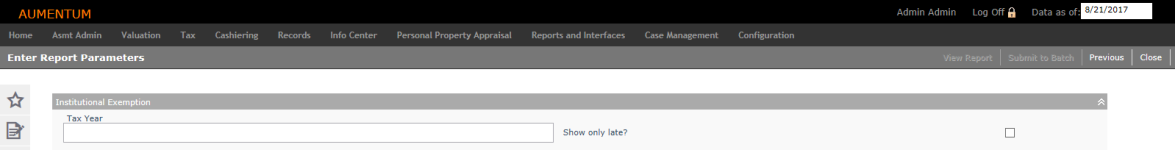

Enter the Tax Year.

-

Check the Show only late? checkbox to show any late institutional exemptions.

NOTE: The Maintain Revenue Object Modifier screen (Asmt Admin > Revenue Object Modifier Maintenance > Select Revenue Objects > Maintain Revenue Object Modifier) includes an Application Late? checkbox in the Questions panel that when checked, indicates the application is late for the particular PIN/account. When checked, the information is then reported in the Institutional Exemption report. If the Show only late? checkbox is checked, only those defined as late on the Maintain Revenue Object Modifier screen are printed in the report. -

Click View Report to generate the report in a separate browser window, or click Submit to Batch to open the Monitor Batch Processes screen on which you can view the progress of the report. When completed, click the report in the grid to open the View Batch Process Details screen, and click the report to open it. Click Close to close the batch screens and return to this screen.

-

Click Close to end the task.

-

Report Samples