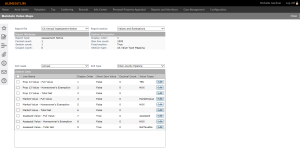

Value Maps

Navigation:  Asmt Admin > Reports & Extracts > Report Setup > Value Maps

Asmt Admin > Reports & Extracts > Report Setup > Value Maps

Description

Define which value types are to be mapped for each available value section on a report, such as a tax bill, statement, or assessment notice. Each report must have a roll caste and roll type values mapped to each section if the values need to display on the report.

Steps

-

On the Maintain Value Maps screen, make a selection from the Report file and Report section drop-down lists.

-

If applicable, make a selection from the Roll caste and Roll type drop-down lists. Certain report sections do not allow for selection of roll case and roll type, such as Flag Values.

-

In the Section Lines panel, click Edit for an item in the grid.

-

On the Edit Value Map Lines screen, select the Show zero value checkbox to display lines with a zero amount on the report.

-

In the Available Values panel, select the checkbox for one or more items in the grid.

-

Click Add Item(s) to move the selected items to the Attached Values panel.

-

Select item(s) in the Attached Values panel and click Remove Item(s) to move them back to the Available Values panel.

-

-

Click Save in the Command Item bar. You automatically return to the Maintain Value Maps screen.

-

Click Cancel to return to the Maintain Value Maps screen.

-

Click Close to end the task.

-

-

-

-

Click Close to end the task.

NOTE: Some sections are fixed and you cannot add new lines to them.

Prerequisites

Configuration Menu

-

Maintain Functional Calendar – The calendar for the appropriate tax year must be set up before creating criteria groups for that year.

-

Systypes – Set up these user-defined systypes:

Bill Value Types – Descriptive codes for groups of value types which are displayed on a particular section of the report.

Roll Type – Property tax roll types

Dependencies

-

You must set up a value map before you can print/export selected items.

-

Value maps must be set up before you can print/export bills or Truth in Taxation notices.

-

You must set up a value map before you can print assessment notices.